The South Korean stock market soared on each of the first two trading days following President Lee Jae-myung’s official inauguration after securing a decisive victory in the early election held on June 3, winning by a substantial margin over his opponents.

The peaceful transition of power and the political clarity it brings have been met with visible enthusiasm. Undoubtedly, Lee and his party, together with the people of South Korea, have every reason to relish the celebratory honeymoon phase of their administration.

The stock market’s benchmark Kospi posted a remarkable combined gain of 4.2 percent over those two days to end at 2,812.05 points on Friday, representing the highest closing level in nearly a year since July 18 last year. During the same period, foreign investors made net purchases totaling 2.07 trillion won ($1.52 billion) on the main board, marking the most net inflow from overseas investors in a year.

This sharp uptick in buying activity reflected renewed confidence in the Korean market under the new leadership.

The rise in stock prices is widely interpreted as a reflection of relief across the investor community, stemming from the peaceful resolution of the monthslong political impasse, triggered by the former president’s controversial declaration of martial law last December.

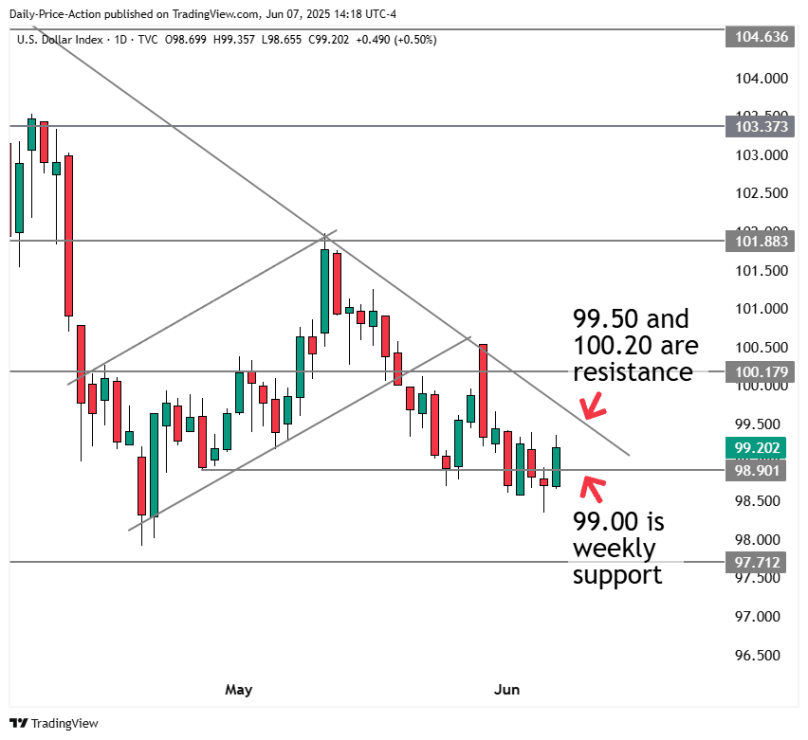

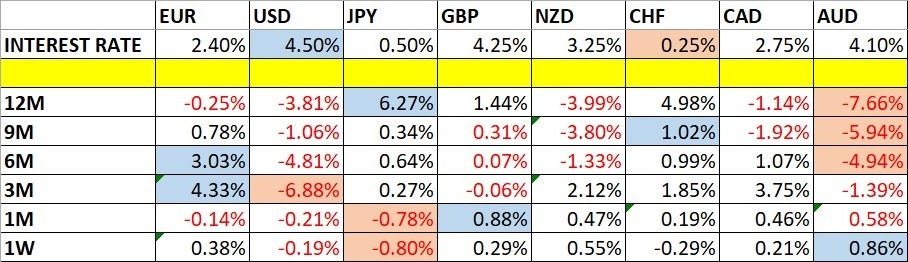

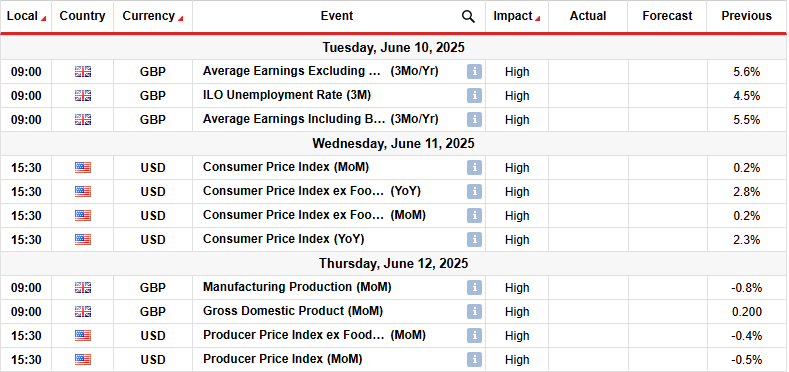

With stability now restored, there is cautious hope that Lee’s administration will introduce pragmatic, market-friendly reforms. Contributing to the rally are also favorable external factors: a persistent weakening of the US dollar against major global currencies and the announcement that the US and China intend to resume trade negotiations —developments that typically benefit emerging markets like South Korea.

