- The British pound initially trying to rally during the trading session here on Tuesday but has given back those gains pretty quickly.

- Ultimately, I think you’ve got a scenario where traders are going to look at this through the prism of a potential downtrend tying to form.

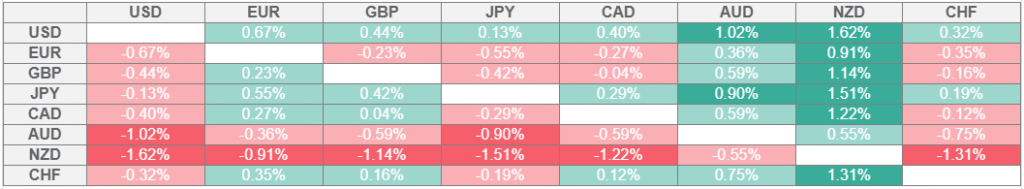

- And I am seeing this across the Forex world where the US dollar is supposed to be crumbling and losing its status as the world’s reserve currency is basically fighting tooth and nail with a lot of these currencies.

I’m Not Shorting, But…

Now, having said that, the British pound is not necessarily where I’m looking to short if I’m going to start trading in favor of the US dollar. But if this one gives it up, everybody else doesn’t stand a chance because the British pound has been the all-star, if you will, of currency trading recently.

After all the market is very strong for the British pound until recently. And while other currencies did fairly well, the British pound not only did well on the way up, but it did well on the way down when the U S dollar was destroying everything in its site, the British pound did okay. It fell less than others. So, I watched this chart very closely as an indicator on how the US dollar is going to do because of its show strength here. It’s going to destroy Canadian dollars, New Zealand dollar, Australian dollar, Japanese yen, the euro to a point, Swiss franc to a point. But we are seeing a bifurcation between Europe and Asia.

There are some outliers out there like the Mexican peso that might do okay just because of the interest rate differential between it and the US dollar, but the British pound is the harbinger of everything at this point. If we can break above the 1.36 level in this pair, then I think the US dollar really starts to suffer at the hands of pretty much everybody. So while we are still very much in an uptrend, it’s not lost on me that we are struggling at the same place yet again. Jackson Hole Symposium speeches at the end of the week could be the final nail in the coffin of whichever direction we pick. Right now, the dollar looks like it’s not quite ready to give up.

Ready to trade the GBP/USD Forex analysis? Check out the best forex trading company in UK worth using.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.