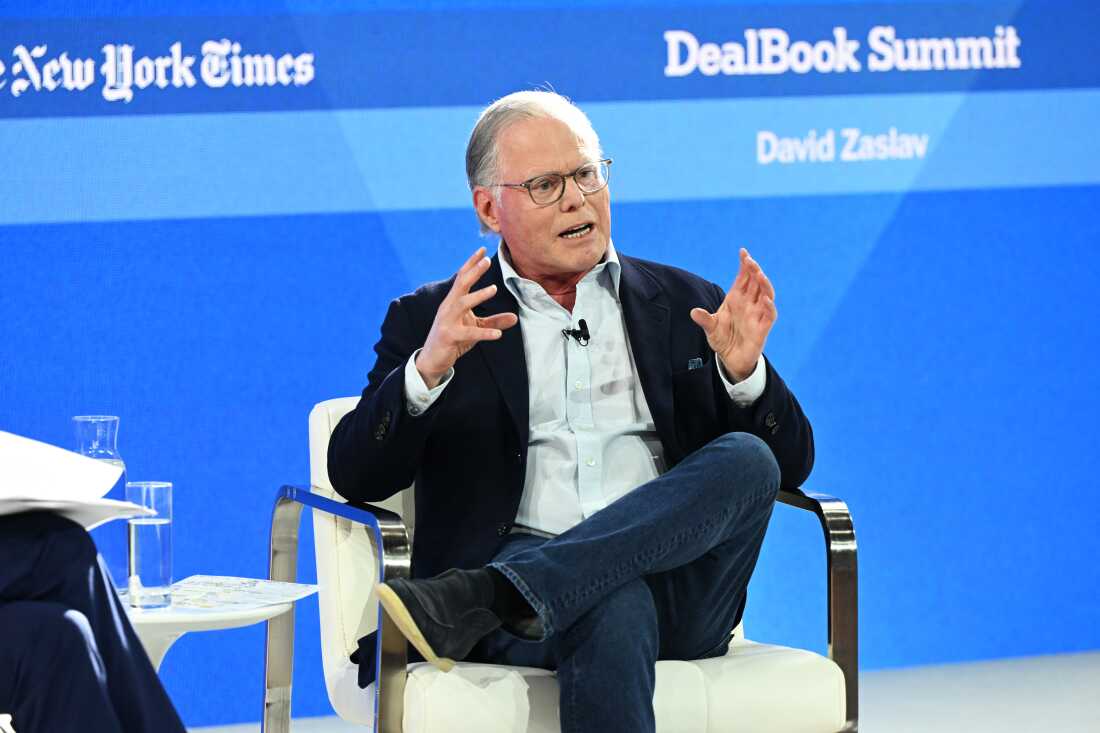

Warner Bros. Discovery chief David Zaslav, shown at a New York Times event in 2023, announced on Monday that the company would be split, with its streaming and Hollywood studios on one side, and its cable properties on the other. The company currently includes HBOMax, Warner Bros. movie and television studios, and CNN among its properties.

Slaven Vlasic/Getty Images/Getty Images North America

hide caption

toggle caption

Slaven Vlasic/Getty Images/Getty Images North America

Warner Bros. Discovery chief executive and president David Zaslav yielded to the reality of the digital age and to the skepticism of Wall Street investors on Monday by announcing he would split the company into two: one focusing on streaming, the other on its cable networks.

Zaslav will lead the streaming and studios company, which will include HBO Max and the Warner Bros. movie and television studios. The cable business, including CNN, TBS, TNT and Discovery, is to be run by the current corporation’s chief financial officer, Gunnar Wiedenfels.

“The cultural significance of this great company and the impactful stories it has brought to life for more than a century have touched countless people all over the world. It’s a treasured legacy we will proudly continue in this next chapter of our celebrated history,” Zaslav said in announcing the split.

“By operating as two distinct and optimized companies in the future, we are empowering these iconic brands with the sharper focus and strategic flexibility they need to compete most effectively in today’s evolving media landscape.”

Under Zaslav, the new digital company will seek to continue building subscribers in countries around the world for its own streaming service while creating content for its bigger competitors – Netflix, Disney+ and Amazon Prime.

Debt weighs down Zaslav’s ambition

The break-up represents a collapse of Zaslav’s ambitions and aspirations for the mega-media company.

Just three years, two months and one day ago, Zaslav completed the acquisition of Warner Media in a deal valued at $43 billion to create Warner Bros. Discovery. He said the combined company would have the scale and caliber of offerings to compete with digital streaming giants. It didn’t. That deal required taking on more than $50 billion in debt. While a significant amount has been paid off, much remains.

Warner Bros. Discovery’s history since has been marked by a series of moves to pay down that debt, including the killing of CNN’s nascent streaming service (which is just now being rebuilt), bids that failed to win renewal of NBA rights for Turner Sports, and layoffs at various properties.

The company has lost nearly half its market valuation since the merger, though shares bounced up by nearly 10% in the hours after Monday’s announcement. Zaslav had a compensation package valued at $52 million last year – making him one of the country’s highest-paid corporate chieftains, according to a study by Harvard Law School. (Shareholders voted against it in a symbolic vote.)

What’s CNN’s fate?

The transaction is supposed to close by the middle of next year, though it is contingent on an assessment from the U.S. Internal Revenue Service that it can proceed free of taxes. President Trump has made clear in his first few months back in office that he is willing to deploy what are supposed to be non-partisan levers of government for political and ideological aims.

Most recently, Trump suggested he would seek to revoke governmental contracts with Tesla after a public falling out with its controlling owner, Elon Musk, who had previously served as his adviser on slashing federal budgets. In the case of Warner Bros. Discovery, Trump has repeatedly blasted CNN as unfair, partisan and “fake news.”

“These are two much smaller companies than the grand vision [Zaslav] anticipated when he bought the assets from AT&T,” former CNN US president Jonathan Klein tells NPR. “The question is: now that they’re small enough to be bought, who buys each of these units?”

Comcast really underwent much the same transformation – splitting its broadcast, movie and broadband properties from its cable channels.

Several former television executives asked whether the new parent for MSNBC and CNBC – named Versant – might be a natural buyer for Warner Bros. Discovery’s cable channels. Or private equity investors intent on maximizing profits might decide to pick up Warner Bros. Discovery’s cable networks, Versant – or both.

In any of those scenarios, a new owner would almost certainly have to pick between retaining MSNBC or CNN.

NPR financial correspondent Maria Aspan contributed to this story.