Historically, traditional markets served as informal forums where policymakers could gather sentiment from the people, as citizens exchanged views and insights while trading goods. In our current era, financial markets serve a parallel — yet far more complex and consequential — role.

They function as barometers of public and investor sentiment, allowing market participants around the globe to continuously evaluate a nation’s economic performance, policy direction and future outlook.

From that perspective, the recent rally in the stock market, alongside the strengthening of the Korean won, can be read as a strong initial endorsement of the promises and rhetoric offered by President Lee during the campaign. His campaign period, however, was notably brief, offering limited time for his team to flesh out fully detailed policy plans.

Nonetheless, the messaging struck a chord, especially among investors and market observers eager for reform and modernization.

One of Lee’s key campaign priorities is addressing the “Korea Discount” — a persistent and well-documented phenomenon that refers to the comparatively low valuation of Korean-listed companies relative to their international peers. It is largely attributed to weaknesses in corporate governance, low shareholder returns and systemic inefficiencies in South Korea’s regulatory and economic framework.

To address this issue, Lee has pledged to revise Article 382-3 of the Commercial Act. The proposed amendment would obligate directors of listed companies to act not just in good faith but specifically in the interest of both the company and all its shareholders. The current version of the act requires directors to act for the benefit of the company, but lacks explicit emphasis on shareholder interests.

Lee has also vowed to introduce the cumulative voting system. Many view this as a powerful tool for enhancing minority shareholder rights, as it allows shareholders to pool votes to elect at least one representative to a board, in contrast to the traditional system of one vote per share per director.

Deliberative policymaking

In addition, he supports other measures aimed at prompting companies to return a greater portion of earnings to shareholders and limiting the negative effects of corporate spinoffs that often disadvantage minority investors.

While these governance-focused reforms are grabbing headlines, Lee has also promised fiscal stimulus on a massive scale. Though not explicitly intended to push stock prices higher, a major supplementary budget is expected to provide a strong economic stimulus to offset faltering domestic demand.

This comes at a time when South Korea, an export-driven economy, is grappling with declining overseas sales due mainly to the US government’s imposition of steep tariffs on most of its trading partners.

It is worth noting that the previous administration had already introduced a 13.8 trillion won supplementary budget back in May, aimed to assist those affected by weak consumer spending, fund recovery in wildfire-stricken regions and support the development of national artificial intelligence infrastructure.

The new extra budget being considered under Lee’s administration is reportedly about three times the size of the previous one, signaling a bold fiscal approach. Taken together, these initiatives have offered a strong psychological boost to the stock market.

They enhance the growth outlook for shares in a wide range of South Korean companies, many of which have long underperformed relative to their counterparts in other advanced economies. The anticipation of pro-growth reforms, combined with short-term liquidity injections, has widened the upside potential for equities.

Yet, such optimism must be tempered with realism. The market lift resulting from policy announcements and fiscal measures may not be sustainable unless underpinned by genuine improvements in economic fundamentals.

Corporate earnings, gross domestic product growth and export competitiveness — particularly in light of evolving global trade dynamics and tariff uncertainties — remain the true drivers of long-term performance.

Furthermore, the risk of unintended consequences looms large. Even the best-intentioned policy can yield adverse results. Business leaders and major corporations have already voiced concerns that overly aggressive changes to the Commercial Act might deter boards from making bold, strategic investments, out of fear of legal entanglements or shareholder activism.

Similarly, the large supplementary budget, if not crafted with precision and expertise, risks missing its mark. Without broad consultation and careful planning, the spending could end up inefficiently allocated, raising government debt while failing to generate meaningful economic uplift. That would not only disappoint voters but also strain public finances further.

These concerns are especially pertinent in today’s political landscape, where the Democratic Party of Korea holds a commanding majority across both the executive and legislative branches. This political dominance could enable the administration to push forward its agenda swiftly, but also tempt it to bypass the kind of open, deliberative policymaking that democracy requires.

President Lee must remain aware that while voters handed him a clear mandate, they did not grant him unchecked authority. The people expect reform, yes — but they also expect balance, consultation and accountability. As the proposed revision of the Commercial Act implicitly acknowledges, those in power have a duty to act not just in their party’s interest, but in the collective interest of the entire nation.

Yoo Choon-sik

Yoo Choon-sik worked for nearly 30 years at Reuters, including as the chief Korea economics correspondent, and briefly worked as a business strategy consultant. The views expressed here are the writer’s own. — Ed.