This telecom stock could be well positioned if the stock market sinks or soars.

Verizon Communications (VZ -0.66%) is on a roll. The telecommunications giant recently reported better-than-expected second-quarter results. Verizon raised its full-year guidance. For the 35th year in a row, J.D. Power recognized as having the best wireless network quality.

I recently bought more shares of Verizon. However, my decision to add to my position had nothing to do with any of the aforementioned positives for the company. I completed my purchase before Verizon’s Q2 update. Why did I just buy more of this ultrahigh-yield dividend stock?

I’ve got a feeling

As The Beatles sang on the rooftop of a London building in 1969, I’ve got a feeling. My feeling, though, isn’t a warm and fuzzy one. I suspect another stock market selloff is on the way. Three underlying reasons form the basis of this hunch.

First, the Buffett indicator is at an all-time high of 209%. This indicator reflects the total market capitalization of U.S. stocks as a percentage of U.S. GDP. Warren Buffett stated in a 2001 Fortune article that if this metric approaches 200%, “you are playing with fire.” I don’t find it surprising whatsoever that Buffett isn’t buying many stocks these days.

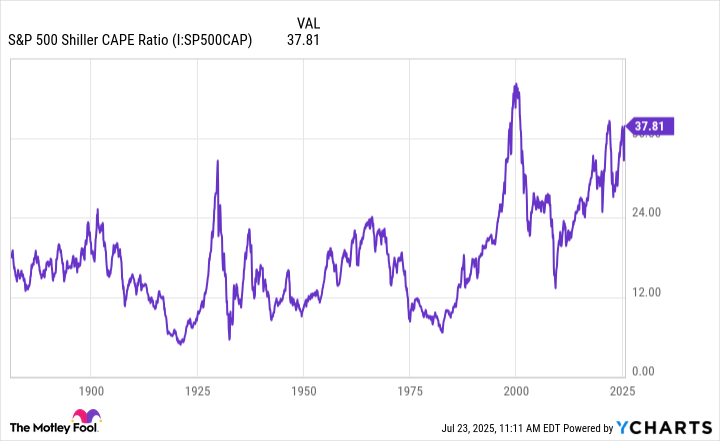

The second reason for my concern also relates to stock market valuation. The S&P 500 (^GSPC 0.41%) Shiller CAPE ratio is close to its second-highest level ever. Soon after the ratio peaked in early 2000, the stock market plunged as the dot-com bubble burst. After hitting its second-highest level in late 2021, the S&P 500 slid into a bear market.

S&P 500 Shiller CAPE Ratio data by YCharts

Third, I think the full economic impact of the tariffs implemented by the Trump administration has yet to be felt. Trade deals may reduce this impact somewhat, but the bottom line is that Americans will probably pay higher prices on many products. Even if some U.S. companies absorb the higher costs, that will translate to lower earnings. Either scenario could eventually affect the stock market.

Verizon checks off the boxes

Where does Verizon fit into all of this? The company and its stock check off the boxes for what I’m looking for in a time of uncertainty.

Importantly, Verizon’s shares aren’t priced for perfection in a market that arguably is. The telecom stock’s forward price-to-earnings ratio is below 9.2. That’s a far cry from the S&P 500’s forward earnings multiple of 22.7. It’s also lower than the valuations of Verizon’s largest peers, AT&T (T 0.50%) and T-Mobile US (TMUS -1.10%).

The executives of many public companies have spoken extensively about tariffs in their quarterly updates. That’s because concerns have mounted about how businesses will be affected by trade policies. Guess how many times tariffs were mentioned in Verizon’s Q2 earnings call by either management or analysts? Zero.

There’s a simple reason tariffs haven’t been a hot topic for Verizon: The company is largely resistant to the impact of tariffs. Furthermore, Verizon’s business is somewhat resistant to overall economic downturns. Wireless services have become a must-have that consumers won’t do without, even if they have to pinch pennies in other ways.

Image source: Getty Images.

What if the stock market and economy roar?

My suspicion that the stock market could sink in the not-too-distant future could be totally off-base. The good news is that even if the stock market and economy roar, Verizon should still perform well. The company’s business looks strong. It’s on track to close the acquisition of Frontier Communications (FYBR -0.12%) in early 2026, which should boost growth.

I can’t leave out Verizon’s dividend, either. The telecom giant’s forward dividend yield of 6.3% gives Verizon a great head start in delivering double-digit percentage total returns. Thanks to a nice increase in free cash flow expected this year, that juicy dividend looks even more secure.

I’ve got a feeling that Verizon will be a long-term winner regardless of what happens over the near term.

Keith Speights has positions in Verizon Communications. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.