- Earlier this month, Lucid Group unveiled its all-new Gravity SUV at IAA Mobility in Munich, marking its European debut and integrating advanced features such as a 926-volt charging system and partnership-driven intelligent mobility through NVIDIA and DreamDrive 2. The launch also coincided with a strategic Uber investment, a leadership transition to an interim CEO, and heightened activity around Lucid’s global expansion and technology collaboration efforts.

- These developments reflect Lucid’s push to penetrate the premium EV market in Europe and expand its footprint in emerging autonomous fleet segments, but they emerge amid ongoing financial headwinds, elevated short interest, and significant operational challenges.

- We’ll examine how the introduction of the Gravity SUV in Europe and advanced driver-assistance features could reshape Lucid’s investment outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Lucid Group Investment Narrative Recap

To be a Lucid Group shareholder today, you have to believe the company can overcome persistent operating losses and significant cash burn by carving out a leading position in the premium EV and autonomous mobility space. The recent Gravity SUV European debut showcases Lucid’s technology, but it doesn’t materially change the near-term catalysts or address the ongoing need for substantial external funding, which remains the biggest risk to the business.

Among recent news, the $300 million Uber partnership, which will see Lucid supply 20,000 Gravity SUVs for a new robotaxi program, stands out as directly relevant. This large fleet order could prove a key catalyst by expanding Lucid’s revenue streams and boosting brand credibility, but successful execution and delivery remain to be seen.

Yet, in contrast, investors should be aware of ongoing dilution risk as Lucid continues to seek new capital infusions and manage heavy debt…

Read the full narrative on Lucid Group (it’s free!)

Lucid Group’s narrative projects $5.6 billion in revenue and $285.8 million in earnings by 2028. This requires 82.4% yearly revenue growth and an earnings increase of about $3.4 billion from current earnings of -$3.1 billion.

Uncover how Lucid Group’s forecasts yield a $23.25 fair value, a 10% upside to its current price.

Exploring Other Perspectives

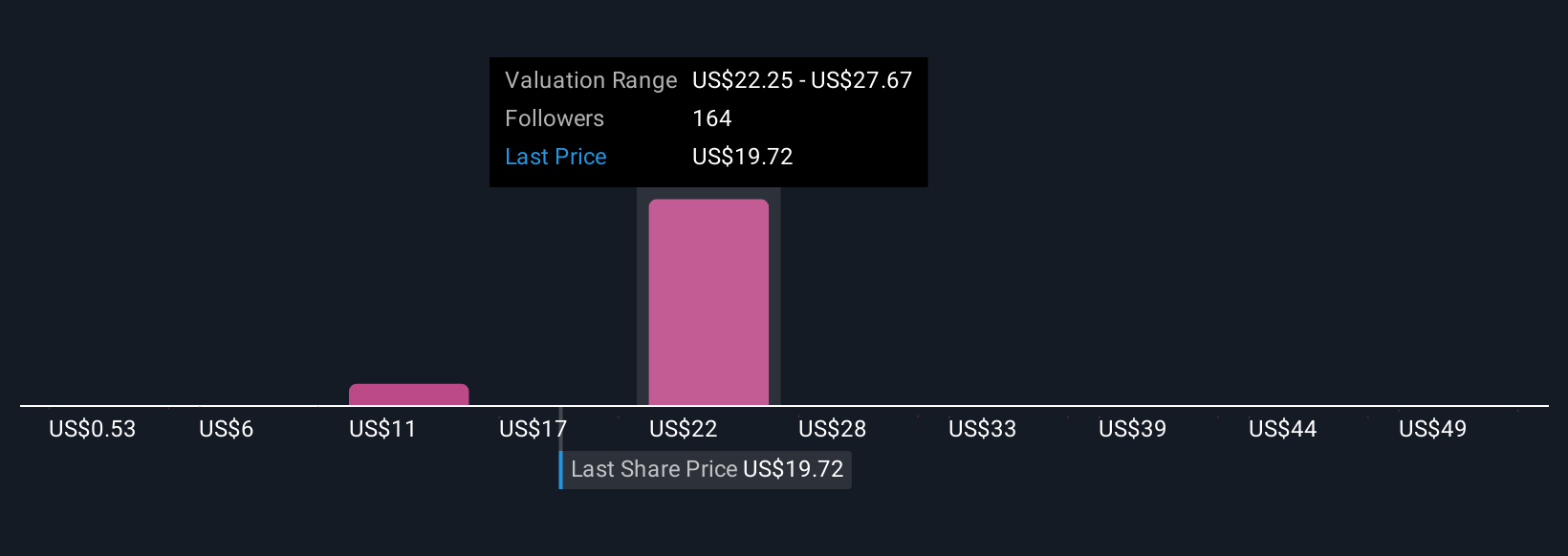

Sixteen independent fair value estimates from the Simply Wall St Community range from US$0.53 to US$30 per share, revealing wide divergence in expectations. With ongoing reliance on external capital and associated dilution risk, your outlook may depend on how you weigh Lucid’s growth ambitions against its funding needs, consider reviewing several different perspectives before making up your mind.

Explore 16 other fair value estimates on Lucid Group – why the stock might be worth as much as 42% more than the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com