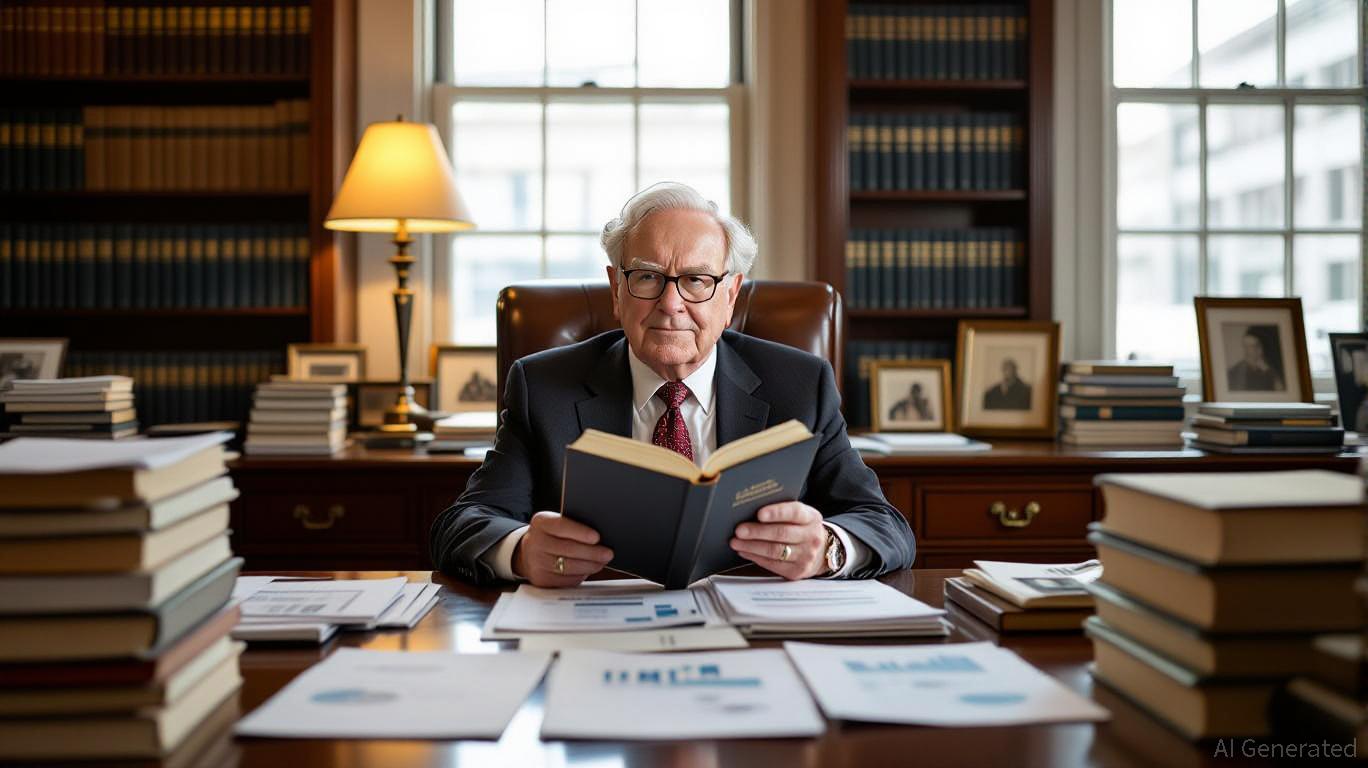

In an era marked by inflationary pressures, geopolitical tensions, and sector-specific uncertainties, Warren Buffett’s investment philosophy remains a beacon for investors seeking to build lasting wealth. His principles—rooted in temperament, index investing, and the purchase of great companies at fair prices—offer a roadmap for navigating 2025’s volatile markets. By dissecting his strategies and aligning them with current economic indicators, investors can adapt timeless wisdom to modern challenges.

