The U.S.-China tech rivalry has entered a new phase, marked by a controversial financial arrangement between Washington and semiconductor giants Nvidia and AMD. In 2025, the Trump administration secured a 15% revenue-sharing agreement with both firms for their AI chip sales in China, a move that has reshaped investor sentiment, valuation metrics, and the long-term competitive dynamics of the global semiconductor industry. This article examines how geopolitical risk is being priced into semiconductor equities and what this means for the future of U.S. tech leadership in a bifurcated global market.

The 15% Revenue Tax: A New Export Control Paradigm

The agreement, confirmed by multiple sources including the Financial Times and Reuters, requires Nvidia and AMD to cede 15% of their revenue from AI chip sales in China to the U.S. government. This applies to chips like Nvidia’s H20 and AMD’s MI308, which were previously banned due to national security concerns. The arrangement, while framed as a “revenue-sharing” mechanism, functions as an export tax, reducing gross margins and profitability. For Nvidia, which generated $17 billion in Chinese revenue in its last fiscal year (13% of total sales), the 15% cut could trim gross margins by 8–10 percentage points. AMD, with $6.2 billion in Chinese revenue (24% of total sales), faces a similar margin compression.

This policy shift reflects a broader strategy by the Trump administration to monetize access to strategic markets while maintaining control over advanced technology. Unlike traditional export bans, the 15% tax allows U.S. firms to retain a foothold in China’s $400 billion AI infrastructure market, albeit at a cost. The precedent raises questions about the U.S. government’s willingness to prioritize economic gains over consistent national security standards, potentially undermining its credibility in future trade negotiations.

Investor Sentiment and Valuation Implications

The market’s initial reaction to the 15% tax was mixed. While the resumption of China sales boosted investor confidence, the margin impact led to short-term volatility. For example, Nvidia’s stock surged 3.9% in July 2025 following the reinstatement of export licenses, but analysts adjusted earnings forecasts to account for the 15% revenue reduction. Similarly, AMD’s shares rose 5.6%, though its lower gross margins (around 50% for AI chips) mean the tax’s impact is more pronounced.

Valuation metrics such as price-to-earnings (P/E) ratios have been recalibrated to reflect the new reality. Nvidia’s P/E ratio, which had traded at 50x in early 2025, dipped to 42x by August as investors priced in the margin drag. AMD’s P/E ratio fell from 60x to 52x during the same period. However, these adjustments may be temporary, as the AI sector remains in high demand. If China’s AI infrastructure spending continues to grow at a 35% CAGR (as projected by industry analysts), the incremental revenue from China could offset margin pressures and justify higher valuations over time.

Long-Term Competitiveness in a Bifurcated Market

The 15% tax has significant implications for the long-term competitiveness of U.S. semiconductor firms. On one hand, it preserves access to China’s AI market, which is critical for sustaining growth in a sector dominated by U.S. innovation. Nvidia’s H20 and AMD’s MI308 are designed for civilian AI applications, such as smart factories and autonomous systems, where Chinese demand is surging. By maintaining a presence in China, these firms avoid ceding market share to domestic competitors like Huawei and Alibaba, which are rapidly advancing in AI chip design.

