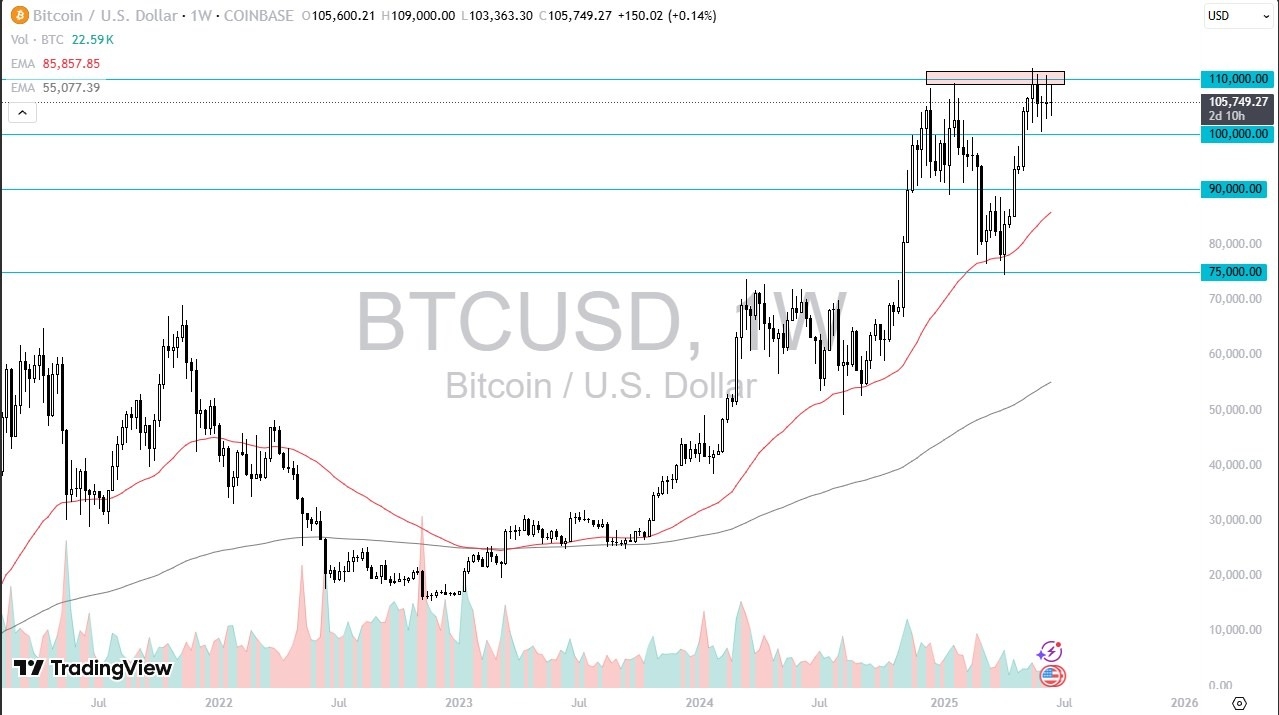

The Bitcoin market has shown itself to be a bit confused at the moment, as we have formed the 3rd neutral candlestick in a row on the weekly timeframe. This suggests that we are looking at this through the prism of a consolidation zone, with the $100,000 level offering support, and the $110,000 level above offering resistance. Ultimately, we are just simply sitting in the middle of the range at approximate “fair value”, so now we need another catalyst. Ultimately though, I prefer the upside.

The NASDAQ 100 is slightly positive for the week, but ultimately this is a situation where we are consolidating as well, with the 22,000 level as a major resistance barrier. If we can break above there, the market could take off to the upside and really, I think we’ve got a situation where we have just simply a bit of consolidation, as we have rocketed far too quickly to the upside. I think we’ve got some time here in a bit of the range until we get some type of external catalyst.

Silver has been all over the place during the course of the week, as we shot toward the $37 level, only to turn around and fall toward the $35.50 level. This is a market that is in the midst of trying to consolidate and work off some of the excess froth from the previous couple of weeks, and now we have a scenario where traders are looking at dips as potential buying opportunities. However, keep in mind that silver is going to be very volatile with so many geopolitical issues going on at the same time. Ultimately, I do prefer the upside in general.

