I wrote on 8th June that the best trades for the week would be:

- Long of the GBP/USD currency pair after a daily (New York) close above $1.3616. This did not set up.

- Long of Silver in USD terms. This closed 0.78% higher over the week.

- Long of the S&P 500 Index pair after a daily (New York) close above 6,142. This did not set up.

The overall win of 0.78% equals a loss of 0.26% per asset.

Last week was basically mildly risk-on, with stock markets rising and the US Dollar falling on more positive than expected US inflation, PPI and consumer sentiment data. However, all that changed in the early hours of Friday in the Middle East as news broke of a very strong Israeli strike on Iran’s key military figures and its nuclear materials and scientists. This sent markets into a risk-off direction.

The Israeli strike has led to what could be described as all-out war between Israel and Iran, with Iran firing powerful ballistic missiles at Israeli population centers, and Israel in turn hitting hard at the military, the nuclear program, and increasingly at Iranian oil facilities.

This war has been long awaited, and it seems clear that the Israeli attack was acquiesced in by the Americans, who so far at least are not helping with offensive actions, although they are likely assisting in Israel’s strong antimissile defense, which is continuing to intercept over 90% of projectiles. However, the missiles which get through cause serious damage and fatalities, although at a level the Israeli public can probably accept, at least for a few more days or weeks.

It seems clear that the Iranian regime and nuclear program is in serious jeopardy, the nuclear program more so, and Iran has a limited supply of perhaps 2,000 ballistic missiles that it may not be able to replenish. The big question is whether the Americans will join in the drive to destroy Iran’s nuclear program, or whether Iran might sue for a negotiated settlement that would be acceptable to the USA.

The progress of the resolution of these questions is likely to be the major factor influencing markets over the coming week, but there are also major central bank meetings that could impact several G7 currencies.

Last week’s most important data releases were:

- US CPI (inflation) – this was lower than expected, with annualized CPI expected to rise from 2.3% to 2.5%, but rising to only 2.4%.

- US PPI – this key inflation metric was expected to rise by 0.2% month-on-month, but increased by only 0.1%, reinforcing the relatively low CPI data.

- US Preliminary UoM Consumer Sentiment – this was far better than expected, suggesting surprising consumer resilience.

- UK GDP – lower than expected, declining by 0.3% month-on-month, while a decline of only 0.1% was expected. This will raise recession fears for the UK, with the Bank of England facing a tough challenge as it will struggle to cut its relatively high interest rate while the high inflation rate persists.

- US Unemployment Claims – as expected.

The coming week has some very high-impact data releases, including policy meetings at four major central banks, which can significantly affect the Forex market.

This week’s important data points, in order of likely importance, are:

- US Federal Reserve Policy Meeting

- Bank of Japan Policy Meeting

- Bank of England Policy Meeting

- Swiss National Bank Policy Meeting

- US Retail Sales

- UK CPI (inflation)

- New Zealand GDP

- UK Retail Sales

- UK Unemployment Claims

- Australia Unemployment Rate

The most impactful events on the Forex market will likely be the top five items.

The comments from the central banks will be closely watched, and the only rate change that is widely expected to happen will be at the SNB, which is likely to be cut by 0.25%.

Thursday is a public holiday in the USA and New Zealand.

For the month of June 2025, I forecasted that the EUR/USD currency pair would increase in value. The performance of this forecast so far is:

As there were no unusually large price movements in Forex currency crosses over the past week, I make no weekly forecast.

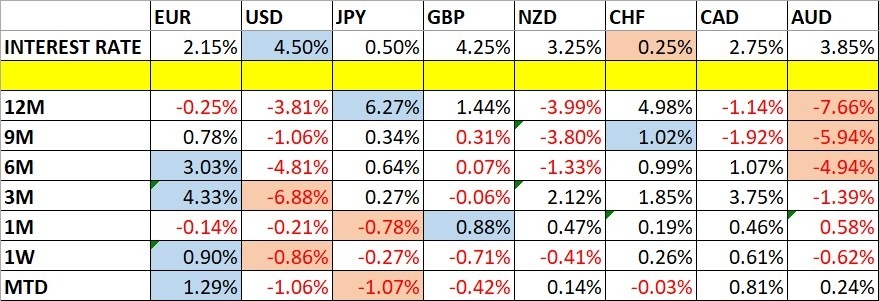

The Euro was the strongest major currency last week, while the US Dollar was the weakest. Volatility increased last week, with 26% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to be higher as we will get several major central bank policy releases.

You can trade these forecasts in a real or demo Forex brokerage account.

