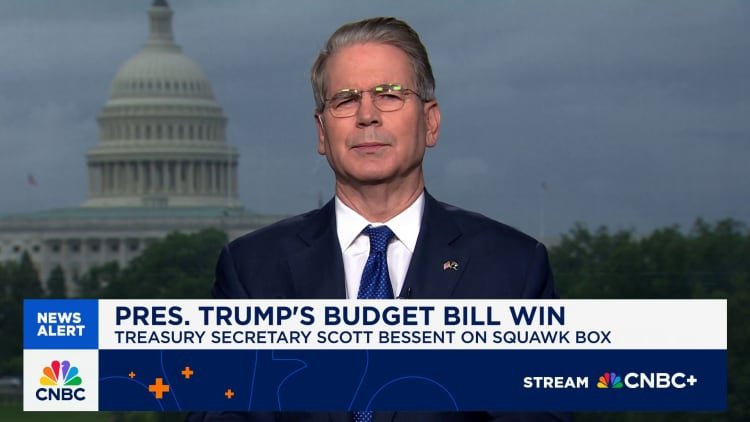

Before President Donald Trump’s policies sent the dollar plunging, investors could reliably use a number of indicators to figure out how to trade. Europe cuts interest rates? Sell euros. Markets look jittery? Buy dollars. Oil prices spike? Time to snap up currencies from commodity exporters.

But now, those signals are misfiring more frequently. Traders at UBS Group AG and Mizuho International, say the models they used to count on getting it right are instead getting it wrong. And the new forces driving currency markets, like the broad shift of money out of the US and foreign investors buying dollar hedges, are hard to track because the data is sparse, making it tough for professionals to adjust their systems. As a result, they’re running smaller and simpler trades

“Rules of thumb have kind of gone out of the window,” said Lu Xin, a currency derivatives trader at UBS. “Everyone has come to accept that more uncertainty is the new norm.”

Xin says he’s being cautious when it comes to risk and that his trading strategies are stricter. “People are more afraid to be short options going into weekends,” he added.

Live Events

At Mizuho, the confusion has become something of a running joke on the desk. Jordan Rochester says his colleague, options trader Nikhil Kochhar, was shouting “Why!?” to puzzling market swings so often that he gifted him a custom baseball cap with that tagline.”What will happen in one or two months time is someone will tap us on the shoulder and say, ‘Why weren’t you short more dollars? It was obvious,'” said Rochester. “It wasn’t obvious.”