After last week’s excellent news, Intel got more good news from Micron’s earnings Tuesday last night.

Shares of Intel (INTC 6.25%) were outperforming on Wednesday, with the stock up as much as 5.6% before pulling back to a 3.2% gain as of 12:08 p.m. today as the broader market sold off.

Intel shares have been on a tear over the past month, after the U.S. government, SoftBank, and then Nvidia all invested in the chipmaker, giving it much-needed votes of confidence as it ramps up its all-important 18A node.

Then today, the company got even better news from another outside party in the form of Micron, which announced its fourth-quarter earnings last night.

Micron lifts guidance for PCs and traditional servers

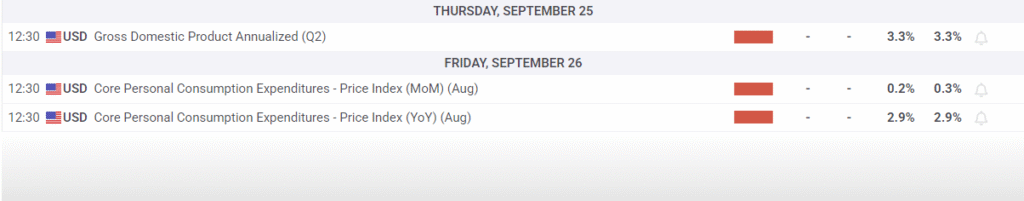

On its earnings call last night, Micron management lifted guidance for certain end markets that are of utmost importance to Intel: personal computers (PCs) and traditional servers.

Micron CEO Sanjay Mehrotra said that the traditional-server market had “strengthened significantly,” with Micron now predicting growth in the mid-single digits for 2025 after previously forecasting flat unit growth, which is a significant change.

Intel has been criticized for missing out on the AI server market for graphics processing units, which is still going like gangbusters, as expected. But Intel is still a strong leader in enterprise traditional servers, which is the sub-segment Mehrotra described here.

It appears that business may be waking up after a few down years. About a year ago, Intel partnered with Amazon to make a custom Xeon central processing unit (CPU) for Amazon’s agentic AI and inference ambitions. That partnership could see a lot of growth in the third and fourth quarters as a result.

Micron also lifted its outlook for PCs, which make up Intel’s largest segment and where it still has about 76% market share of x86-based PCs. Mehrotra said that the Windows 10 end-of-life, which is occurring in October, as well as the adoption of AI PCs, are spurring a better-than-expected outlook for the PC market in 2025. Micron now sees this market up in the mid-single digits, compared with low single digits previously.

Image source: Getty Images.

Stronger end markets could be Intel’s bridge to better times

The fourth quarter will see the first sales of Intel’s Panther Lake CPU for the PC market, and will be the company’s first chip produced on its 18A node. That node is the culmination of the company’s “five nodes in four years” strategy announced in 2021, in which management believed its technology would become competitive with Taiwan Semiconductor Manufacturing once again.

So if Intel can sell Panther Lake CPUs into a stronger PC market and revenue comes in higher than expected, that will give the company more of a financial bridge to 18A high-volume manufacturing next year. And if the company is stronger financially, it can afford to invest in expanding 18A, and potentially attract more third-party foundry customers for both 18A and the upcoming 14A node, which is scheduled for 2028.

Billy Duberstein and/or his clients have positions in Amazon, Intel, Micron Technology, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Amazon, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.