The long-anticipated tidal wave has finally crashed ashore. In November last year, Donald J. Trump secured a near-landslide victory to secure his second term as U.S. President. At the time, one prediction cut across the national political divide: all market participants agreed that the markets should brace for heightened volatility. Now, nearly a year later in September 2025, ‘Trumponomics’—a blend of aggressive tariffs, protectionist trade policies, immigration curbs, and industrial nationalism—has left unmistakable marks on the U.S. stock market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Some sectors have thrived, others have stumbled, their fortunes tied to imports, global supply chains, foreign labor, or government favor. A closer look at the winners and losers of Trump’s market entry offers clues to where stocks may head in Q4.

Trump Tariff Tantrum Storms the U.S.

One of Trump’s first major moves this second term was to introduce sweeping tariffs. In April this year, on a day dubbed “Liberation Day”, Trump imposed a baseline 10% tariff on most imports as well as reciprocal tariffs, even targeting countries considered as political allies. Key sectors affected include autos, electronics, consumer goods, pharmaceuticals, steel, lumber, and luxury goods. Trade wars have indeed ensued since.

In late March, Apple (AAPL) was trading near $220 (just before tariff-related announcements), but by mid-April the stock was trading below $170, as fears of tariffs on Chinese-manufactured components squeezing margins heightened investor concern. Apple bulls weren’t best pleased. Since then, the stock has fully recovered to now trade above $250, which could be a sign that either Apple is incredibly resilient, or Trump’s tariff wave was more of a scare than a new dawn.

Closer to the political sanctum of Washington, Switzerland’s most prized export, watches, were summarily swatted by Donald Trump’s 39% across-the-board tariff on all goods. Watchmaking firm Swatch (SWGAY) responded to a newly imposed 39% import tariff from the U.S. by raising its U.S. prices. For instance, its “MoonSwatch Moonshine Gold” model increased from $400 to $450, reflecting both higher input costs and the pass-through of tariffs.

However, the watchmaker may have had the last laugh, lampooning Trump’s 39% tariff with a special-edition model that playfully reversed the numbers 3 and 9. Understandably, the timepiece is only available in Switzerland and cannot be exported to the U.S. More importantly for Swatch investors, the company enjoyed a bumper sales boost ahead of the tariff’s implementation. Swatch’s CEO, Nick Hayek, noted that the entire industry has adopted a similar approach, which should insulate Swatch from severe sales declines “at least until year-end”—though he emphasized that the current solution remains “temporary.”

Elsewhere, Home Depot (HD) and Walmart (WMT) have both admitted to incoming price hikes on consumer goods, including basic items such as home improvement materials, electronics, and furniture, citing higher import costs. Before the tariff wave in April, Home Depot traded around $370, but soon slid to $325, reflecting expectations of margin compression and softer consumer spending. Walmart’s stock price fell from approximately $90 to around $80 over the same period. Since then, both stocks have recovered and are trading at their highs: at the open today, Home Depot was trading at $410, while Walmart opened at $102.30.

The Orange Man’s Media Full Court Press

Media companies have also felt the full brunt of Donald Trump’s ire. Earlier this month, Donald Trump unleashed a triple salvo upon U.S. media companies, including a $15 billion lawsuit against The New York Times (NYT). In parallel, Trump renewed a push to end quarterly corporate reporting and threw his support behind the SEC to move disputes away from public courts into private arbitration. With the smell of skullduggery in the air, investors have taken fright.

Trump has made repeated threats and occasional filings against other media organizations, raising the specter of a legal strategy aimed at chilling adversarial journalism. A case in point is Paramount Global, which recently settled a lawsuit with Trump for $16 million, opening the door for a merger with Skydance, suggesting that Trump may leverage legal claims to extract concessions or influence media M&A deals again in the future.

Outside of the economic realm, possibly Trump’s most eyebrow-raising move was to cite “national security” as justification to tighten control over media access to military information. According to journalists, the Pentagon now requires credentialed journalists to pledge not to report unauthorized materials, including unclassified information.

