Donald Trump and Xi Jinping in 2017.

(Bloomberg) — No one can agree on what a likely meeting between Donald Trump and Xi Jinping will mean for China’s sputtering stock market.

Most Read from Bloomberg

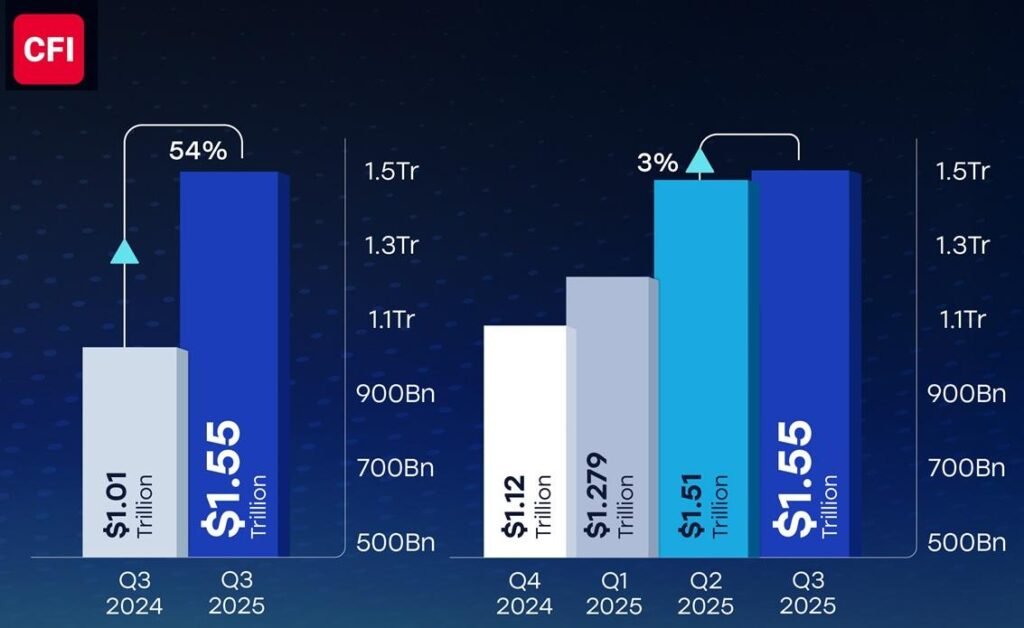

Chinese equities, which have zoomed higher for much of this year, have lost steam in recent weeks. The MSCI China Index is down around 3.9% this month, lagging far behind the 2.3% rise in MSCI Asia Pacific Index. China is also underperforming the US stock market the most since the April trade dispute roiled global markets.

Now, as the two leaders look set to meet later this month at the Asia-Pacific Economic Cooperation summit, analysts are trying to figure out whether investors should see the recent downturn as a dip-buying opportunity or a warning of things to come.

Bank of America Corp. analysts are among the bulls, advising investors to stay risk-on until the end of this month in the belief that the Trump-Xi meeting and China’s fourth plenum political gathering could act as catalysts for a move higher. Goldman Sachs Group Inc. says the default mindset for investors should become buy the dip, seeing a 30% upside for Chinese stocks by the end of 2027.

But Morgan Stanley is more cautious, warning investors not to dip-buy given the ongoing risk of trade tensions flaring up again. Strategists including Laura Wang have recommended investors wait for a slide of between 10% to 15% in the MSCI China as well as clear signs of a solution to the trade conflict before buying again.

Nomura Holdings Inc.’s Chetan Seth also thinks the risk-reward no longer makes sense after the recent rally. He told clients that US-China tensions are an overhang, and the MSCI China will only become “meaningfully attractive” when its forward price-to-earnings ratio drops below 11 times. It is currently around 12.8 times, according to data compiled by Bloomberg.

Trump has predicted that the upcoming meeting with Xi would yield a good deal on trade and said he had a “great relationship” with his Chinese counterpart. But the US president also conceded that the highly anticipated talks may not happen.

A major question for China bulls is who will drive the next stage of the rally. Although the country’s $23 trillion of household deposits remain a persistent hope for ensuring a so-called slow bull run, local funds and foreign investors have been the bigger driver so far.