Silver has been all over the place during the course of the week, as we shot toward the $37 level, only to turn around and fall toward the $35.50 level. This is a market that is in the midst of trying to consolidate and work off some of the excess froth from the previous couple of weeks, and now we have a scenario where traders are looking at dips as potential buying opportunities. However, keep in mind that silver is going to be very volatile with so many geopolitical issues going on at the same time. Ultimately, I do prefer the upside in general.

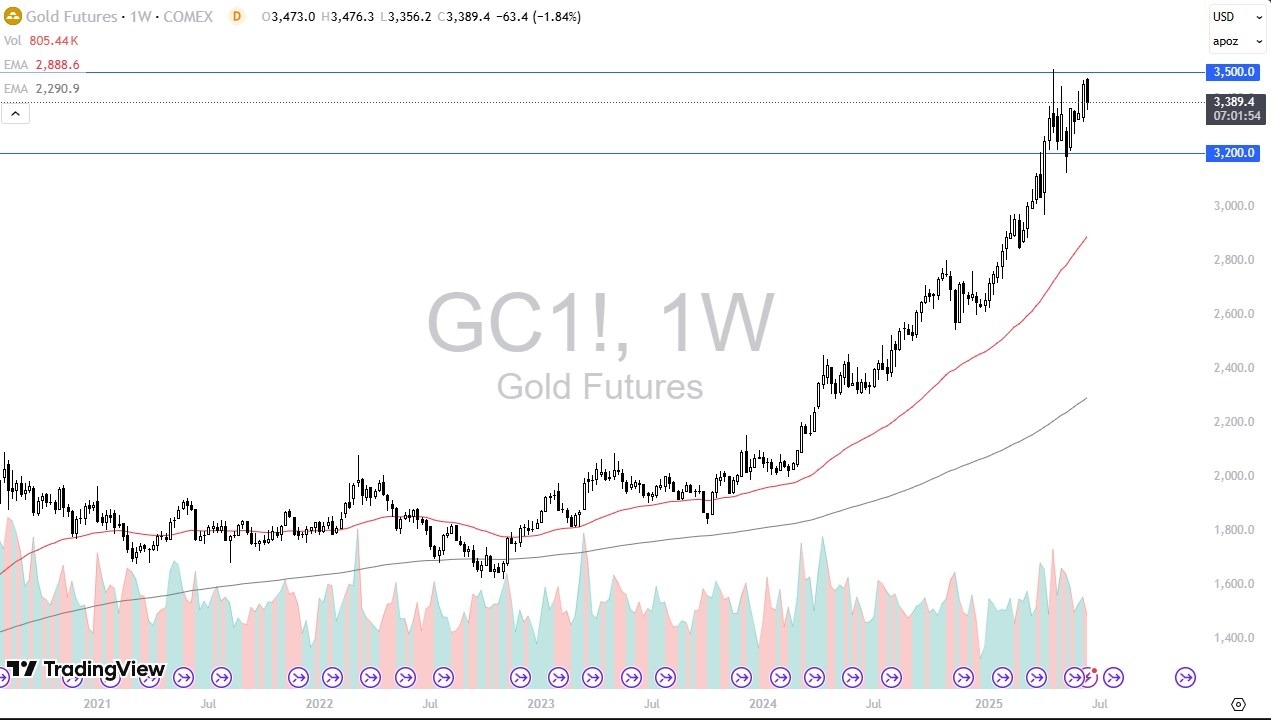

Gold fell during the week, pulling back from the crucial $3500 level. The $3500 level of course is a large, round, psychologically significant figure that a lot of people would be watching, and of course an area where you would expect to see a lot of options barriers. If we can break above the $3500 level, then the market could very well go look to the $3800 level based on the “measured move” of consolidation that starts at the $3200 level, extending to that same $3500 level.

