By Noel Randewich

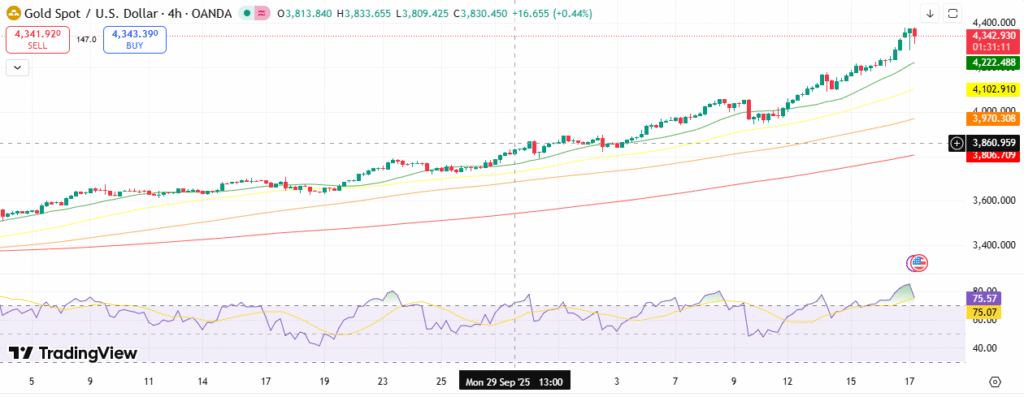

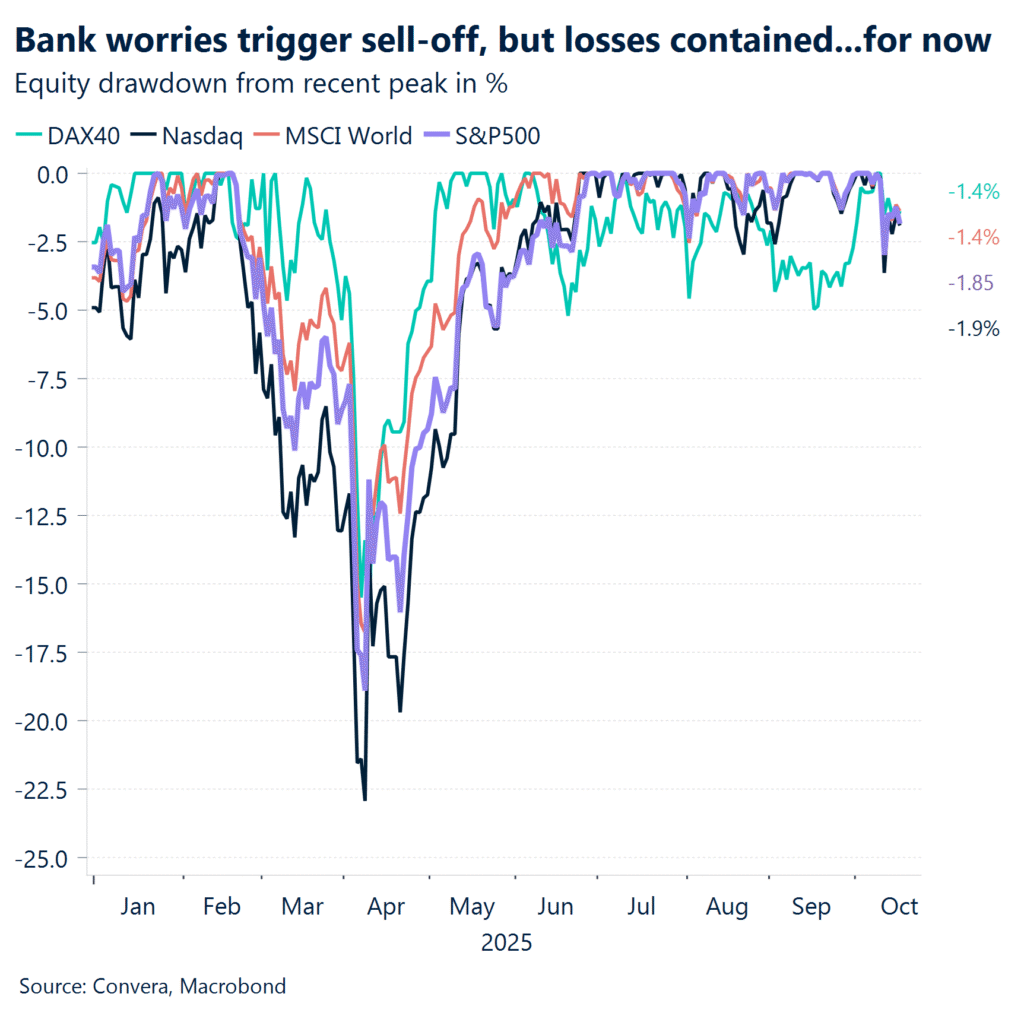

Wall Street fell on Thursday, with signs of weakness in regional banks spooking investors already on edge over China-U.S. trade tensions.

Regional bank Zions Bancorporation ZION dropped 13% after disclosing an unexpected loss on two loans in its California division, adding to growing investor unease about hidden credit stress as lenders navigate economic uncertainty with interest rates still relatively high.

Also increasing worries about regional banks, Western Alliance WAL said it initiated a fraud lawsuit against one of its borrowers. Its stock slumped 11%.

With the S&P 500 recently at record highs, investors were also watching for developments between Washington and Beijing after their trade war escalated last week.

U.S. President Donald Trump has threatened 100% tariffs on China starting November 1, as well as other new trade measures against the world’s second largest economy following Chinese curbs on exports of rare earth minerals.

“With the added uncertainty of U.S. and China trade and increased rhetoric and what that could mean for the economy and for the markets, I think that’s adding to market instability,” said Tom Hainlin, an investment strategist at U.S. Bank Wealth Management in Minneapolis.

TSMC 2330, the world’s largest manufacturer of advanced semiconductors, gave a bullish outlook for spending on artificial intelligence.

Nvidia NVDA, a top TSMC customer, was up 0.2%, but other heavyweight tech-related stocks lost ground, with Apple

AAPL, Tesla

TSLA and Meta Platforms

META each down more than 1%.

Salesforce CRM jumped about 4% after the business software seller forecast revenue of more than $60 billion for 2030, above Wall Street estimates.

