The interim CEO bought 30,000 shares of Opendoor stock last month.

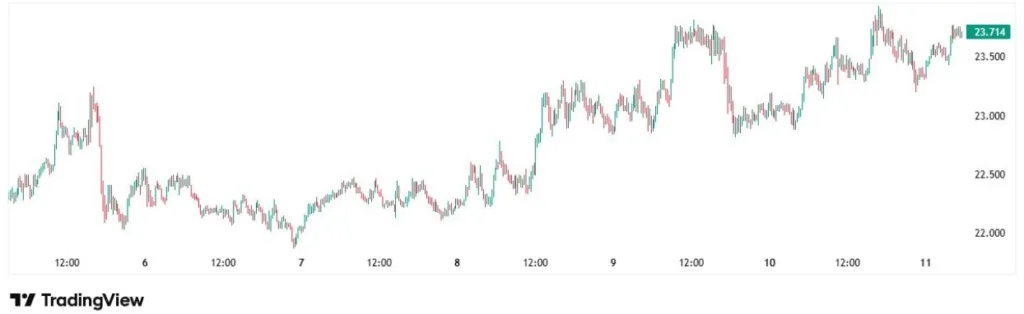

Opendoor Technologies (OPEN -9.17%) stock popped by as much as 10% Monday morning. The stock remains highly volatile, and its next move showed investors why it’s a risky bet. Shares lost all of those gains and more in heavy midday trading.

As of 1:22 p.m. ET, Opendoor stock was lower by 3.8% on the day.

Image source: Getty Images.

Meme stocks aren’t for investors

Traders who frequent the forums on social media platforms like Reddit have turned Opendoor into a meme stock. That has led to retail traders and some investors following it closely. Shares popped early Monday after reports were published highlighting a 30,000-share purchase by Opendoor’s interim CEO.

Those reports triggered some heavy trading in the name; it surpassed its 65-day average trading volume only halfway through the session. The problem is that Shrisha Radhakrishna’s 30,000-share purchase occurred on Aug. 28 — after he was named as temporary CEO when Carrie Wheeler stepped down from the top job.

Another catalyst driving Monday’s early move higher was a push on social media over the weekend to bring back co-founder Keith Rabois. There has been no indication from Rabois that he would be returning to Opendoor.

Another factor that may be contributing to jumps by Opendoor is the stock’s high short interest. As of mid-August, more than 24% of Opendoor’s stock was held by short-sellers. That means any move higher may get enhanced by a short squeeze.

All of those things are really just short-term noise for long-term investors, though. Opendoor’s business has been struggling amid a sluggish housing market. With the Federal Reserve expected to begin lowering its benchmark interest rates soon, the housing market could get some relief. However, with retail traders driving the action for Opendoor stock, investing in it remains a risky proposition.

Howard Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.