The Light Sweet Crude Oil market fell rather hard during the course of the week, as the Iranians and Israelis signed a cease-fire. This of course has taken some of the “risk premium” out of the market for crude oil, as tensions in the Middle East seem to be slowing down a bit. Because of this, I think you have a situation where traders simply got rid of those “panic longs”, as we had gotten far too ahead of ourselves. With this being the case, range bound trading is more likely than not going to be where we go from here.

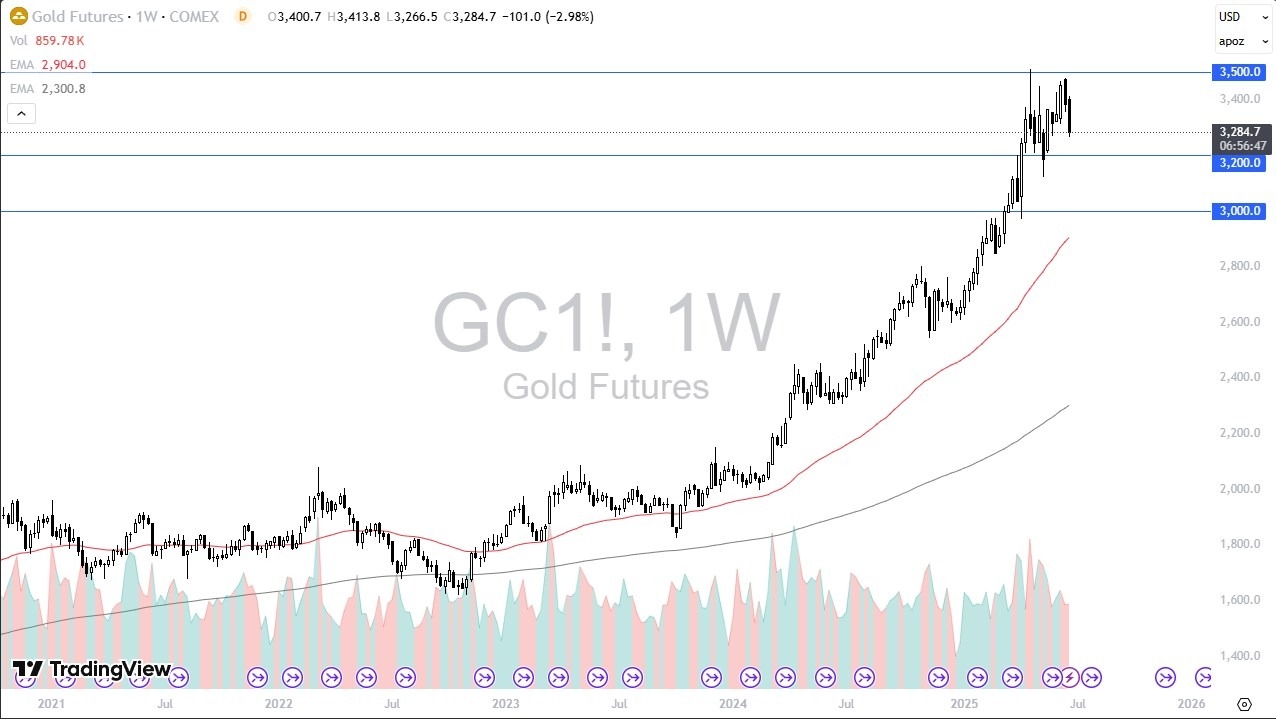

Gold markets have fallen rather significantly during the course of the week, and I think what we have is a situation where a lot of the “risk premium” coming out of the gold trade has had a major influence. That being said, now that the situation in the Middle East has calmed down, I think we will focus on things like central bank buying, the idea that the Federal Reserve is going to cut later this year, and of course the overall momentum trade. Because of this, traders will more likely than not look at any dip as a potential buying opportunity, especially near the crucial $3200 level.