The Power of Temperament: Staying Calm in a Storm

Buffett’s emphasis on temperament is not just a mantra but a practical approach to market volatility. In 2025, as the U.S. economy grapples with inflation (2.4% CPI, 2.8% core inflation) and the ripple effects of tariffs, panic selling has become a recurring risk. Buffett’s 2008 New York Times op-ed, which urged investors to “be fearful when others are greedy and greedy when others are fearful,” remains relevant. For instance, when the S&P 500 dipped in April 2025 due to tariff-related jitters, Buffett’s approach would have advised buying quality assets at discounted prices.

Actionable Step: Avoid knee-jerk reactions to market swings. Use downturns to accumulate shares in companies with durable competitive advantages, such as those in healthcare (e.g., UnitedHealth Group) or energy (e.g., Chevron).

Index Investing: The Democratization of Long-Term Growth

Buffett has long championed broad-based index funds as a cornerstone of wealth creation. In 2025, with the S&P 500 averaging 15% annual returns since 2009, this strategy remains compelling. For investors lacking the expertise to pick individual stocks, index funds offer diversification and resilience. The Federal Reserve’s projected 3.125% federal funds rate by late 2026 underscores the importance of low-cost, long-term vehicles to outpace inflation.

Actionable Step: Allocate a portion of your portfolio to S&P 500 index funds, especially if you lack the time or knowledge to analyze individual equities. Rebalance annually to maintain alignment with your risk tolerance.

Buying Great Companies at Fair Prices: Buffett’s Contrarian Edge

Buffett’s recent moves—such as trimming Apple (AAPL) by 30% and investing $1.6 billion in UnitedHealth Group—highlight his contrarian approach. UnitedHealth, down 46% year-to-date in 2025 due to regulatory scrutiny and rising medical costs, became a target for Buffett’s value-driven strategy. By purchasing undervalued companies with strong fundamentals, he capitalizes on market overreactions.

Actionable Step: Identify sectors where market pessimism may be overblown. For example, healthcare (despite short-term headwinds) and industrials (with stable cash flows) offer long-term potential. Use discounted valuations to build positions in companies with robust balance sheets and pricing power.

Patience: The Investor’s Greatest Tool

Buffett’s “forever” holding period philosophy is a counterintuitive antidote to today’s fast-paced trading culture. In 2025, as the S&P 500’s price-to-earnings ratio normalizes post-tariff-driven corrections, patience becomes a strategic advantage. For instance, Buffett’s 2025 investments in Lennar Corp (LEN) and Nucor (NUE) reflect confidence in construction and materials sectors, which are poised to benefit from infrastructure spending and demographic trends.

Actionable Step: Focus on companies with long-term tailwinds, such as aging populations (healthcare) or energy transition (Chevron). Avoid overtrading; let compounding work for you.

Navigating 2025’s Economic Landscape: Key Considerations

- Inflation and Interest Rates: With core inflation at 2.8% and the 10-year treasury yield near 4.5%, investors must prioritize companies with pricing power to offset rising costs.

- Tariff Risks: Buffett’s criticism of “economic warfare” via tariffs highlights the need to diversify geographically and sectorially.

- Debt Management: In a high-interest-rate environment, reducing leverage is critical. Buffett’s advice to pay down debt quickly aligns with the Fed’s cautious rate-cutting path.

Conclusion: Building Wealth, Not Just Portfolios

Warren Buffett’s principles are not relics of a bygone era but adaptable frameworks for today’s challenges. By cultivating discipline, leveraging index funds, and embracing contrarian opportunities, investors can navigate 2025’s uncertainties with confidence. The key lies in aligning short-term actions with long-term goals—a lesson that remains as relevant now as it was in 1942 when Buffett first began investing.

Final Actionable Step: Audit your portfolio quarterly. Trim speculative positions, rebalance toward undervalued sectors, and reinvest dividends to harness the power of compounding. In a world of volatility, Buffett’s timeless principles are your best defense—and offense.