Billionaire investor Warren Buffett’s advice to “hang out with people better than you” is shaping how leaders and professionals approach success in 2025.

At the 2004 Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK.B) annual meeting in Omaha, a young attendee asked Buffett for guidance on achieving success, as reported by Inc.

The billionaire investor’s response was strikingly simple: “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction,” Buffett said.

Trending: The same firms that backed Uber, Venmo and eBay are investing in this pre-IPO company disrupting a $1.8T market — and you can too at just $2.90/share.

His longtime partner, Charlie Munger, added bluntly, “If this gives you a little temporary unpopularity with your peer group, the hell with ’em.”

Buffett emphasized that success isn’t just about financial gains. Integrity, focus, and continuous learning are essential traits in the people you choose to surround yourself with.

“You’re looking for three things in a person: intelligence, energy, and integrity. And if they don’t have the last one, don’t even bother with the first two,” he noted.

Buffett once shared his top financial advice for the middle class, focusing on simplicity and long-term stability.

He emphasized “paying yourself first,” advising people to set aside money for savings and investments before spending. At a Berkshire Hathaway annual meeting, he said, “Do not save what is left after spending, but spend what is left after saving.”

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Buffett also recommended cutting unnecessary expenses, living on a lean budget, and investing consistently in a low-cost S&P 500 index fund.

He told investors, “Consistently buy an S&P 500 low-cost index fund. Keep buying it through thick and thin, and especially through thin.”

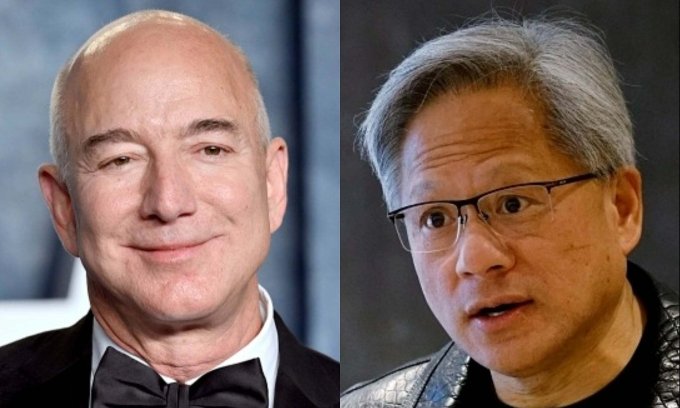

People have long wondered if Buffett’s approach could simply be copied. Even Amazon.com Inc. (NASDAQ:AMZN) founder Jeff Bezos asked him that question.

Airbnb Inc. (NASDAQ:ABNB) CEO Brian Chesky shared a story on “The Carlos Watson Show,” recalling a lunch at Sundance with both Buffett and Bezos.

Chesky, then a 31-year-old newcomer to tech, asked Bezos about Buffett’s best advice. Bezos recounted asking Buffett why no one copied his simple investment strategy, to which Buffett replied, “Because no one wants to get rich slow.”