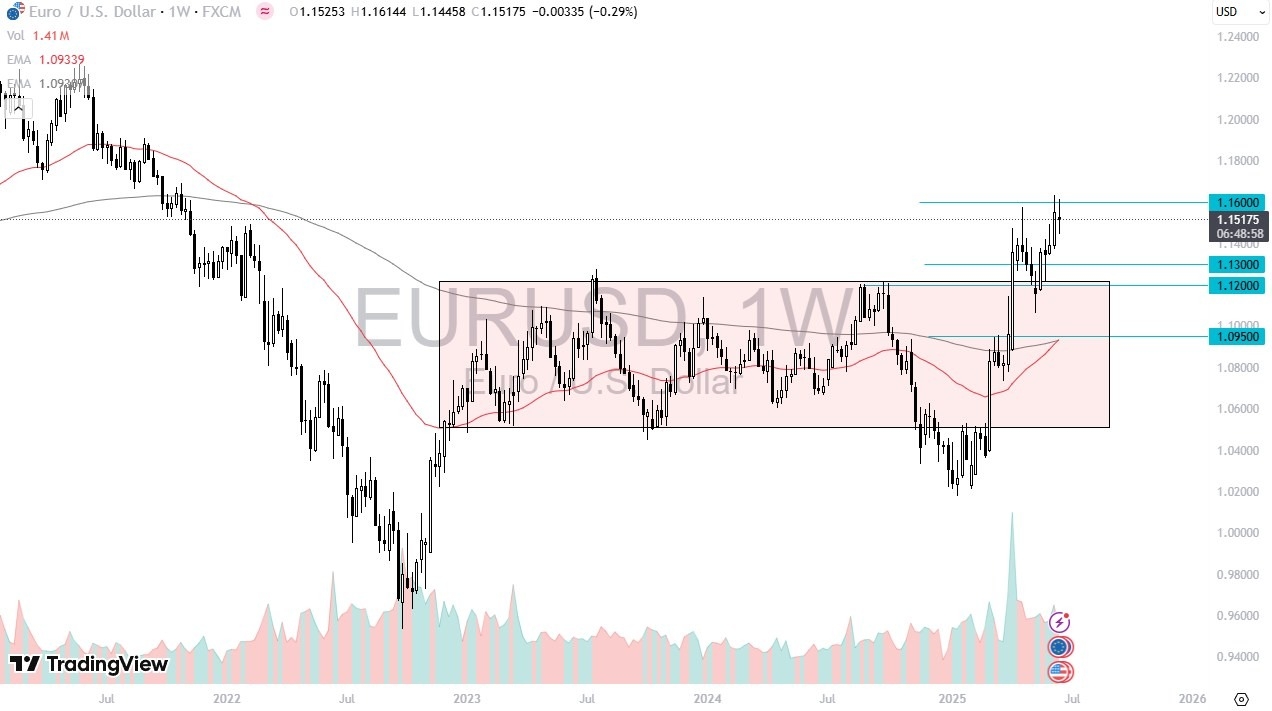

The euro has been all over the place during the week, reaching the 1.16 level at one point, only to turn around and fall quite drastically. The 1.16 level is an area that has been important multiple times in the past, and it is starting to offer a lot of problems for the euro. The 1.13 level underneath could be a bit of a support level but will just have to wait and see whether or not the market is likely to continue going higher. Quite frankly, the US dollar is starting to fight back. Anything below the 1.13 level would be a warning signal for the euro.

The Light Sweet Crude Oil market fell during the week, but we have seen quite a bullish move over the last couple of weeks, and it certainly suggests that the market is going to continue to move on the latest headlines coming out of Israel and Iran. We are currently sitting at the 200 Week EMA, which of course will attract a certain amount of attention, but ultimately it looks like we have started to change the overall trend, so a “buy on the dip” mentality probably makes the most sense here, unless of course peace breaks out in the Middle East.

The US dollar rallied rather significantly against the Mexican peso during the course of the week as we continue to hang around the 19 MXN level. The 200 Week EMA is sitting at the top of the candlestick, and if we can break above that level, then it’s possible that we could go looking to the 50 Week EMA, closer to the 19.5 MXN level. On the other hand, if we break down below the bottom of the candlestick for the past 2 weeks, we could see this market drop toward the 18.20 MXN level.

The British pound has been rather volatile during the trading week, reaching toward 1.3650 level before turning around and testing the 1.34 level. This is a market that looks a lot like a situation where we might be getting a little overdone here, and this consolidation is starting to suggest that we might be getting ready to fall from here. It’s a little early to say that, but that is something that I’m paying close attention to at the moment.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.