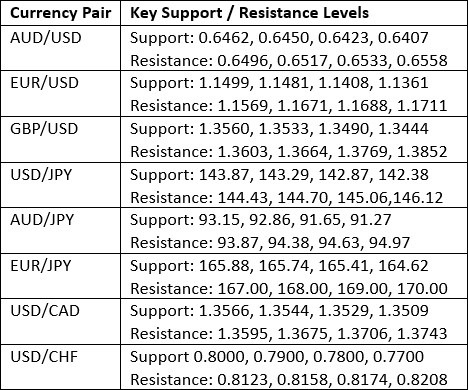

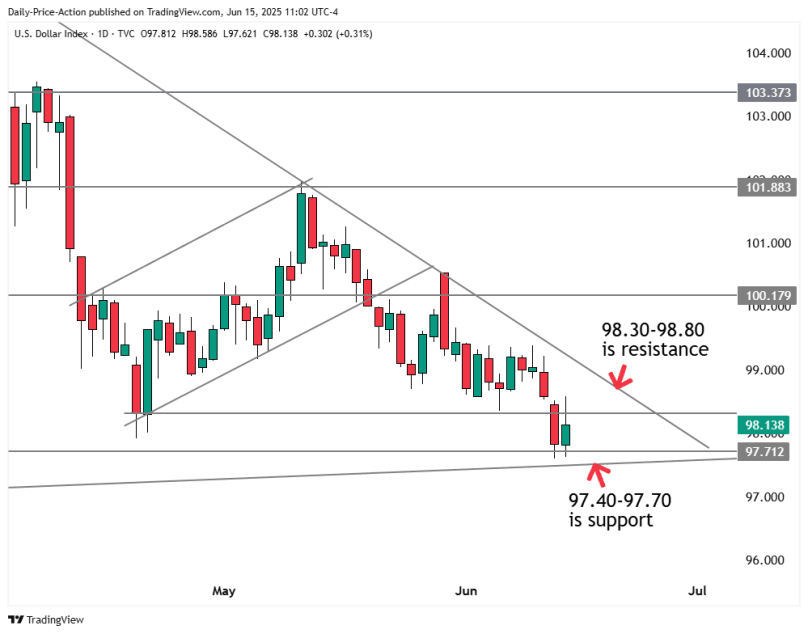

Last week, the US Dollar Index printed a bearish candlestick which made the lowest weekly close since February 2022. There is clearly a long-term bearish trend in the US Dollar. Bulls have two reasons to hope for higher prices though:

- The support level at 97.67, which is continuing to hold so far.

- The outbreak of full-scale war between Israel and Iran early on Friday which triggered a run into safe havens, which to some extent still includes the US Dollar, although increasingly precious metals and some other currencies are taking on that role.

I think it makes sense to be trading in line with the long-term trend which will be short of the greenback, but only after the price has either got established below the support level at 97.67, or alternatively if the price is rejecting a key resistance level above, but the latter scenario is extremely unlikely to play out this week.

The EUR/USD currency pair reached a new 3.5 year high last week, well above the big round number at $1.1500, before giving back some gains on Friday as news emerged of the outbreak of war between Israel and Iran. The Euro was the strongest major currency last week while the US Dollar was the weakest.

A minor factor against bulls is that the resistance level at $1.1569 has continued to hold.

It seems unlikely that even if the war escalates, that the US Dollar will gain strongly, so I have faith in the long-term bullish trend here. This currency pair has an excellent record of respecting the long-term trend, so I am happy to be long here over the coming week.

Gold in US Dollar terms made its highest ever daily close last Friday, but only by a very small amount. This is basically bullish, but looking at the daily chart below, you could say that the price action is only testing a triple top.

The primary precious metal got a boost Friday from the outbreak of war between Israel and Iran, which triggered a flight into safe havens, although not an especially strong one.

It seems unlikely that the war will end any time soon, and there has been a strongly bullish long-term trend for a long time, so being long of Gold over this week will probably be a good bet.

More cautious traders might want to wait for another bullish breakout, maybe even above the record high just below $3,500.

Silver in US Dollar terms again reached a new thirteen-year high last week, above $36 per ounce, but a look at the weekly candlestick shows that it is a doji, which typically signifies indecision. Nevertheless, there is a clearly strong bullish trend in precious metals generally, although silver was rising even before Gold made its major upwards movement.

I am not strongly optimistic that Silver will rise further this week, but it seems more likely to rise than fall.

More cautious traders might want to wait for a new long-term high to be reached, or at least a strong daily close, before entering a new long trade here.

Looking at the daily price chart for WTI Crude Oil below, a lot of interesting and bullish things can be seen:

- The bullish double bottom at around $55.00.

- The cup and handle chart pattern which followed the double bottom, or at least something very close to that pattern.

- The accelerating bullish momentum of recent days.

Of course, crude oil got a major boost Friday as news emerged of what is frankly the outbreak of all-out war between Israel and Iran. This long-anticipated hot conflict outbreak has dramatically pushed up the price of crude oil, as can be seen in Friday’s candlestick. However, bulls might want to beware the large upper wick as crude oil gave up some of its gains later in the day.

There is despite the potential blow-off top another reason to be even more bullish: since markets closed Friday, Israel has begun hitting Iranian energy targets, trying to establish an equation between deliberate Iranian fire on Israeli population centers and the destruction of Iran’s oil production capability.

I think Crude Oil is likely to rise over the coming week, although if a diplomatic solution to the war is found soon – which seems very unlikely – the price would drop dramatically.

I prefer to wait for a new 6-month high close before going long of WTI Crude Oil, so I will only enter a new long trade after a daily close above $80.43.

I see the best trades this week as:

- Long of the EUR/USD currency pair.

- Long of Gold in USD terms.

- Long of Silver in USD terms.

- Long of WTI Crude Oil if there is a daily (New York) close above $80.43.

Ready to trade our weekly Forex forecast? Check out our list of the top 10 Forex brokers in the world.