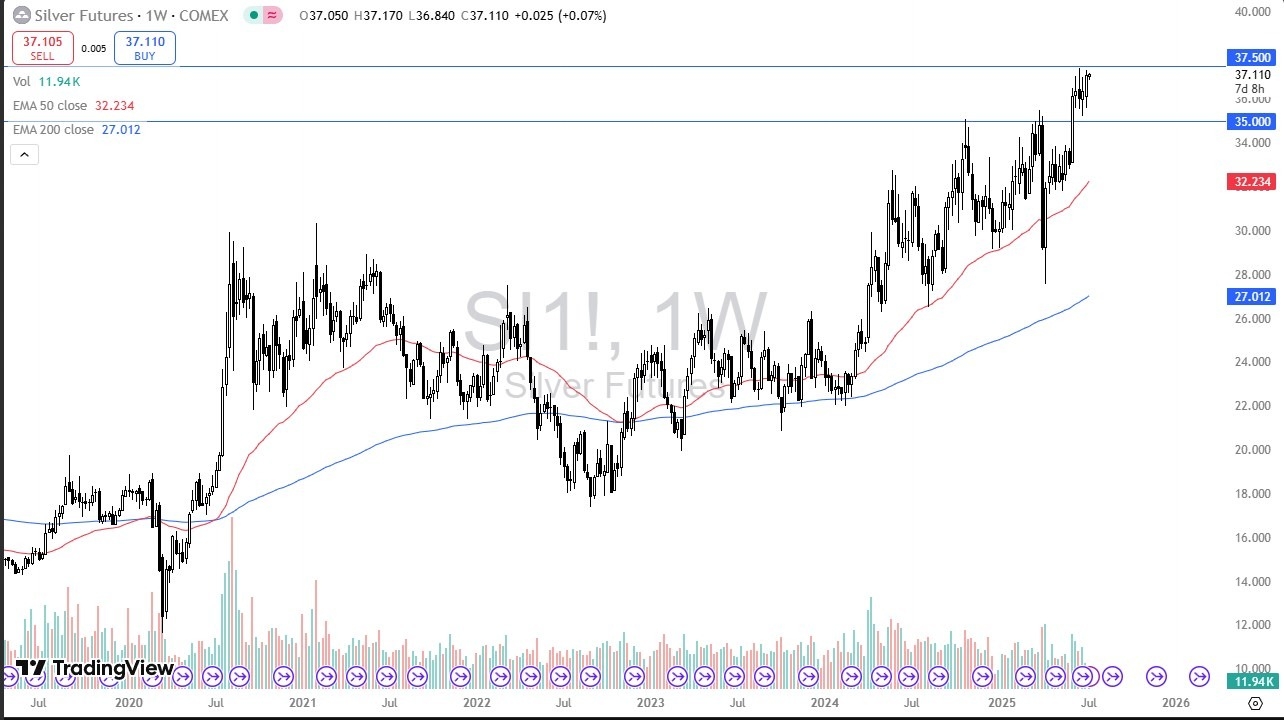

Silver has been very bullish during the past week, but as you can see from the weekly chart, the market continues to bounce around $35 on the bottom and the $37.50 level above. All things being equal, this is a market that continues to be very noisy, and I think this is a situation where we are very bullish overall, but short-term pullbacks will continue to attract a certain amount of attention any time he gets close to the $35 level. If we can break above the $37.50 level, then we could open up a move to the $40 level.

The gold market has been slightly bullish during the trading week, but much like the silver market, we find ourselves in a fairly tight range of $300. The $3200 level underneath is a significant amount of support just waiting to happen, and the $3500 level above is a significant barrier. All things being equal, if we can break above the $3500 level, then we could go looking to the $3800 level. Ultimately, gold continues to see plenty of buyers on dips, and I fully anticipate that over the next several weeks we will continue to go higher in general.

