By Sukriti Gupta and Twesha Dikshit

Wall Street’s main indexes were set to open lower on Tuesday as renewed concerns over a U.S.-China trade conflict dampened sentiment, while investors parsed results from big U.S. banks, which kicked off the third-quarter reporting season.

BlackRock’s BLK assets under management hit a record $13.46 trillion and JPMorgan Chase

JPM raised its full-year forecast for net interest income after beating expectations for third-quarter profit. Still, BlackRock’s shares fell 0.7% premarket and JPMorgan dipped 1.1%.

Goldman Sachs GS fell 2.9% despite beating Wall Street expectations for quarterly profit.

Citigroup C and Wells Fargo

WFC shares bucked the trend to rise 0.8% and 3.6% after reporting quarterly results.

“The most important thing to think about is not the actual earnings, which in large part were better across the board … but all of them are also trading at or near all-time highs,” said Art Hogan, chief market strategist at B Riley Wealth, on why many lenders’ shares were lower despite reporting strong quarterly results.

The earnings reports will help investors assess the impact of tariffs on corporate America and offer fresh clues on the economy at a time when major official data releases remain delayed due to an ongoing government shutdown.

Analysts on average expect S&P 500 companies’ third-quarter earnings to grow 8.8% from a year ago, according to LSEG data.

At 8:50 a.m. ET, Dow E-minis (YMcv1) were down 441 points, or 0.95%, S&P 500 E-minis ES1! were down 67.25 points, or 1%and Nasdaq 100 E-minis

NQ1! were down 313.5 points, or 1.25%.

Markets had rebounded in the previous session after President Donald Trump’s conciliatory tone on trade tensions with China as well as Treasury Secretary Scott Bessent’s comments that the U.S.-China meet later this month remained on track.

On Tuesday, Washington and Beijing began charging additional port fees on ocean shipping firms that move everything from holiday toys to crude oil, reviving trade frictions.

Trump’s threats to impose additional 100% tariffs on Chinese goods on Friday over Beijing’s rare earths export controls injected volatility back into markets and knocked Wall Street’s main indexes off their record levels.

The AI-driven momentum and optimism around U.S. rate cuts have driven stock markets to record highs.

On Tuesday, investor focus will also be on Federal Reserve Chair Jerome Powell’s speech at the NABE annual meeting for further insight into the U.S. central bank’s monetary policy path.

Among other moves, shares of U.S. rare earth miners rose premarket, adding to sharp gains in the previous session.

Critical Metals CRML rose 35.5%, USA Rare Earth

USAR gained 11.7% and MP Materials

MP advanced 6.8%.

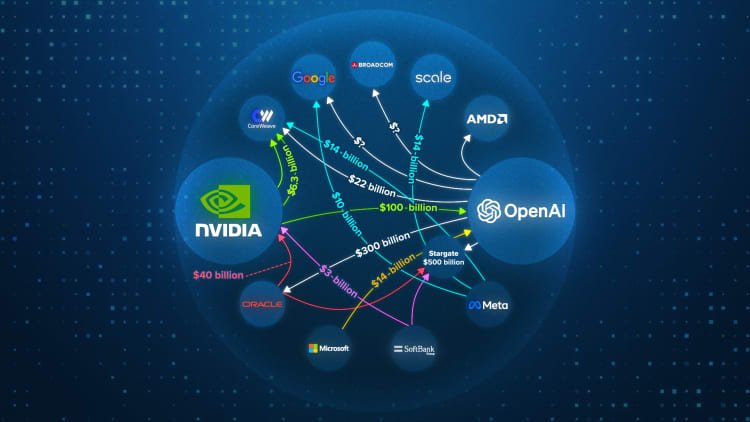

Broadcom AVGO lost 2.4% premarket after surging almost 10% on Monday when it partnered with OpenAI to produce the startup’s first in-house artificial intelligence processors. Reuters on Tuesday reported that Broadcom was launching a new networking chip.

U.S.-listed shares of Chinese companies fell. Alibaba Group BABA, JD.com

89618 and PDD Holdings

PDD declined 3.9%, 2.5%, and 2.1%, respectively.