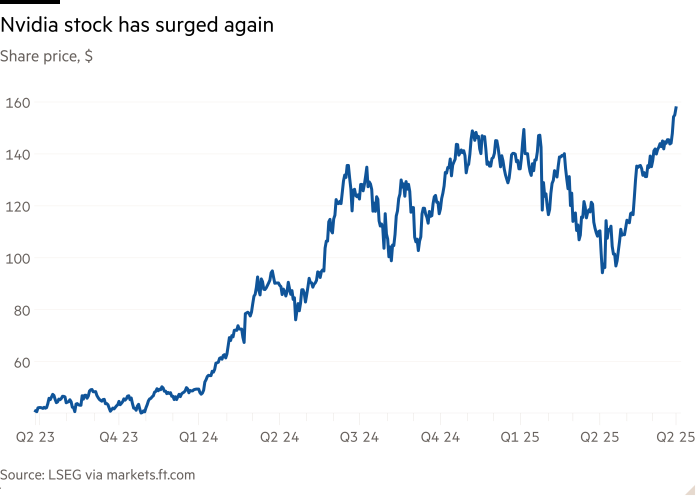

Technology companies must constantly evolve to stay relevant. And Nvidia (NVDA 1.74%) is no stranger to this phenomenon. Founded in 1993, the legendary chipmaker first made its name in video game graphics, eventually getting a notable boost from cryptocurrency mining before its big break with the arrival of generative AI in late 2022.

Now, Nvidia’s data center business (where it sells AI chips) represents 89% of its $44.1 billion in total revenue, while the once-core gaming segment represents just under 9%.

But this is not the time for management to rest on its laurels. There are already signs that its AI chip business could be slowing. And over the next decade, a transition to new business verticals could be key to the company’s success.

The generative AI hardware business is slowing

The start of a new megatrend will often see a flurry of capital spending as hardware improves rapidly and companies throw caution to the wind to avoid falling behind their rivals. But eventually, the technological improvement will slow down, competition will increase, and margins will start to decline.

The networking hardware company Cisco Systems experienced this during the dot-com bubble. Shares have still never surpassed their all-time high reached in 2000.

So far, there is no sign that Nvidia is on the cusp of crashing like Cisco. With a forward price-to-earnings multiple (P/E) of just 34, its valuation remains very reasonable, considering its growth rate. For context, the S&P 500 averages a P/E of 29. However, there are some early signs that its generative AI hardware business might be starting to cool.

The company’s revenue growth has decelerated to 69% (down from 262% last fiscal quarter). And while this may have something to do with the recent ban on chip exports to China, the bigger story may be that its customers are increasingly turning to in-house solutions for their AI hardware needs.

The good news is that Nvidia has several promising new verticals that could help diversify its revenue streams over the next decade.

Will new business niches save the day?

Nvidia’s expertise in designing and producing cutting-edge computer chips will give it an advantage in opportunities outside of just generative AI. Robotics and self-driving cars could be the next big thing.

For example, Tesla has already made extensive use of Nvidia’s chips to create its supercomputer Dojo, which supports the training of its humanoid robots and self-driving taxis. The latter program began commercial operations in Austin, Texas, this month. While it is unclear how these businesses will perform over the long term, they have epic potential.

Image source: Getty Images.

Analysts at McKinsey believe self-driving technology could generate $300 billion to $400 billion in annual revenue by 2035, while Goldman Sachs estimates the humanoid robot opportunity could hit $38 billion by that time. Nvidia’s automation and robotics segment has already started to pick up, with first-quarter sales jumping 72% year over year to $567 million.

Is there risk in long-term investing?

Long-term investing is generally the key to sustainable returns in the stock market. But when your time horizon expands from years to decades, some unexpected risks can emerge.

According to Ernst & Young, the average U.S. S&P 500 company has a lifespan of just 15 years because of technological disruption and failure to adapt to changing conditions. Many others experience long periods of stagnation, even if they survive.

Nvidia can maintain a dominant position because of its vast scale and competitive moat in advanced computer hardware design. These industries will probably exist for the foreseeable future.

But whether or not it continues to thrive will depend on how well its management can execute long-term pivots to new technology verticals as the generative AI opportunity continues to mature and potentially slow down.

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cisco Systems, Goldman Sachs Group, Nvidia, and Tesla. The Motley Fool has a disclosure policy.