dow

U.S. equities closed out a turbulent week with strong gains, overcoming trade-war jitters, With Dow Jones confirming key bullish breakouts.

•

Last updated: Sunday, June 29, 2025

Quick overview

- U.S. equities finished the week strongly, with the Dow Jones and Nasdaq each gaining around 4% despite trade-war concerns.

- Investor confidence was bolstered by strong performances in the financial, industrial, and technology sectors, leading to all-time weekly highs for the S&P 500 and Nasdaq.

- Friday’s trading session highlighted market vulnerabilities, as a surprise tweet from President Trump temporarily disrupted positive momentum.

- Overall, stable economic data and solid consumer demand suggest continued earnings growth, with the Dow targeting new record highs.

Live DOW Chart

DOW

U.S. equities closed out a turbulent week with strong gains, overcoming trade-war jitters, with Dow Jones confirming key bullish breakout, now targeting all time highs.

Markets Overcome Trade Fears to Close Strongly Higher

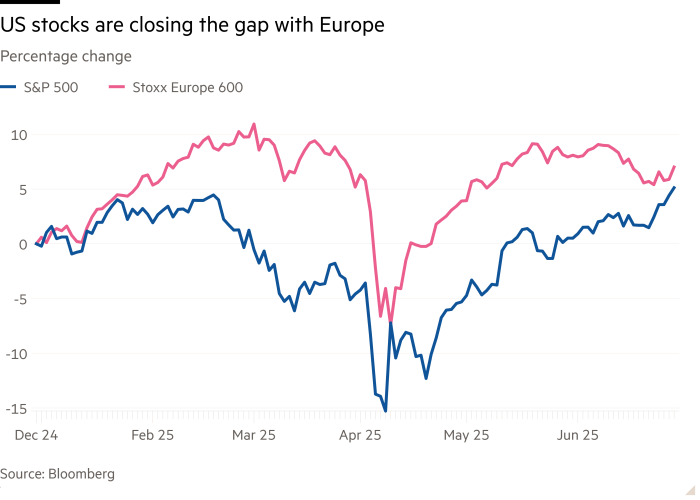

U.S. stock markets delivered an impressive weekly finish, despite dramatic tariff-related swings that rattled traders on Friday. The Dow Jones Industrial Average and Nasdaq Composite each surged around 4% for the week, marking robust gains that confirmed key technical breakouts and kept the 2025 bull trend intact.

Solid Sector Support Fuels Optimism

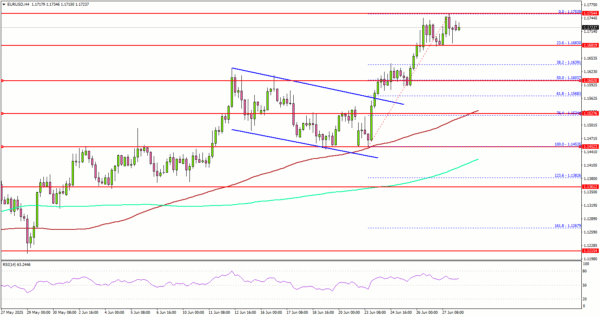

Investor confidence remained resilient, with the financial, industrial, and technology sectors leading the advance. Both the S&P 500 and the Nasdaq closed at all-time weekly highs, driven by optimism about continued economic strength and healthy corporate earnings. The Dow Jones, in particular, validated a long-watched bullish breakout above its 20-week simple moving average (SMA), a technical level that had capped recent rallies.

This breakout signals that buyers have regained control, setting the stage for the index to aim for new record highs.

Friday’s Turbulence Highlights Ongoing Risks

Despite the upbeat weekly close, Friday’s session reminded investors that markets remain vulnerable to sudden news flow. Early in the day, strong buying momentum pushed major indices toward fresh records. But sentiment was jolted by President Trump’s surprise tweet cancelling trade talks with Canada, which revived fears of a tariff escalation.

At one point, the S&P 500 lost over 40 points, briefly turning negative before buyers stepped back in. By the close, the Dow had still gained 1% for the day, capping off its strongest week since April’s tariff-driven reversal.

Dow Jones Chart Weekly – Breaking Higher After the Squeeze

Traders Betting on Resilient Economy

Beyond trade headlines, investors appear reassured by stable economic data, solid consumer demand, and the prospect of contained inflation. These factors strengthen the case for continued earnings growth and suggest the Federal Reserve may turn into a more accommodative stance, .

As the new week starts, markets seem increasingly willing to look through short-term geopolitical noise in favor of longer-term fundamentals. We have the NFP report on Thursday, but until then the Dow might have reached a new all time high, so let’s hope.

Dow Jones Live Chart

DOW

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.