Relentless stock-market highs, astronomical valuations for OpenAI, and reports of hyperscalers taking on more debt have stoked fears that the AI boom is another tech bubble ready to pop.

Even OpenAI CEO Sam Altman acknowledged this summer that investors were getting “overexcited about AI” and drew parallels with the dot-com bubble.

But Capital Economics pointed out that year-ahead earnings forecasts for S&P 500 companies—forward-twelve-month (FTM) earnings per share (EPS)—are rising and underpin the stock market rally.

“Although this has mainly reflected developments in the ‘big-tech’ sectors, which have collectively continued to experience phenomenal earnings growth, FTM EPS have also picked up in the rest of the index,” Capital Economics’ chief markets economist John Higgins wrote in a note Monday.

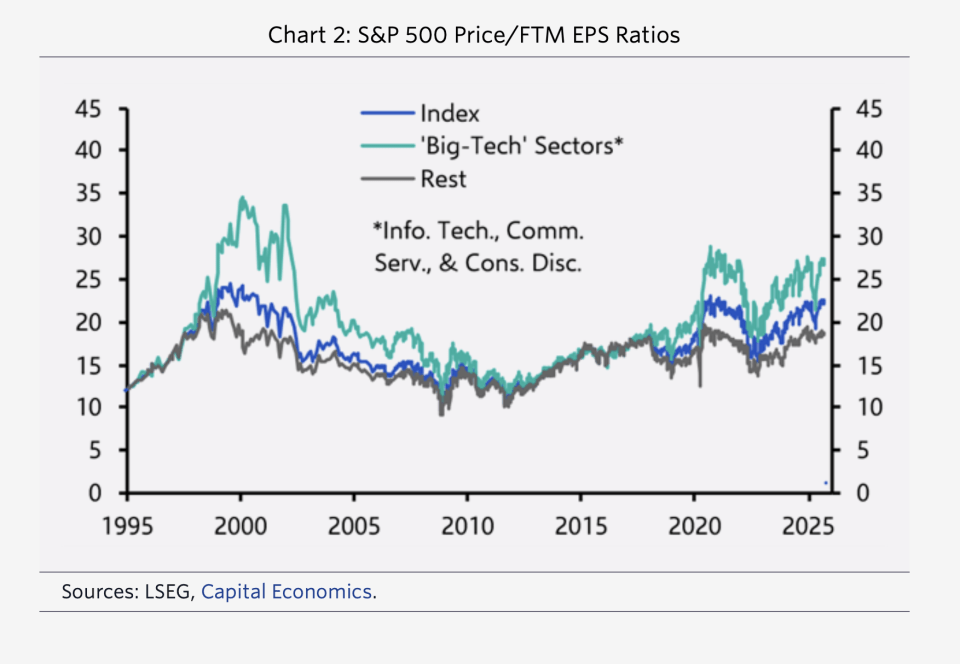

Meanwhile, the ratio of stock prices to earnings estimates has barely increased, edging up to roughly 22.6 from about 22.3 at the start of this year, he added.

And in fact, the ratio for big tech stocks, which have been driving the market surge, has actually dipped marginally.

“The upshot is that price/FTM earnings ratios—for the S&P 500; the big-tech sectors combined; and the rest of the index—are still not as high as they were when the dotcom bubble burst,” Higgins said.

Another key difference between now and the earlier boom-bust era is that the Federal Reserve is lowering rates instead of raising them, though it’s not clear how aggressive the current easing cycle will be.

To be sure, Capital Economics still sees a big correction hitting the S&P 500 eventually, once the AI hype in the stock market has peaked.

But Higgins said that may not happen before 2027. At the same time, the AI boom is transforming the economy.

“And the economy more generally doesn’t look as soft as some recent labor market data have suggested,” he added. “Finally, the bond market would be more likely to come seriously unstuck if the Fed tightened policy, as it did in 1999/2000. This time around, the central bank looks set to do the opposite.”

Similarly, Oxford Economics also noted this week that the current boom has better fundamentals than the dot-com days. The price-to-earnings ratio for tech stocks today is just 56% of what it was at the peak of the dot-com bubble, according to a note Tuesday. And for chip stocks, it’s even lower at 43%.

The dot-com bubble was also marked by investors throwing money at startups with little or no earnings, only to see those bets backfire. But Oxford Economics said just 4% of the tech and telecom firms in the S&P 500 are making a loss versus 12% just before the dot-com bubble popped.

And while OpenAI is not yet profitable, chipmakers like Nvidia and TSMC supplying the AI boom are awash in earnings amid high demand.

Aside from the current stock valuations, the bigger picture for AI is that the technology still promises to usher in a revolution, similar to what the internet did, it added.

“There are certainly many firms that could not secure their share of the market, but the technology itself never failed to take off. It just took longer than people initially expected,” Oxford pointed out. “We expect a similar outcome for AI in the end, but how bumpy the road ahead will depend on the pace and the effectiveness of the technology uptake.”