Optimism about AI and expectations of U.S. interest rate cuts have lifted Wall Street to record highs this year. The S&P 500 has gained 13% so far in 2025, and it is valued at an elevated 23 times expected earnings, a five-year high, according to LSEG.

Robust earnings from major U.S. banks this week offered fresh signs of economic resilience at a time when official macroeconomic reports remain delayed due to an ongoing government shutdown.

Analysts on average see S&P 500 aggregate earnings up 9.2% in the third quarter, versus expectations of an 8.8% increase two weeks ago, according to LSEG I/B/E/S.

The S&P 500 insurance index (.SPXIN) dropped 3.9% after industry bellwether Travelers Companies TRV posted quarterly revenue below estimates, with its stock losing 2.8%. Insurer Marsh & McLennan

MMC reported quarterly results and fell 8%.

The S&P 500 fell 0.98%, trading at 6,606.00 points. The Nasdaq declined 0.92% to 22,461.58 points, while the Dow Jones Industrial Average was down 0.85% at 45,859.71 points.

All 11 S&P 500 sector indexes declined, led lower by financials SPF, down 2.7%, followed by a 1.65% loss in energy

SPN.

Data showed the Philadelphia Fed Business Index for October declined 12.8 points, compared with a rise of 8.5 estimated by the economists polled by Reuters.

Fed Governor Christopher Waller said he supported an additional interest rate cut in October due to mixed readings on the state of the job market.

Hewlett Packard Enterprise HPE slumped almost 10% after the technology company forecast annual profit and revenue below Wall Street expectations.

J.B. Hunt JBHT shares jumped 20% after the trucking firm reported third-quarter profits.

Declining stocks outnumbered rising ones within the S&P 500 (.AD.SPX) by a 3.7-to-one ratio.

The S&P 500 posted 29 new highs and 14 new lows; the Nasdaq recorded 109 new highs and 84 new lows.