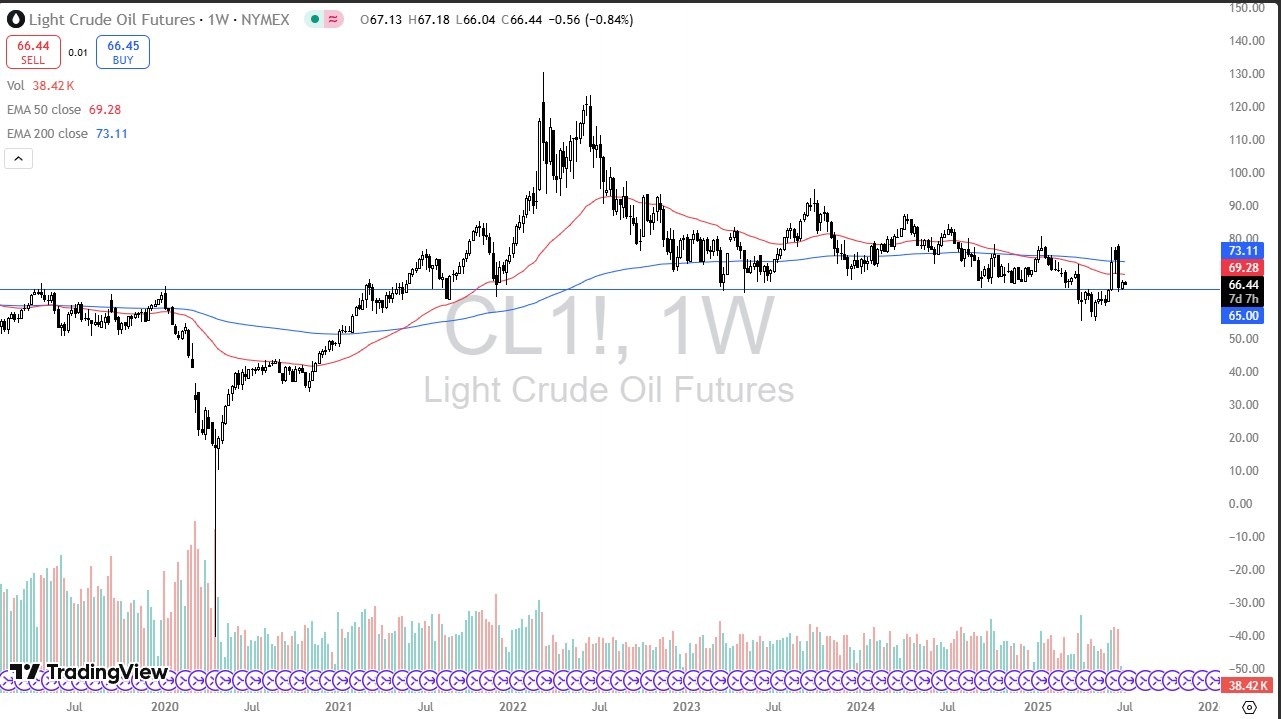

The light oil market crude oil market has bounce just a bit during the course of the week as we continue to hang around the $65 level. All things being equal, this is a market that I think continues to see a lot of volatility, but rallying from here to reach the $80 level is what I fully anticipate as we are heading into the busiest time for demand in the crude oil market. Short-term pullbacks at this point in time is likely to attract plenty of buying opportunity.

Bitcoin has gone back and forth during the week as we continue to see a certain amount of upward pressure over the longer term, with the $110,000 level being a major barrier. If we can break above that level, then it’s likely that we could go looking to the $120,000 level. Short-term pullbacks will continue to attract value hunters underneath, especially near the $100,000 level, an area that has been important multiple times and of course has a lot of psychology attached to it.

