Not for the first time, there is speculation the company might be bought out.

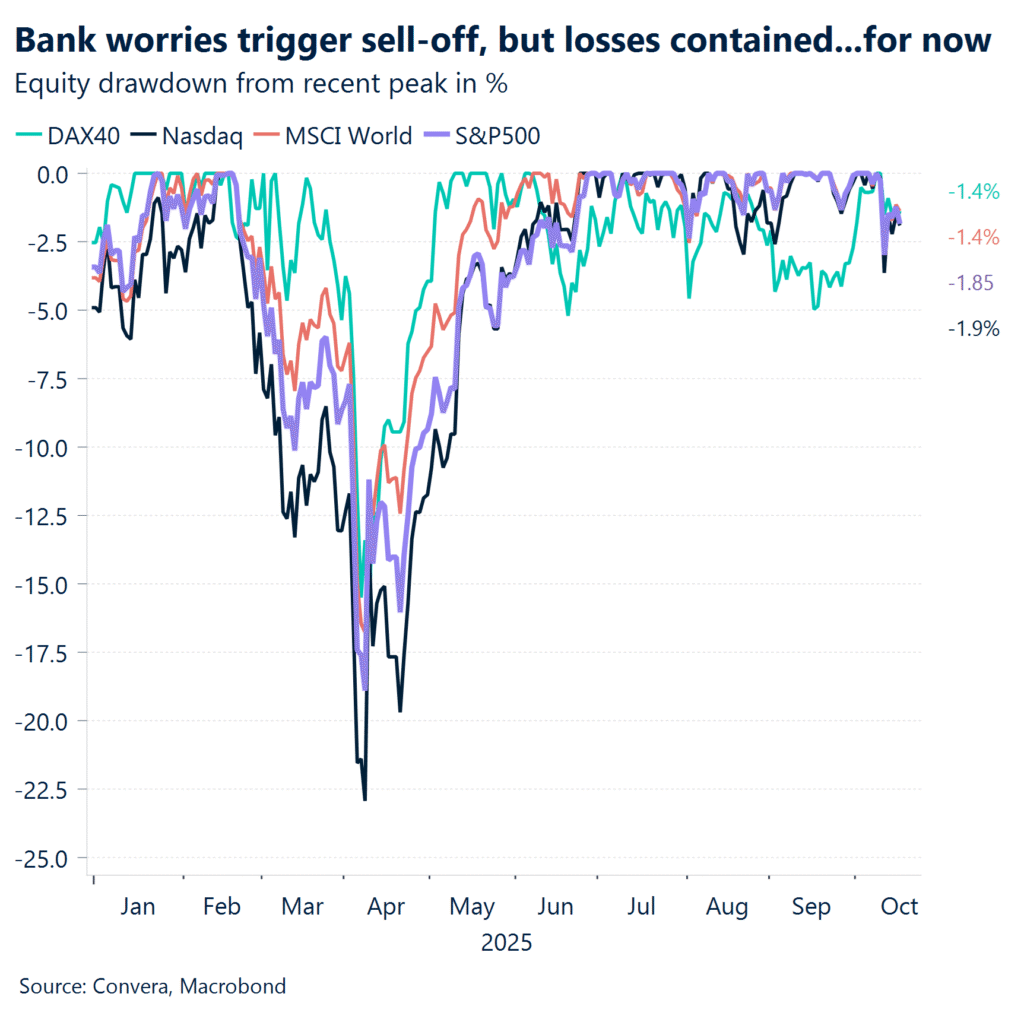

The stock of software development, security, and operations company GitLab (GTLB 11.35%) saw a sudden blast of investor interest Thursday. Thanks to the resulting share price spike as the market barreled to a close the day, the tech company’s share price ended up rising by nearly 11%. That was a far better performance than the S&P 500 index’s 0.6% slump that trading session.

Does a dog want a bone?

The catalyst behind GitLab’s late-inning rally appeared to be a posting on stock market tracking website Street Insider that afternoon.

Image source: Getty Images.

Citing one unnamed source, the site wrote that peer company Datadog was again mulling a takeover bid for GitLab. Management is apparently considering offering more than $60 per share, which is 37% higher than GitLab’s Wednesday closing price.

Street Insider added that, according to its source, Datadog is working with Morgan Stanley to nail down the financing arrangements for its bid.

Neither GitLab nor Datadog has yet commented on the story.

Previous speculation

Datadog has apparently considered a GitLab play before. According to a Reuters article published last July and citing unidentified “people familiar with the matter,” GitLab was considering a sale of its business after potential suitors expressed interest. Reuters specifically mentioned Datadog as an interested party.

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Datadog and GitLab. The Motley Fool has a disclosure policy.