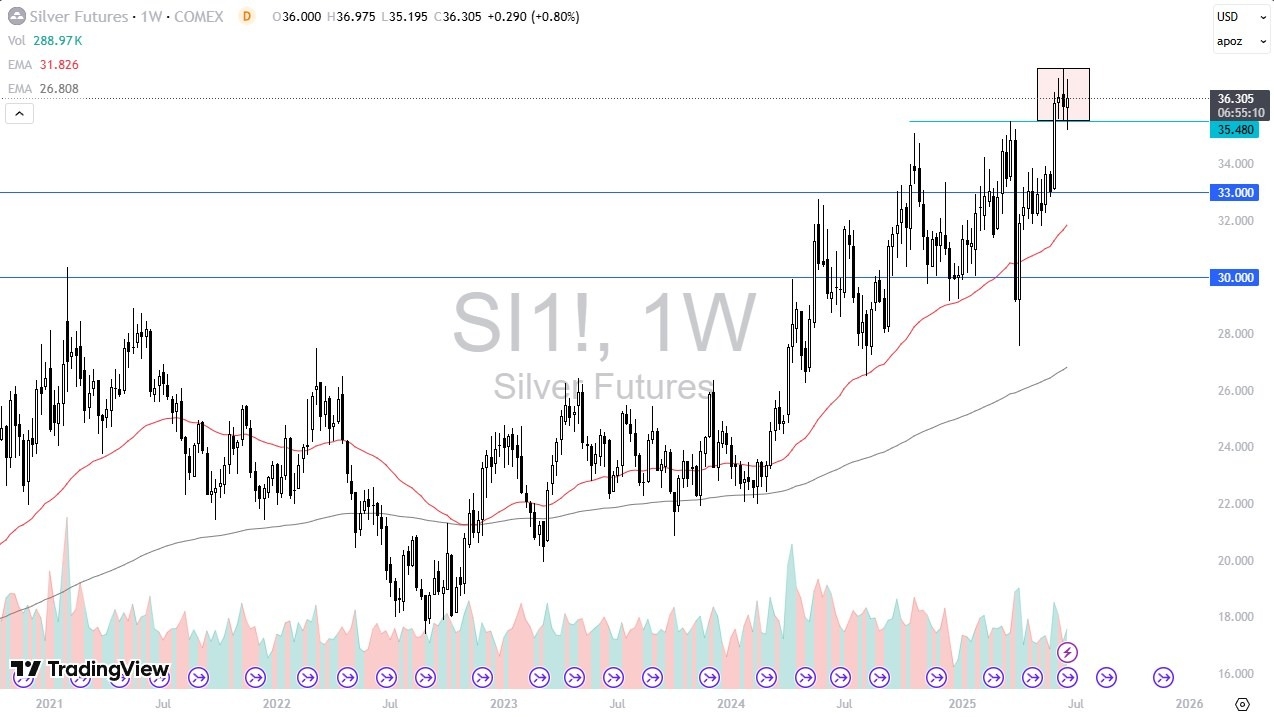

Silver has had yet another back and forth type of trading week, and it looks to me like traders are going to continue to look at this as a market that needs to work off some of the excess froth from the previous shot higher, with the $35.50 level offering significant support. If we were to break to the upside, pay close attention to the $37.50 level, because it is an area that could offer support going forward as it is now resistant. Any move above opens up the possibility of $40. At this point, I look at this is a market that is likely to either go sideways or break out to the upside. I have no interest in shorting silver.

