Long Trade Idea

Enter long short position between 67.74 (the lower band of its horizontal resistance zone) and 69.14 (Friday’s intra-day high).

Market Index Analysis

- The Coca-Cola Company (KO) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices trade near records, with mounting concerns about the health of this bull cycle.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Legal drama over President Trump’s tariffs and concerns over the independence of the Federal Reserve will weigh on this week’s sentiment, as investors await Friday’s NFP report. After four months of gains, equity markets enter September, historically the weakest month for bulls. US manufacturing data is due for release today, expected to show contraction and rising prices. Volatility could accelerate amid lower trading volumes as investors rethink portfolios.

Coca-Cola Company Fundamental Analysis

The Coca-Cola Company is one of the world’s largest beverage companies, with a recent push into healthy alternatives and bottled water. It began paying dividends in 1920, and as of 2019, has increased its dividend for 57 consecutive years. It also has a high brand loyalty.

So, why am I bullish on KO after its breakout?

Coca-Cola remains reasonably valued at current levels, while its brand loyalty and pricing power can overcome short-term issues. I like the dividend yield as compensation for taking a risk at the current breakout. Besides an industry-leading return on equity, returns on assets and invested capital are excellent. During times of economic uncertainty, KO offers one of the small luxuries consumers retain despite tighter budgets.

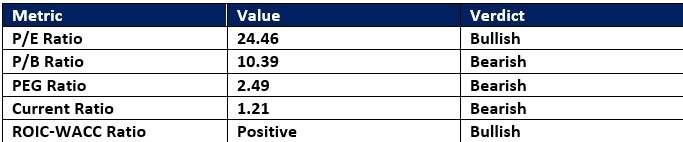

Coca-Cola Company Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 24.46 makes KO an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 30.01.

The average analyst price target for KO is 78.70, which suggests moderate upside potential with limited downside risks.

Coca-Cola Company Technical Analysis

Today’s KO Signal

Coca-Cola Price Chart

- The KO D1 chart shows a price action breaking out above its horizontal support zone.

- It also shows price action challenging its descending 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

- The bullish trading volume rose during the breakout.

- KO drifted lower as the S&P 500 inched higher, a bearish trading signal, but bullish factors returned.

My Call on Coca-Cola

I am taking a long position in KO between 67.74 and 69.14. Valuations are reasonable, and I view the brand loyalty, pricing power, and market position as adequate downside protection. The dividend yield adds to the bullish case for KO, and I confidently buy the breakout.

- KO Entry Level: Between 67.74 and 69.14

- KO Take Profit: Between 78.70 and 80.17

- KO Stop Loss: Between 64.65 and 66.05

- Risk/Reward Ratio: 3.55

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.