Trump’s Biggest Beneficiaries

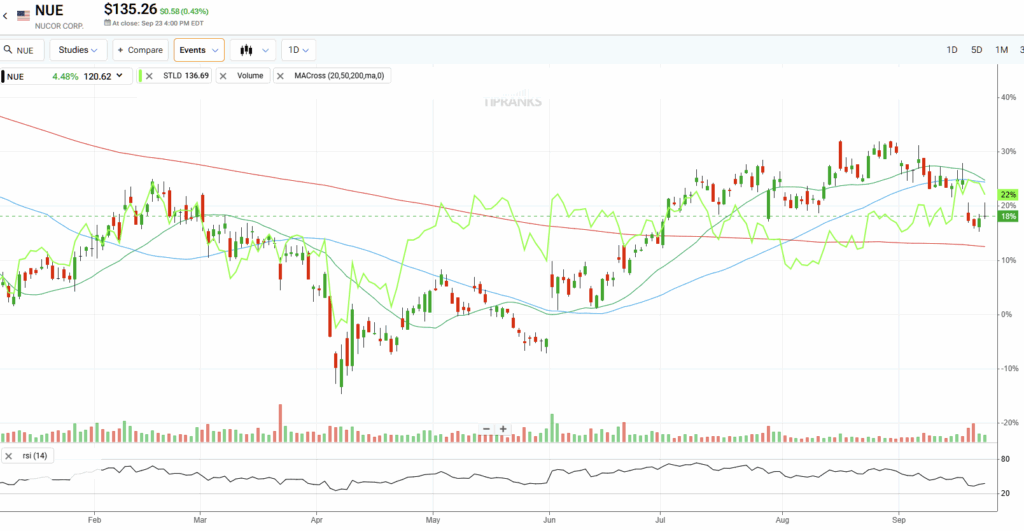

Steelmakers have been among the biggest beneficiaries of Trump’s policies. Just this week, Trump invoked his “golden share” authority to sustain operations at U.S. Steel’s Granite City mill. The move ensures that the U.S. maintains some domestic capacity, which could eventually lead to lower steel prices. For now, tariffs of 25-50% on imported steel have propped up domestic prices, assisting domestic producers such as Nucor (NUE) and Steel Dynamics (STLD)—both of which are up ~20% year-to-date.

Defense contractors and mining firms have likewise gained ground. Lockheed Martin (LMT) has rallied on the back of rising defense outlays and favorable industrial policy treatment. Meanwhile, rare-earth supplier MP Materials (MP) saw its share price climb 50% in July, after news broke that the Pentagon would become its largest shareholder with a $400 million preferred stock purchase.

Companies deemed critical—such as those involved in semiconductors, rare earths, and defense—are being shielded or actively supported. This preferential treatment has buoyed stocks in these strategic niches, even as the broader industrial sector grapples with elevated input costs.

Stars, Stripes, and Stock Picks

Trump’s imprint on the U.S. stock market is impossible to miss. Companies tied to foreign inputs, sprawling supply chains (not to mention visa applicants) have been punished, while steelmakers, defense contractors, strategic-materials firms, and those able to localize production have generally thrived. The bigger picture is that marketwatchers were right a year ago: volatility has spiked, consumer prices have climbed, and investors now scrutinize industrial policy risk more closely than ever.

Whether these moves achieve Trump’s stated goals—reshoring manufacturing, protecting domestic labor, cutting trade deficits—remains uncertain. What’s obvious is that government policy has been driving valuations sharply in both directions and has influenced the corporate world to the highest degree in living memory.

Looking ahead, the winners may well be the brands and sectors that embody the “All-American” image, hiring droves of American employees. Think Harley-Davidson, Bank of America, General Electric, UnitedHealth, Wells Fargo, Chevron, ExxonMobil, American Express, American Tower, and T-Mobile. Companies that wear America on their sleeve—or stand as captains of American glory—seem likeliest to enjoy policy tailwinds, with the Administration bending the rules of corporate engagement to protect them in global competition.

As traders like to say: tin hats on.