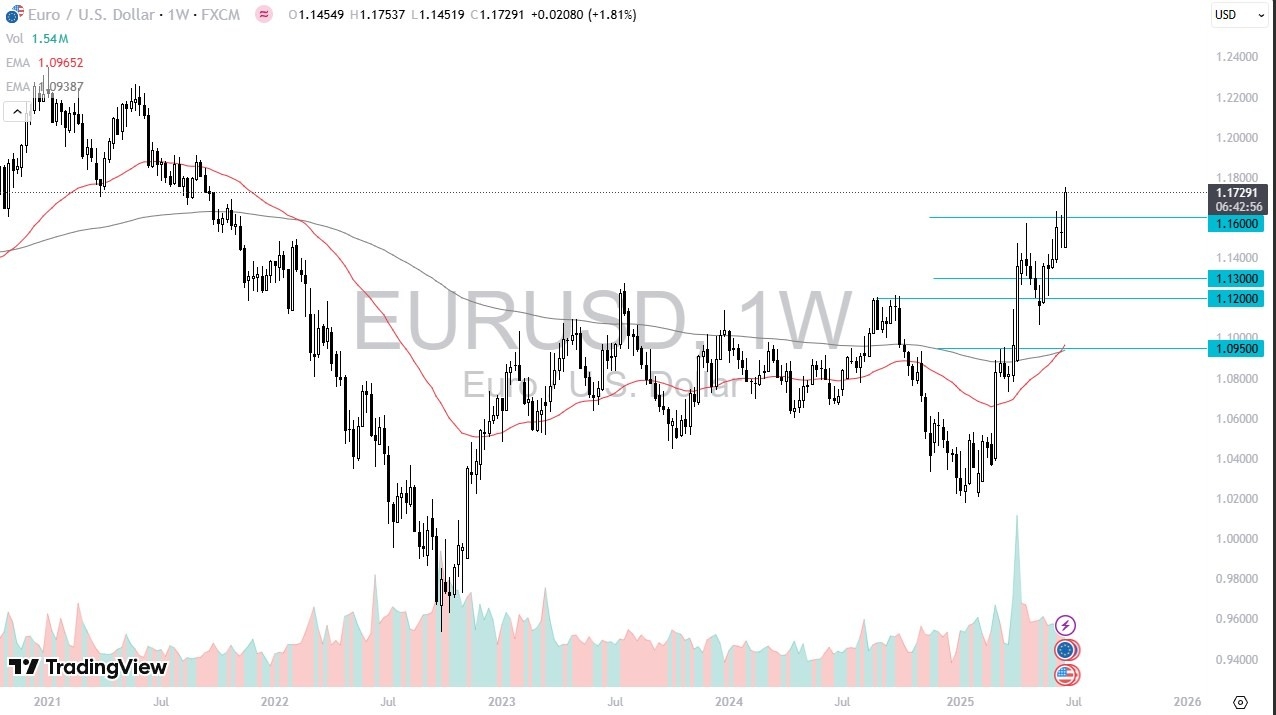

The euro has finally broken above the crucial 1.16 level over the past week, and it’s likely that we could continue to see a little bit of upward momentum, considering that we are closing toward the top of the candle. Ultimately, GDP numbers and Core PCE both pointed to a potentially slowing US economy, which of course will help this market rally as well due to expectations of the Federal Reserve cutting rates later in the year. The upside is probably somewhat limited though, but that’s nothing new for this market as it does tend to grind more than trend.

The US dollar has crumbled against the Mexican peso during the course of the week, as it now threatens to break below the crucial 18.80 MXN level. If it does, then I suspect we have more selling coming in on the market, which makes a certain amount of sense considering that the overall risk appetite around the world seems to be picking up, which is bullish for exporters such as Mexico, which of course has the United States as one of its biggest customers. Beyond that, you get paid to short this market and hang on to the position due to the interest rate differential.

The US dollar initially tried to rally against the Canadian dollar during the week but has found selling pressure. That being said, we are still in the midst of a potential bottoming pattern, as we bounce from the 200 Week EMA previously. That’s obviously a very bullish signal if it turns out to be true, but right now I think what we have is a situation where the Americans in the Canadians are so intertwined that it’s difficult to get overly bullish one way or the other. After all, we fell rather hard from the recent highs, so sooner or later we will find a “buy on the dip” type of opportunity.

The Australian dollar has been all over the place during the week, as we continue to see quite a bit of choppy and sideways action in general. All things being equal, this is a market that continues to pay close attention to the 0.6550 level. This is an area that has been like a brick wall for resistance, and it continues to be so. That being said, the market were to break out to the upside above there, it’s likely that we would see the Australian dollar truly take off. Otherwise, we have a lot of sideways action ahead of us.

The German index has screamed higher during the course of the week, and it looks as if the buyers have returned to push German stocks to all-time highs. All things being equal, the market looks as if it is trying to follow all other equity markets to the upside. The market breaking above the €24,500 level is a potential target for the week coming up, and at this point in time it looks like a situation where if we do get a short-term pullback, buyers will be willing to step in and take advantage of it.

Ready to trade our Forex weekly forecast? We’ve made this forex brokers list for you to check out.