The German index DAX had a very back and forth week over the last 5 trading sessions as we continue to see the €24,600 level offer a pretty significant barrier. If we were to break above that level, then it’s likely that the market will just simply continue the overall long trend. That being said, we have recently seen a massive jump higher, so it does make a certain amount of sense that we have spent this time consolidating. This is especially true, considering that the time of year is fairly quiet for a lot of markets to begin with.

Copper had another explosive week, as we continue to get trade headlines, and of course traders start to price in the idea of copper being a major component of artificial intelligence, so this is a different market that was just a few years ago. The market is very strong, but we also gave back quite a bit of the gains late in the week, so I think this is a situation where you probably look for dips to continue buying copper from a longer-term standpoint with particular interest paid to the $5.50 level, and then the $5.20 level.

Silver initially rallied during the week but got absolutely clobbered near the $40 level. The resulting candlestick is a very ugly shooting star, but it’s worth noting that the previous 2 candlesticks were a large, explosive, positive candlestick, followed by a hammer. In other words, there is a lot of noise in this area, and I think you continue to see a lot of back and forth trading more than anything else. With that being the case, the market is just simply trying to sort out whether or not we have enough momentum to go higher. I would not be looking to short this market.

Gold markets rallied a bit during the week to reach just below the $3500 level but got clobbered as we have seen an absolute hammering of price. The market looks like it’s going to form a shooting star just as the silver market is, but we are basically in the middle of overall consolidation, so my plan is to wait for some type of significant sell off that I can start buying again, especially near the $3200 level. If we break above the $3500 level, that obviously very bullish turn of events, but right now it looks like we just don’t have the volume where the momentum.

The NASDAQ 100 spent the week grinding higher, and the key word here would be “grinding.” After all, we are overextended and of course it is summer, so that means that we are looking at a situation where volume might be a bit of a problem. Volume has dropped off of a cliff during the last 5 or 6 weeks, so it’ll be interesting to see whether or not there can be something to get the markets moving. Right now, it looks like any dip gets bought, but it’s not going to be a clean break to the upside unless something drastically changes.

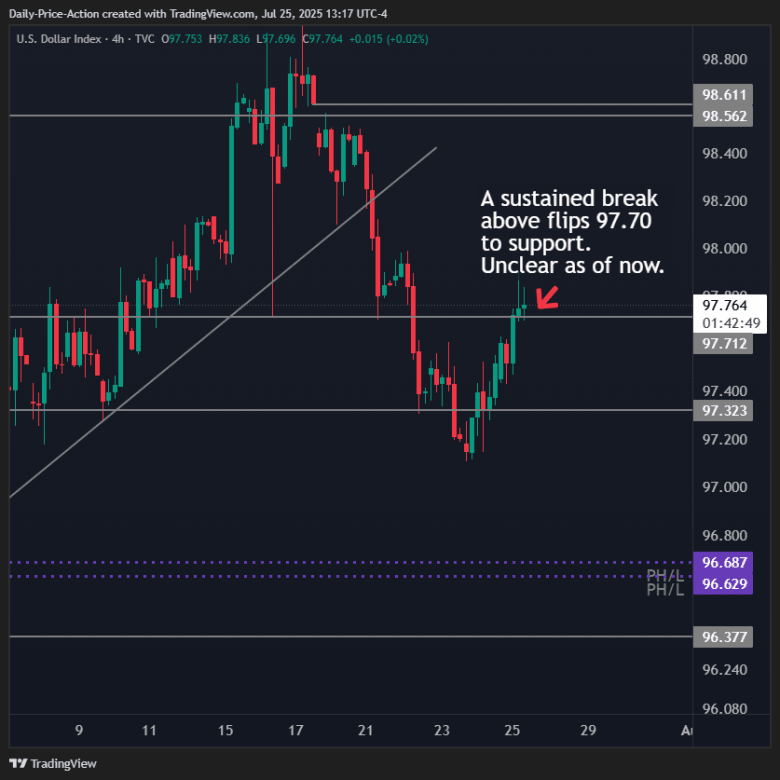

The US dollar initially plunged for the week but has found enough support just above the crucial 1.3550 level and the 200 Week EMA to turn things around and bounce quite nicely. Because of this, it looks like the US dollar is trying to build up enough momentum and stability to finally turn things around against the Canadian dollar, but we need a break above the 1.38 level in order to really get things going. At this point, I like buying dips, because I quite frankly think the US dollar is oversold, and don’t like the Canadian dollar at all.

The US dollar fell against the Japanese yen during the week to crash into the ¥146 level, an area that had been important multiple times in the past, so it’s not a huge surprise to see a bit of “market memory” come into the picture here, as we have turned around to bounce quite nicely and reach the crucial ¥148 level. If we can break above the ¥148 level, then that might send this pair rallying quite nicely. That being said, I don’t have any interest in shorting this pair at the moment due to the interest rate differential and the fact that I think the Federal Reserve has shocked a lot of traders bite been stubbornly tight with its monetary policy.

The Euro rallied quite nicely during the week but has found significant resistance near the 1.18 level. By pulling back the way we have, it suggests that we are getting ready to go into a bit of consolidation and considering that we are in the dead of summer and a lot of other markets are basically doing nothing, this should not be a huge surprise. If we break down below the 1.15 level, then I start to think about being bearish, but right now this is a market that I think you are trading back and forth.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.