Shares of Apple (AAPL 3.98%) jumped this morning after a couple bits of scuttlebutt leaked regarding the popularity of the new iPhone 17… alongside a positive note from investment bank Wedbush.

As of noon ET, Apple stock is up 4.3%.

Image source: Getty Images.

iPhone 17 demand

Tech site The Information broke the first news just ahead of the weekend, reporting that Apple has been telling its suppliers to increase production of parts specific to the $799 iPhone 17 rather than the $1,099 iPhone 17 Pro by 30%. As The Fly reports, this suggests stronger demand for the cheaper phone than the more expensive — in line with corollary reports that consumers are feeling stretched and are starting to pinch pennies.

That’s the bad news.

The good news, as Bank of America just observed, is that shipping lead times for iPhone 17 orders have expanded to 18 days — nearly twice the 10-day lead times observed for the iPhone 16 last year. And this suggests strong demand, albeit perhaps for cheaper iPhones.

Is Apple stock a buy?

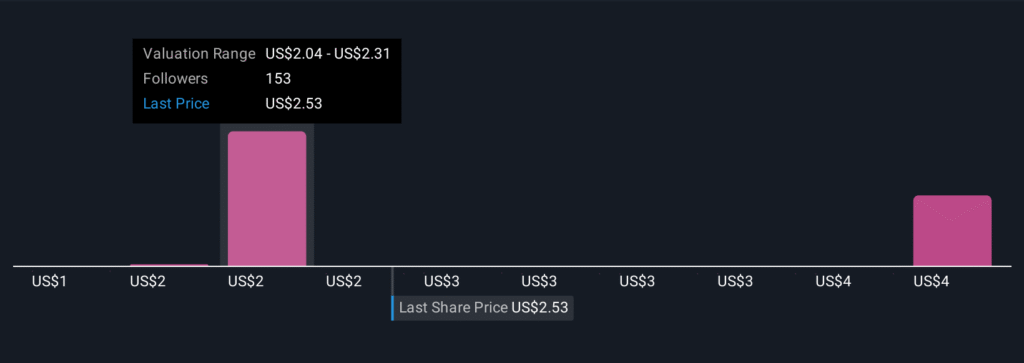

Last but not least, we learned today that Wedbush is raising its price target on Apple stock to $310 a share, implying more than 21% upside in Apple stock. Wedbush says it’s “positively surprised” to see iPhone 17 demand tracking 10% to 15% ahead of demand for the iPhone 16 last year. iPhone production is up at least 20% this year, says the banker, arguing investors are “clearly underestimating this iPhone cycle.”

Even assuming margins are lower on cheaper iPhones, 20% to 30% demand growth would imply Apple’s earnings can grow faster than the 12% long-term growth rate most analysts forecast for Apple. Maybe not fast enough to justify Apple’s 37x earnings P/E ratio — but apparently enough to boost the stock a bit anyway.

Bank of America is an advertising partner of Motley Fool Money. Rich Smith has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.