When I was an undergraduate studying computer science in Hong Kong, I noticed a distinct pattern. The brightest students weren’t locals, but those from mainland China. Fiercely competitive and technically brilliant, their ambitions weren’t aimed at Shenzhen or Hangzhou. They all dreamed of Silicon Valley.

That experience shaped my view of the ongoing discussion about whether Chinese technology offers greater opportunity than its US counterpart. On the ground in Hong Kong, we saw the opposite: a brain drain, with China’s best and brightest wanting jobs at Google, Nvidia, and Microsoft.

The Dragons Take Flight

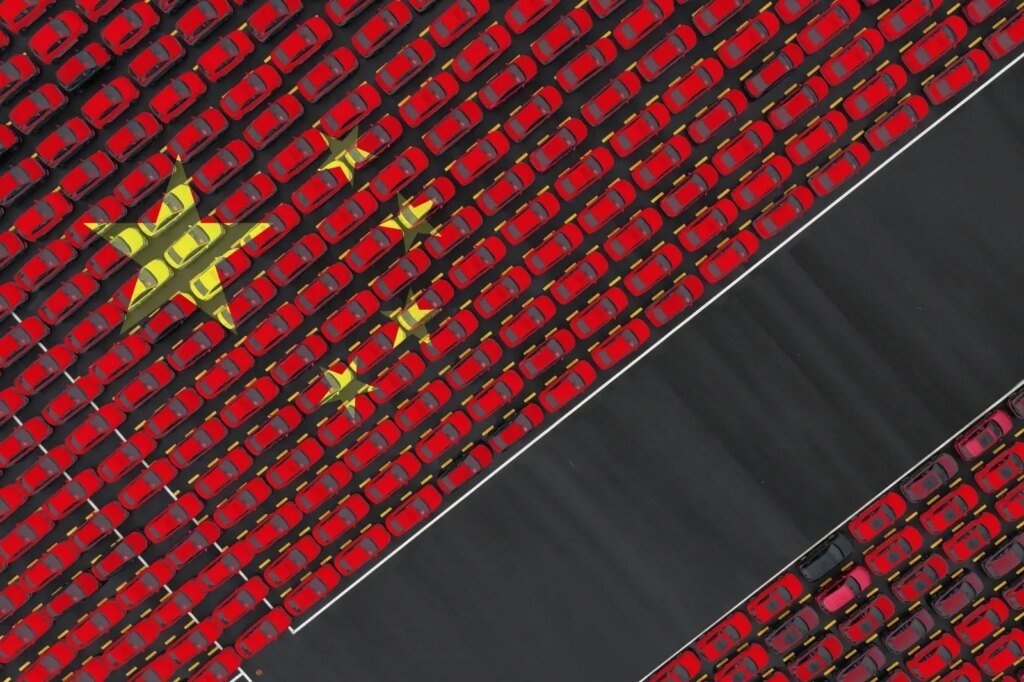

China’s “dragons”, including Baidu, Alibaba, Tencent, and Xiaomi, dominate one of the world’s largest digital economies. For investors tired of stretched US valuations, they can look refreshing. In some sectors, such as electric vehicles, Chinese firms are not just competitive but world leaders.

The rally since Xi Jinping’s Central Commission speech in July, which promised greater support for innovation, shows how quickly sentiment can turn. Mainland retail investors piled in, lifting valuations across the board. On the surface, the case for China looks straightforward: world-class companies trading at a fraction of US prices.

Cheap for a Reason

But markets are efficient in their own way, and cheapness rarely comes without cause.

The most obvious risk is politics. Beijing’s interventions remain fresh in investor memory: the abrupt cancellation of Ant Group’s IPO in 2020, antitrust penalties on Alibaba, and overnight restrictions on gaming for minors that gutted Tencent’s most profitable line. As a parent, I can see the merit in limiting screen time, but markets dislike unpredictability, and China’s regulatory style demands a risk premium.

Then there is foreign policy. Chinese tech firms are overwhelmingly domestic in scope, unlike US counterparts that derive nearly half their revenue overseas. Efforts to expand abroad have stalled, in part because Washington has worked hard to keep Chinese technology out of developed markets. From export controls on advanced chips to lobbying allies against procurement, US policy has been remarkably successful in hemming China’s reach.

(Ironically, Washington’s current restrictions on H1B visas, which make it harder for Chinese engineers to stay in the US, play into Beijing’s hands by pushing talent back toward China’s tech sector. From Beijing’s perspective, that’s a win without a fight.)

Structural challenges also loom large. AI has driven the US tech rally, but China is poorly positioned to benefit. Its companies rely on high-end US chips, now beyond reach. Huawei and SMIC have been told to fill the gap and have near-unlimited budgets to do so. But competing with Nvidia’s ecosystem is a steep, possibly insurmountable, climb. And even if they succeed, the economic case for mass AI adoption in China is weaker. Productivity-enhancing automation matters less in a low-wage economy, especially one already grappling with youth unemployment.

Finally, the numbers don’t lie. Chinese tech may trade on lower P/E ratios, but its earnings, revenue, and free cash flow growth are also weaker. Analysts have been revising forecasts down, not up, and much of the recent buying has come from local retail investors rather than global institutions. Valuations reflect this reality: lower growth, higher risk.

Why the US Still Leads

This contradiction defines Chinese technology today. On the one hand, it is producing world-leading products in areas like EVs and batteries. On the other, it remains trapped, by politics, by geopolitics, and by a domestic focus that limits global reach.

The contrast with US tech is stark. America remains the magnet for global talent, the home of the most advanced chips, and the capital base for companies willing to spend tens of billions on AI infrastructure. Its giants enjoy diversified global revenues and optionality on frontier technologies like quantum computing and space exploration.

Yes, US tech is expensive. But it is expensive for good reason. The premium reflects leadership in the technologies that will shape the next decade, not simply investor enthusiasm.

For investors, the lesson is simple: don’t mistake cheapness for opportunity. The world’s enduring engine of innovation remains in the US.

For those seeking exposure to AI growth, ETFS Technology ETF (Cboe: WWW) offers a diversified way to captures a broad range of leading US tech companies and is well-positioned to benefit from the AI dominance.

Never miss an update

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire