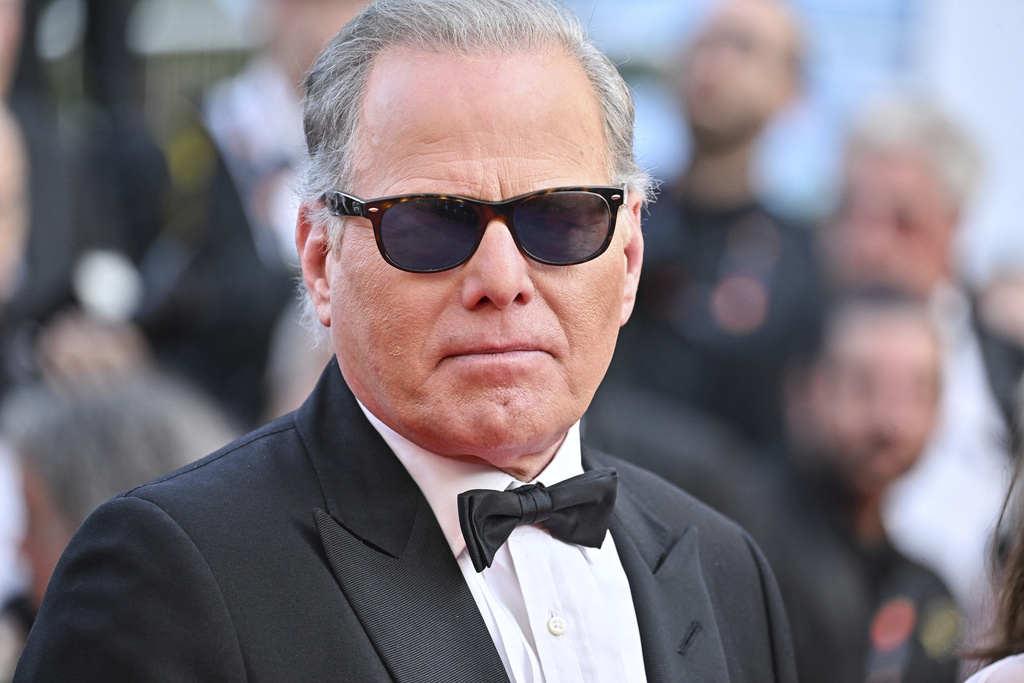

David Zaslav at the premiere of the movie La Passion De Dodin Bouffant during 76th Cannes Film Festival in Cannes, France on May 24, 2023. Photo by Julien Reynaud/APS-Medias/Abaca/Sipa USA(Sipa via AP Images)

Warner Bros. Discovery CEO David Zaslav said his company is being contacted by “multiple parties” interested in buying the media giant — an announcement that sent its stock price shooting higher on Tuesday morning.

Zaslav’s announcement was included alongside a press release that said the WBD board of directors had initiated a “strategic review” of its options, after the company had received “unsolicited interest” recently. The “Open for Sale” news comes as Paramount Global, led by new boss David Ellison, has been pushing to acquire WBD.

Wall Street seemed to like the news, too, with WBD shares jumping 9% an hour into trading on Tuesday. The company is now trading for $19.92 per share — up 87% since the start of the year.

Zaslav, in his statement, reiterated that his company has taken the “bold step” to split into two, with its studio and streaming business, including HBO, as one entity and another dedicated to its global networks business, which would include channels like CNN, TNT, and Discovery.

“It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market. After receiving interest from multiple parties, we have initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets,” Zaslav said.

That announcement comes a few weeks after Bloomberg reported WBD “rebuffed” a $20 per share offer from Ellison and new Paramount. The Hollywood Reporter on Tuesday also noted CNBC’s David Faber said Netflix and Comcast have also looked at buying WBD.

CNBC also reported on Tuesday that WBD decided to announce it was open to offers after having rejected another bid that was higher than Paramount’s $20 per share proposal, according to one person familiar with the matter.

WBD’s recent stock run comes after the company has had a rough few years since WB merged with Discovery, with shares dropping from a peak of near $80 per share in 2021 to below $8 per share in late 2024.

The company, in its Tuesday press release, said there is “no deadline or definitive timetable” for completing its review of its options, and that “there can be no assurance” WBD will make a sale.