EUR/USD Analysis Summary Today

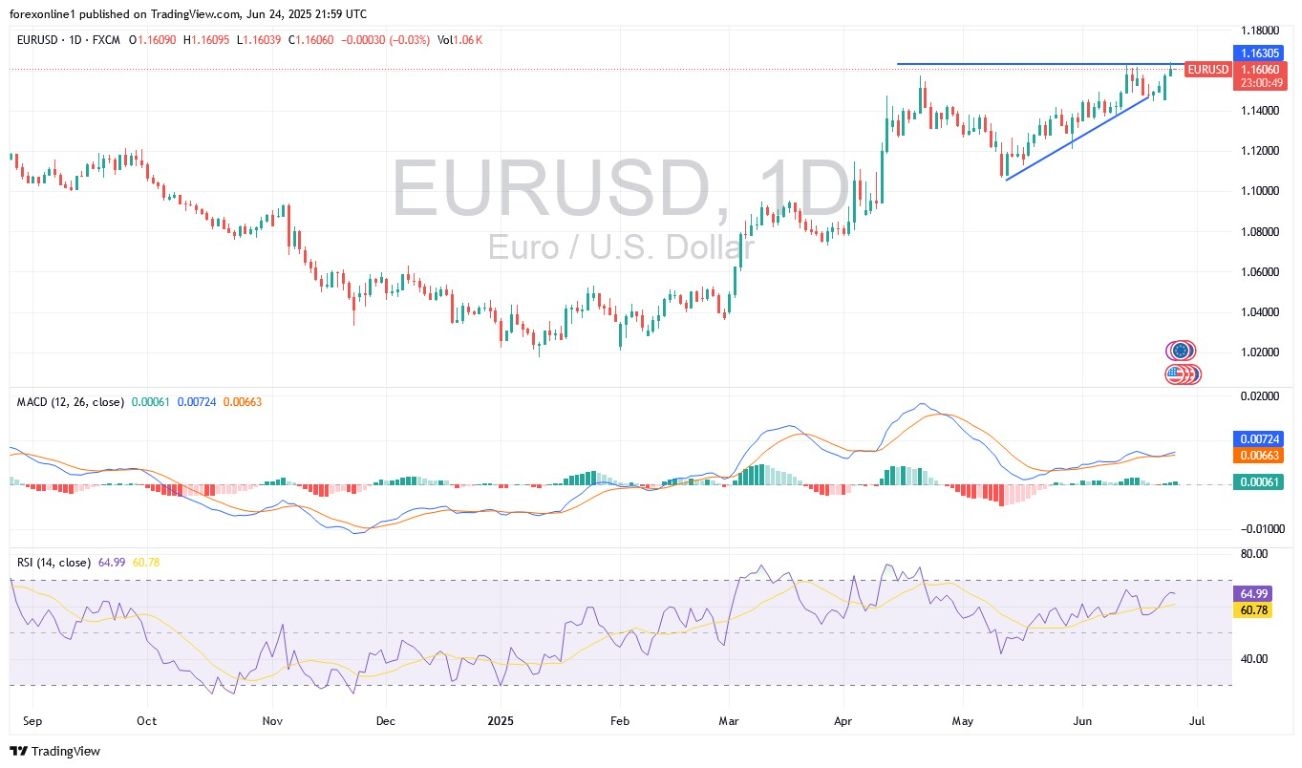

- Overall Trend: Bullish.

- Today’s EUR/USD Support Levels: 1.1542 – 1.1470 – 1.1390.

- Today’s EUR/USD Resistance Levels: 1.1680 – 1.1730 – 1.1800.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1490 with a target of 1.1720 and a stop-loss at 1.1400.

- Sell EUR/USD from the resistance level of 1.1680 with a target of 1.1400 and a stop-loss at 1.1790.

EUR/USD Technical Analysis Today:

For two consecutive trading sessions, the EUR/USD pair has been strongly moving upward, driven by improved investor and market sentiment. Gains extended to the 1.1641 resistance level at the time of writing, marking the pair’s highest point since 2021. The Euro’s gains increased amid the US dollar’s weak performance as traders continue to assess the situation in the Middle East. Recently, US President Trump announced a ceasefire between Israel and Iran, which eased concerns about potential supply disruptions in the energy sector. However, the truce is being tested as Israel has already accused Iran of violating the agreement.

On the economic front, business sentiment in Germany improved, according to the Ifo Index, reaching its highest level in almost a year. However, preliminary PMI indicators painted a mixed picture, with private sector activity in the Eurozone showing signs of stabilization. Meanwhile, concerning monetary policy, analysts still expect a 25-basis-point interest rate cut by the European Central Bank (ECB) before the end of the year. For her part, ECB Governor Lagarde stated that “at current interest rate levels, we believe we are well-positioned to navigate uncertain conditions,” while Governing Council member Villeroy de Galhau said the ECB could still cut rates in the first half of next year.

Trading Advice:

Despite the gains, we still advise selling the Euro against the US Dollar from every upward level, but without taking risks, while closely monitoring factors influencing currency prices.

Technical Levels for EUR/USD Today:

Based on the daily timeframe chart, the EUR/USD pair’s direction remains bullish, and the break of the 1.1600 resistance confirms the strong bullish control over current performance. The 14-day RSI (Relative Strength Index) is around and above the 65 reading, supporting further bullish advances before the indicator reaches overbought territory. Confirming the current direction, the MACD (Moving Average Convergence Divergence) lines are still strongly upward. For technical indicators to move towards overbought percentages for the EUR/USD pair, a rebound towards the 1.1675 and 1.1740 resistance levels, respectively, is needed.

On the downside, and according to performance across reliable trading platforms on the same timeframe, a break of the bullish trend for the EUR/USD pair would require a retreat to the 1.1445 and 1.1360 support levels, respectively. Today’s EUR/USD trading is not solely anticipating important European releases; the focus will also be on statements from Federal Reserve Chair Jerome Powell, which are scheduled for 5:00 PM Egypt time.

Federal Reserve Chair: No Rush to Cut Rates

Yesterday, Federal Reserve Chair Jerome Powell emphasized that there is no rush to cut US interest rates, according to his prepared remarks for a speech to the US Congress. His comments were consistent with previous statements, as several FOMC (Federal Open Market Committee) members have stated that it’s better to wait for a clearer understanding of the level of tariffs the US government will implement and their impact on the economy before adjusting key interest rates.

The Committee kept the federal funds rate unchanged at 4.25%-4.50% for the fourth consecutive meeting in June 2025, in line with expectations. In the accompanying Summary of Economic Projections, the FOMC maintained its forecast for two interest rate cuts this year, though it expects only quarter-percentage-point cuts in 2026 and 2027. The Federal Reserve also lowered its GDP growth forecasts for 2025 to 1.4% (from 1.7% in March) and for 2026 to 1.6% (from 1.8%), while keeping the 2027 estimate unchanged at 1.8%.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.