The USD/MXN has seen a rather solid trading range emerge the past handful of days, and as of this morning the currency pair is around the 18.88875 depending on fluctuations being demonstrated.

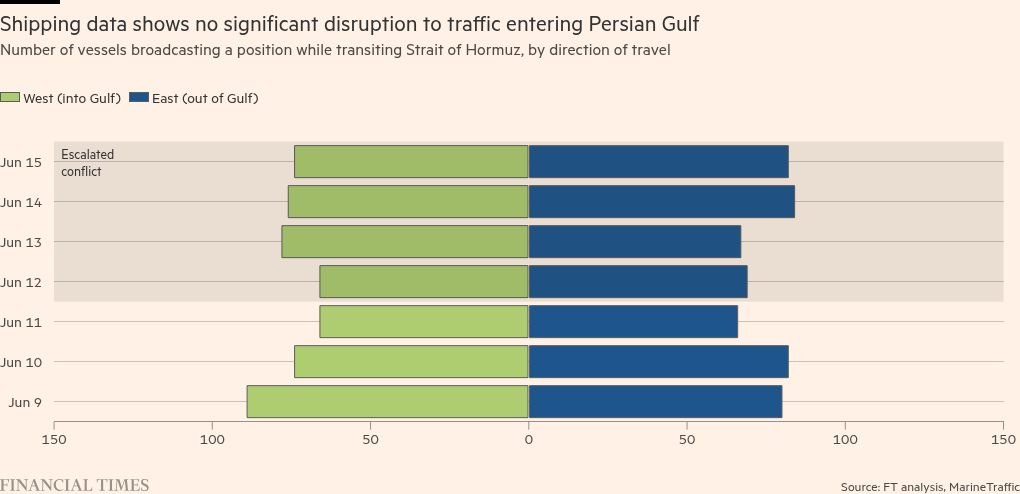

The USD/MXN has provided traders with a rather tempting range the past handful of days. This doesn’t mean it is particularly safe to wager on however. Risk adverse trading shadows are certainly lurking in the global markets this morning, even though it is clear financial institutions are showing behavioral sentiment appears to remain rather calm in the wake of the escalating Middle East concerns.

The USD/MXN is near the 18.88875 ratio as of this writing. A high of nearly 19.10000 was seen on Friday, this a handful of hours after noise from the Middle East increased. However, the USD/MXN also touched the 19.10000 vicinity Tuesday the 10th of June, two and a half days before war broke out between Israel and Iran. Intriguingly though, WTI Crude Oil prices did start to become volatile on the same Tuesday, this as rumors about embassies closing started to be heard from the Middle East.

Energy Prices and the USD/MXN

The correlation of higher energy prices and the USD/MXN should be considered, but cannot be proven – yet it offers some speculative considerations. After touching Friday’s high, the USD/MXN did reverse lower and it began testing the 18.90000 ratio. Upon opening early today the USD/MXN fell again and tested the 18.82800 with a lower spike, but then quickly climbed back to its current ratios a bit higher.

Mexico is a large producer of energy. If Middle Eastern conflict heightens and oil infrastructure in Iran comes into play as a tool for aggressive retribution, not only will WTI Crude Oil prices become volatile, but a knock on effect may be seen in the USD/MXN. Traders of the currency pair should not get over confident about their opinions in the short-term, even the near-term will need constant vigilance for wagers due to the potential of risk appetite in global markets shifting suddenly.

Resistance Levels and Bearish Wagers on Lower Value

The USD/MXN has shown the ability to trade below the 19.00000 level in what can be considered a rather sustained manner since Wednesday of last week – yes there was a definite move upwards on Thursday and Friday as fears hit global markets, but then calm prevailed again.

- Support has been seen around the 18.83000 ratio and this mark will prove interesting for speculators aiming for lower targets.

- The USD/MXN does have the capability of trading fast, and because of the current dynamics in the markets day traders need to be braced for sudden gusts which could alter sentiment from afar.

- Looking for lower momentum in the USD/MXN may feel worthwhile as a wager, but speculators need solid risk management over the next few days.

USD/MXN Short Term Outlook:

Current Resistance: 18.89750

Current Support: 18.87980

High Target: 18.95100

Low Target: 18.84600

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.