The US dollar is trying to carve a local bottom following a dismal end to June. Meanwhile, gold is struggling at its 2025 trend line, which could spell trouble for the metal.

Check out today’s Weekly Forex Forecast for the latest on the DXY, EURUSD, GBPUSD, USDCHF, and XAUUSD.

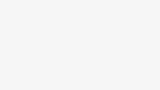

US Dollar Index (DXY) Forecast

The DXY is rebounding today following the release of impressive US employment numbers. Thursday’s non-farm payroll report exceeded expectations, and the unemployment rate dropped from 4.3% to 4.1%.

Technically speaking, Thursday’s rally in the US dollar was not a surprise. Pairs like USDCHF were showing bullish formations on Wednesday, and EURUSD was testing channel resistance from May.

However, the DXY has a significant challenge ahead. The June candle closed below 97.70, making it a substantial confluence of resistance in July.

Additionally, dollar bulls need to reclaim areas like 97.00 and 97.40, which it tested on Thursday. But the much bigger test for the DXY is 97.70, which is the bottom of the ascending channel from 2011.

July will be interesting for the DXY. On the one hand, the US dollar remains in its 2025 downtrend and trades below key areas like 97.70. On the other hand, a break below an area as significant as 97.70 is precisely what it would take to carve out a bottom.

That doesn’t mean it will happen, but I’m not going to rule it out. Regardless of what we get, the chart will have the final say.

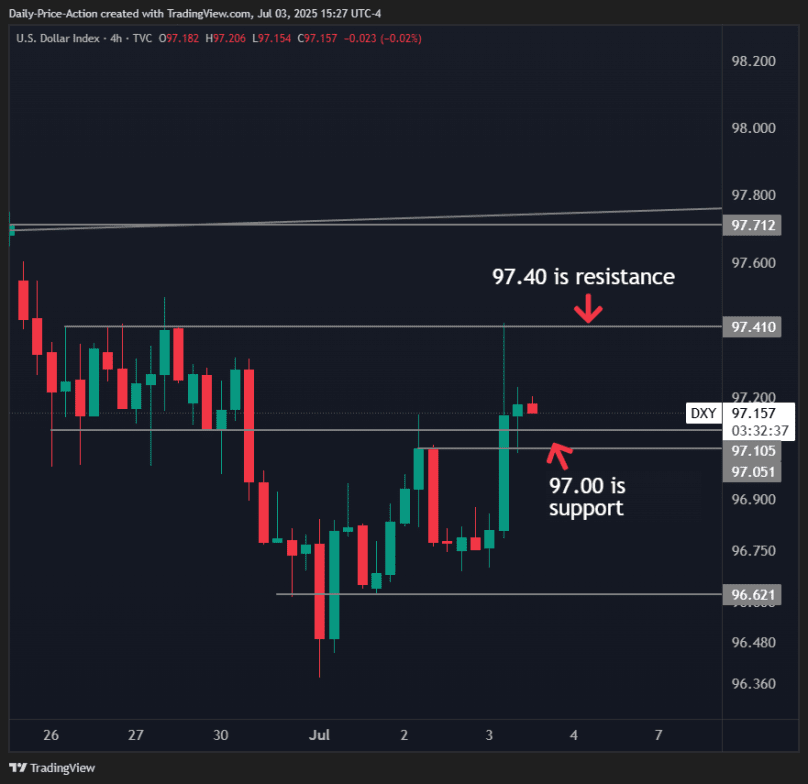

EURUSD Forecast

The EURUSD is pulling back today after the US employment report beat expectations. In the last video, I discussed the potential for a pullback from the euro in early July.

The pair was testing the top of its May channel earlier this week, and the DXY was carving a rounded bottom. So far, we haven’t seen much of a pullback from EURUSD, given how the US dollar gets walked back at each sign of strength.

Currently, EURUSD is finding resistance at 1.1788. The pair also closed a recent 4-hour candle below 1.1745; however, time will tell if this is a meaningful development or not.

My comments about where the euro might trend earlier this week are unchanged. Bulls will be eyeing levels like 1.1685, but especially areas like 1.1630 if we get it.