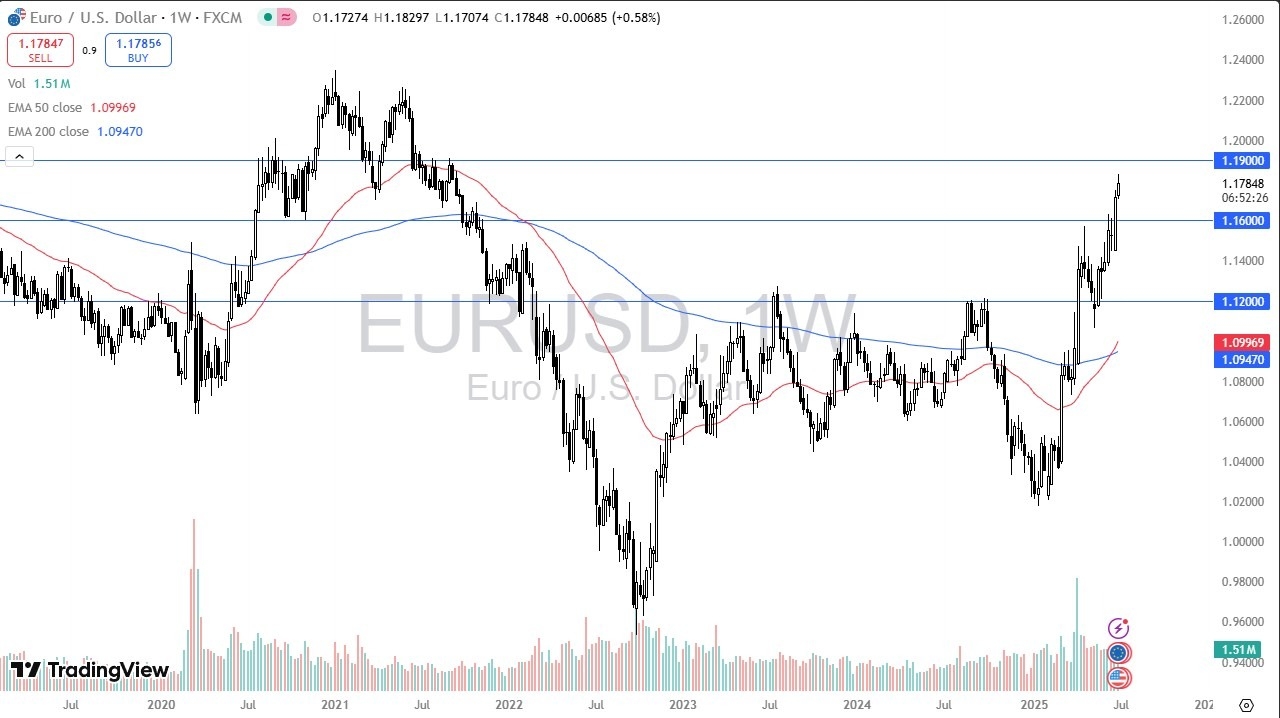

The euro rally during the trading week as we continue to see a lot of bullish pressure, and I think ultimately, we could go looking to the 1.19 level, but a short-term pullback does make a certain amount of sense. If we do pull back from here, I’d be interested in going back into the market if we drop down to the 1.16 level and bounce from there. All things being equal, this is a market that looks very bullish, but we are a little overstretched at this point in time. I have no interest in shorting this pair anytime soon but will be watching the Federal Reserve right along with the rest of the trading world.

The US dollar has initially fell during the course of the trading week against the Japanese yen but has since bounced quite significantly to show signs of life again. The ¥142 level is an area that has been support multiple times, and now we have the 200 Week EMA coming into the same region. The weekly candlestick is a hammer, if we can break above the top of it, then the market could go looking at the 50 Week EMA near the ¥148.23 level. Interest rate differential continues to favor the US dollar, so I do think that there will be plenty of people at least willing to get involved.

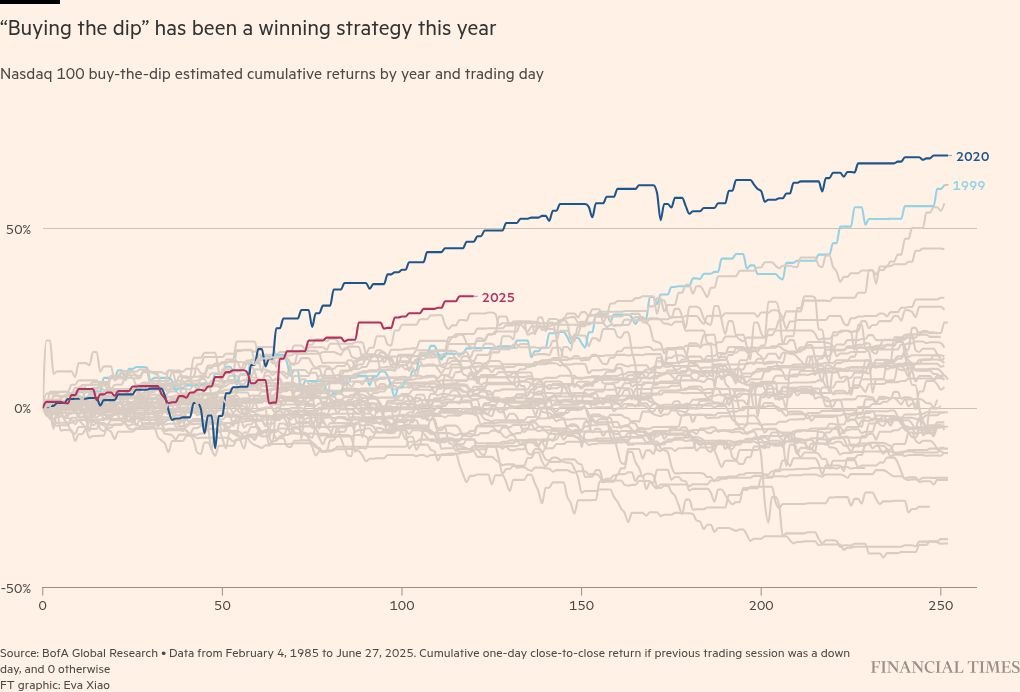

The NASDAQ 100 has rallied a bit during the trading week but gave back some of the gains as we continue to see a lot of noisy behavior. Ultimately, this is a market that continues to be very bullish, and then I think short-term pullback is likely to be the most likely of outcomes, but I think the short-term pullback will more likely than not offer enough value the people are willing to step in and try to pick up the NASDAQ 100 overall. The 22,250 level is an area that I will be looking for very closely.

The S&P 500 rallied during the week to break above the 6200 level. All things being equal, this is a market that if it does pull back, plenty of people will be willing to step in and pick up cheap contracts going forward. The 6150 level is an area that previously has been resistance, so it should now end up being a supportive level. Ultimately, this is a market that I think given enough time will continue to go much higher, based upon the momentum in the fact that no matter what type of news comes out, the market just manages to rally.

Ready to trade our Forex weekly forecast? We’ve made this forex brokers list for you to check out.