Business reporter, BBC News

Getty Images

Getty ImagesWhat does Evergrande do?

Evergrande, formerly known as the Hengda Group, was founded by Mr Hui in 1996 in Guangzhou, southern China.

At the time of its collapse, Evergrande had some 1,300 projects under development in 280 cities across China.

The Evergrande Group as a whole encompassed far more than just real estate development.

Its businesses ranged from wealth management to making electric cars. It even owned a controlling stake in the country’s most successful football team, Guangzhou FC.

Mr Hui was once Asia’s richest person with his fortune estimated at $42.5bn (£31.6bn) by Forbes, but his wealth plummeted as Evergrande’s problems deepened.

Why is Evergrande in trouble?

Evergrande expanded aggressively to become one of China’s biggest companies by borrowing more than $300bn.

But in 2020, the Chinese government brought in new rules to control the amount owed by big real estate developers.

The new measures led Evergrande to offer its properties at major discounts to ensure money was coming in to keep the business afloat.

That meant the company struggled to meet the interest payments on its debts.

Since the start of the crisis Evergrande’s shares have lost more than 99% of their value.

In August 2023, the firm filed for bankruptcy in New York, in a bid to protect its US assets as it worked on a multi-billion dollar deal with creditors.

Why do Evergrande’s problems matter?

Evergrande’s problems and the property crisis as a whole have hurt the Chinese economy as the real estate industry accounted for about a third of the country’s gross domestic product (GDP), an annual measure of all economic activity.

It was not only a significant driver of growth but also a major source of revenue for local governments.

Getty Images

Getty ImagesA sharp fall in investment and fund raising activities in real estate have impacted the financial sector, and allied industries like construction, which are a huge source of employment.

At the grassroots level, it has hit ordinary people in China hard as many families put their savings into property.

All of this has helped put pressure on consumer spending, which Beijing sees as crucial to boosting economic growth.

Why didn’t Evergrande get a state bailout?

Through the property crisis the Chinese government has taken a number of measures to help shore up the industry and the economy.

Beijing has poured hundreds of billions of dollars into measures including the country’s central bank providing low-interest loans for state-controlled banks to support struggling real estate projects.

There has also been help for home buyers and incentives to purchase new household appliances.

But it did not roll direct bailouts for the country’s struggling developers, partly to avoid encouraging more risky behaviour.

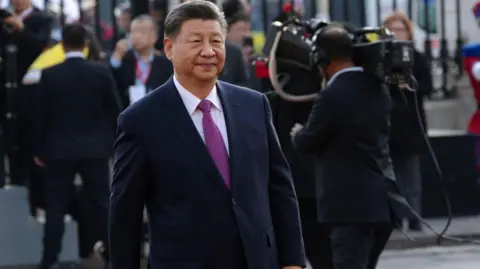

While the property market was once crucial to China’s economic growth, President Xi Jinping’s focus has changed to competing with US to gain the lead in high-tech manufacturing and AI.

So the ruling Communist Party‘s economic priorities have shifted to areas like renewable energy, electric vehicles, automation and robotics.

![[News] TSMC Reportedly Eliminates Chinese Equipment Use in 2nm Production as U.S. Rules Loom](https://koala-by.com/wp-content/uploads/2025/08/TSMC-WAFER-NO6-624x416.jpg)