That could align with the DXY testing the 97.70 region. If so, it will mark a significant test for the forex market in July.

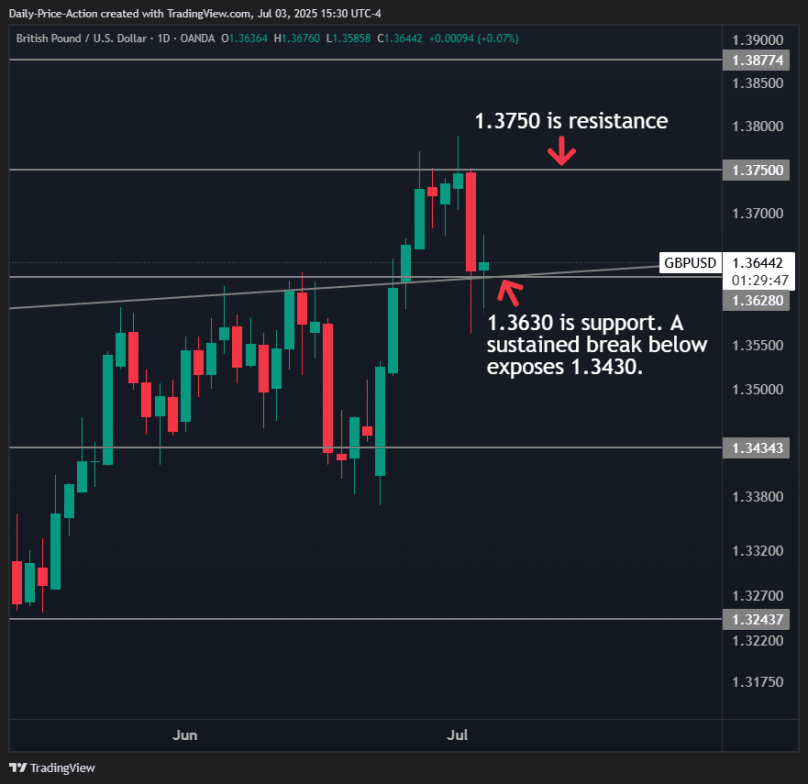

GBPUSD Forecast

The GBPUSD is testing a highly significant area this week at 1.3630. The pair bounced from here on Thursday, but it quickly faded following the strong US jobs numbers.

However, buyers are doing their best to defend 1.3630 on the high time frames. GBPUSD remains above it for now on both the daily and weekly charts.

If the DXY can reclaim levels like 97.10, it could push GBPUSD below the key level. If so, 1.3430 could be next for the pound.

That said, as long as GBPUSD trades above 1.3630, the level remains key support.

