Investors Tyler and Camerson Winklevoss scored a series of compliments from President Donald Trump for their commitment to advancing the cryptocurrency industry.

Gemini, the crypto exchange founded by Tyler and Cameron Winklevoss, will begin trading on Friday after raising $425 million in an initial public offering that signals another advance for the industry.

Shares, which trade under the ticker GEMI, priced at $28 – the high end of the expected $24 to $26 range – giving the company a market cap of about $3 billion. It is listed on the Nasdaq, which recently invested $50 million in the deal.

The platform is “intended to simplify and secure the process of buying, selling, storing, staking, and collecting the digital assets that power the cryptoeconomy,” as noted in the prospectus filed with the Securities and Exchange Commission.

It will join Coinbase and Bullish, two other publicly traded crypto exchanges.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COIN | COINBASE GLOBAL INC. | 324.49 | +0.54 | +0.17% |

| BLSH | BULLISH | 53.99 | +1.37 | +2.60% |

| NDAQ | NASDAQ INC. | 95.88 | +1.22 | +1.29% |

The IPO advances the industry’s American revival that began under President Donald Trump after the establishment of the GENIUS Act, signed in July, which is aimed to make the U.S. the crypto capital of the world.

Tyler Winklevoss, co-founder of Gemini (Bridget Bennett/Bloomberg via Getty Images / Getty Images)

“The Trump administration has been incredible for our industry. It ended the war on crypto and Gary Gensler’s attacks and lawfare against us. It has also repealed a lot of guidance, rulemaking and bulletins that made it impossible for many market participants to do business in crypto,” Tyler told FOX Business earlier this month ahead of the IPO.

The brothers recently committed $21 million in bitcoin to the Digital Freedom Fund PAC, which supports pro-crypto political candidates with a focus on the upcoming midterm elections in efforts to maintain Republican control of the House and Senate.

Bitcoin, the largest crypto by market value, has advanced 22.5% this year and hit a new record Thursday night, hovering above $115,000.

CEO Tyler Winklevoss and President Cameron Winklevoss will maintain 94.7% of the voting power of common stock. Ahead of the deal, the two were worth $14 billion, according to the Bloomberg Billionaire’s Index.

Tyler and Cameron Winklevoss waged a famous legal battle against Mark Zuckerberg over Facebook’s beginnings. Now, they’re predicting the social network’s demise. (Photo by Stefanie Keenan/Getty Images for Hauser & Wirth / Getty Images)

About $21 billion of assets flowed through the platform with $285 billion in trading volume, as of July. The exchange is not profitable with $285.2 million in losses through June. Still, the duo sees a long runway ahead.

“While we are still in the early stages of adoption, we believe that the cryptoeconomy will be embraced by billions of individuals and businesses globally in the coming decades,” the company outlined in the SEC filing.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

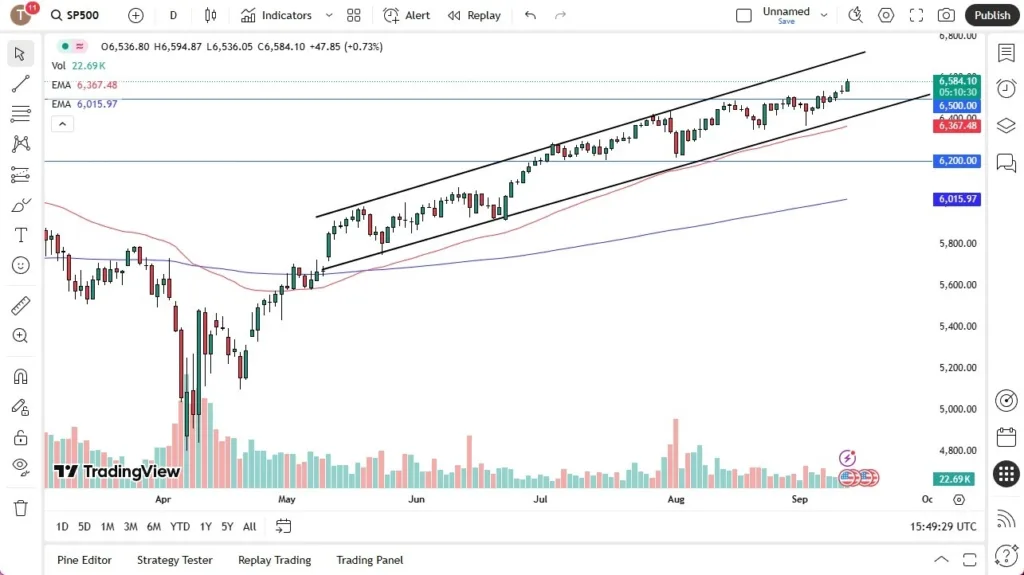

Ethereum, the second-largest crypto, is up nearly 32%. It is still below its record $4,955.23 also reached last month. By comparison, the S&P 500, the broadest measure of the stock market, is up 12%.