Want to invest like Buffett? You don’t need billions of dollars — just a long-term mindset and the discipline to stay consistent.

Few investors command the same level of respect as Warren Buffett, the billionaire chairman and CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B). Nicknamed the “Oracle of Omaha,” Buffett has spent six decades compounding wealth at an extraordinary pace for the company — generating a staggering 5,502,284% total return over that span.

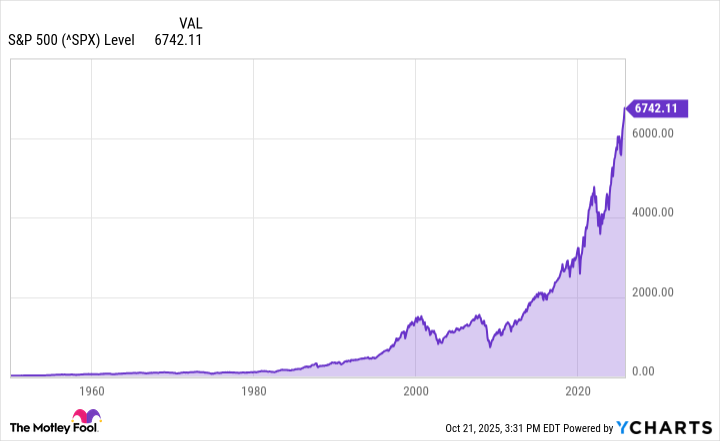

To put that into perspective, Berkshire’s long-term compound annual growth rate (CAGR) of 19.9% is roughly double the long-term performance of the S&P 500 (SNPINDEX: ^GSPC), even when accounting for dividend reinvestment in the index.

While Buffett’s track record is nearly unmatched, the good news is his investment strategy is surprisingly straightforward. His approach can be distilled into a few timeless principles — simple enough for any first-time investor to follow, yet powerful enough to build generational wealth.

1. Focus on businesses you understand

Buffett’s investing philosophy is refreshingly simple: Buy high-quality companies at fair prices and hold them for the long haul — often decades. He avoids complex or speculative ventures, instead focusing on businesses with durable competitive advantages, steady earnings growth, and trustworthy management.

Buffett’s portfolio reflects this discipline. It’s concentrated in consumer staples, financial services, and energy — sectors he believes will remain indispensable through all economic cycles. Berkshire’s top holdings — Apple, American Express, Bank of America, Coca-Cola, Chevron, and Occidental Petroleum — share some common threads: predictable cash flow, powerful brands, and shareholder-friendly capital allocation programs.

Equally telling are the companies Buffett tends to avoid. He’s long steered clear of unproven tech start-ups, cyclical industries, and commoditized businesses that lack pricing power.

For investors, his example underscores a timeless truth: Resist the temptation to follow herd mentality. In investing, such an approach is similar to being a victim of the greater fool theory. Instead, seek out businesses with a long record of profitability, reliable dividends, and management teams that treat shareholders as partners.

Image source: The Motley Fool.

2. The power of passive investing

Buffett long acknowledged that most investors are better off buying index funds rather than picking individual stocks. His reasoning is simple: Over time, the S&P 500 mirrors the growth of the American economy. It’s composed of world-class companies like Apple, Microsoft, Johnson & Johnson, Walmart, and JPMorgan Chase that consistently reinvest profits, raise dividends, and drive long-term wealth creation.

For first-time investors, buying an S&P 500 exchange-traded fund (ETF) through providers like Vanguard, Fidelity, or Charles Schwab is one of the smartest, most stress-free ways to follow Buffett’s playbook. This approach provides instant diversification across hundreds of top U.S. companies — with no need for market timing, stock picking, or guesswork.

3. Think long-term and stay consistent

Buffett’s success never hinged on predicting market moves — it’s built on patience, discipline, and the power of compounding. He’s held some of his core positions for decades, steadily reinvesting dividends and allowing time do the heavy lifting.

The key lesson for beginners is consistency. Invest regularly, reinvest your dividends, double down on winners, and trim laggards. Avoid chasing hot stocks, cryptocurrencies, or viral trends that promise quick riches but lack fundamental strength.

Market corrections and downturns will happen, but Buffett views them as opportunities, not setbacks. They allow disciplined investors to buy quality companies at attractive prices. As he has famously advised, “You want to be greedy when others are fearful, and you want to be fearful when others are greedy.”

In the end, wealth creation is less about timing the market and more about spending long periods of time in the market. Staying calm, patient, and committed to your long-term plan is what separates successful investors from emotional traders — and it’s the mindset that turns ordinary savers into extraordinary investors.