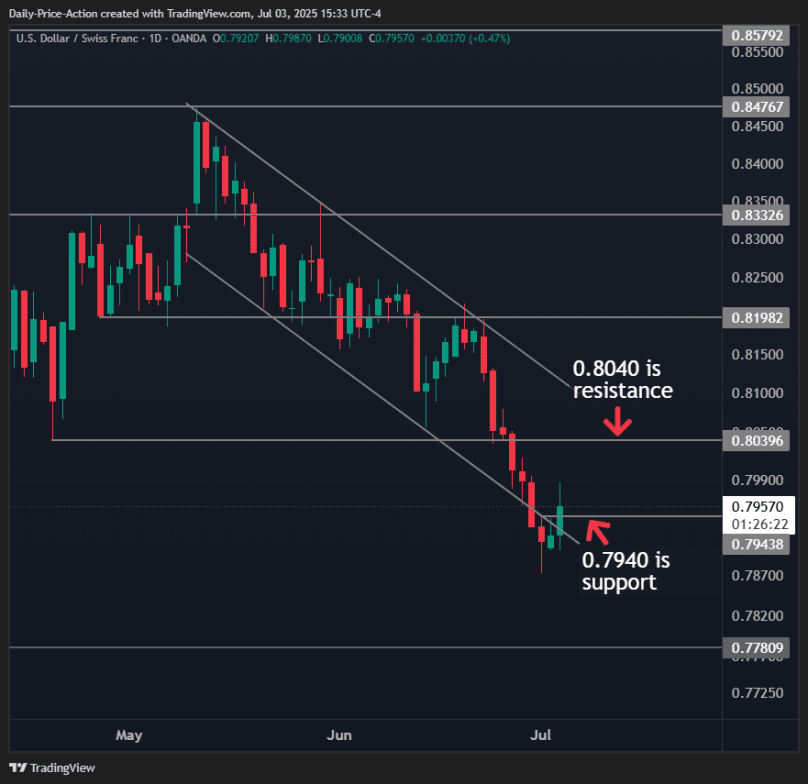

USDCHF Forecast

USDCHF is the pair that was showing bullish signs before Thursday’s NFP. The pair had reclaimed the bottom of its May channel on an hourly basis before the jobs numbers were released.

Of course, attempting a trade ahead of non-farm payroll is always ill-advised. Even if you get the direction right, the volatility and slippage can cause premature stopouts.

Thursday’s bullish reclaim of channel support could trigger a retest of 0.8040. That would be a significant moment for USDCHF, given how it’s the recent range lows, and June also closed below the level.

0.7940 is key support for USDCHF, with resistance at 0.8040. What occurs at 0.8040 could determine the next few weeks for USDCHF.

Keep the DXY and its 97.70 level on your radar as you trade the major currency pairs.

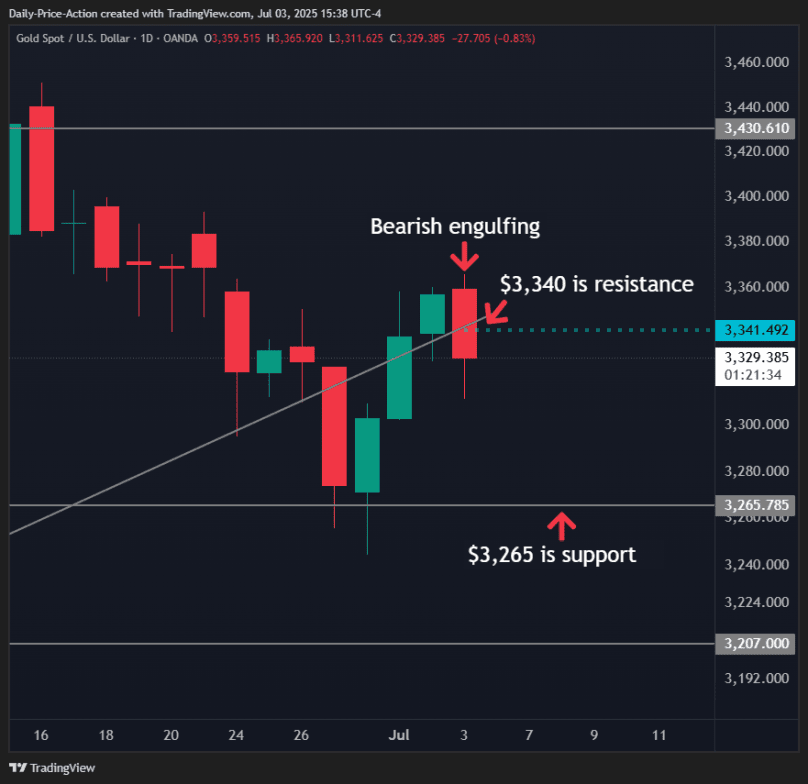

XAUUSD Forecast

Gold is an interesting chart because you have a battle between two high time frames. On one hand, XAUUSD closed below its 2025 trend line at the end of June. On the other hand, gold reclaimed it on the daily time frame last week.

However, we’re seeing sellers step in following the robust US jobs numbers. This is simply gold making good on the weekly breakdown in June.

A weekly break always carries more weight than a daily break. There’s more volume in a weekly candle, and volume equals conviction when trading technical breaks.

As long as gold is below $3,340 on a weekly closing basis, I’ll be eyeing lower levels. First is key support at $3,265, followed by $3,207.

Thursday’s selloff left a buy-side single print at $3,341. That could serve as resistance if XAUUSD holds below the $3,340 region into Thursday’s close.