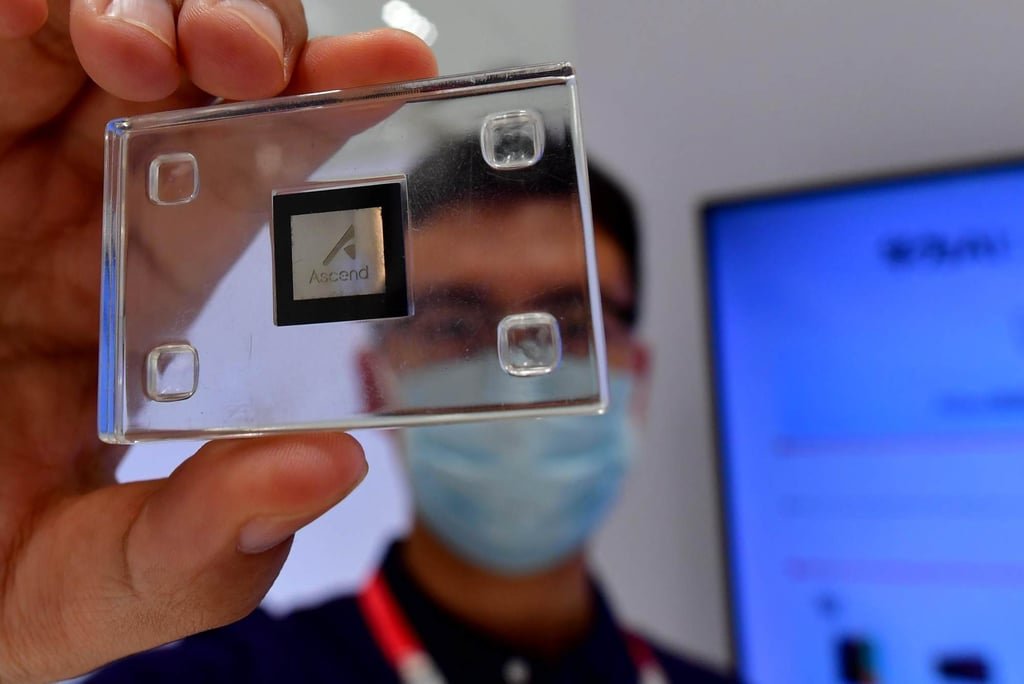

On the other hand, the tax creates a structural disadvantage. Chinese firms are incentivized to accelerate self-reliance, reducing their dependence on U.S. technology. For instance, Huawei’s Ascend 910D and Alibaba’s CloudMatrix 384 are already challenging U.S. chips in certain applications. Additionally, the 15% tax may discourage U.S. firms from deepening their China exposure, especially if geopolitical tensions resurface or if local rivals improve performance.

The arrangement also sets a precedent for future export policies. If the U.S. government extends revenue-sharing requirements to other industries, it could alter the global trade landscape, favoring firms that align with Washington’s strategic interests. This could lead to a bifurcated market where U.S. firms dominate in allied nations but face regulatory hurdles in China and other emerging economies.

Geopolitical Risk Pricing and Strategic Considerations

Investors must now factor in the cost of geopolitical risk when evaluating semiconductor equities. The 15% tax is a tangible example of how U.S. policy can directly impact a company’s bottom line. For Nvidia and AMD, the tradeoff is clear: access to China’s AI market comes at the expense of reduced profitability and regulatory uncertainty.

However, the broader strategic implications are more nuanced. The U.S. government’s decision to monetize export licenses signals a shift toward leveraging trade policy for financial gain, a move that could strain relationships with allies who view such tactics as inconsistent with national security principles. Conversely, it reinforces the U.S. position as a leader in AI innovation, ensuring that its firms remain central to global infrastructure development.

Investment Advice: Balancing Risk and Reward

For investors, the key is to balance the near-term margin drag with the long-term growth potential of the AI sector. Nvidia and AMD’s ability to innovate within regulatory constraints—such as developing compliant chips like the H20 and MI308—positions them to capture a significant share of China’s AI market. However, the 15% tax introduces volatility, and geopolitical shifts could disrupt this trajectory.

A cautious approach is warranted. Investors should monitor quarterly earnings reports for signs of margin resilience and revenue growth from China. Additionally, diversification into other high-growth markets, such as Europe and Southeast Asia, could mitigate China-specific risks. For long-term investors, the AI sector’s structural growth potential may outweigh the short-term challenges posed by the 15% tax, provided U.S. firms continue to lead in innovation.

In conclusion, the U.S.-China tech tradeoff exemplified by the 15% revenue tax underscores the complex interplay between geopolitics and corporate strategy. While the tax introduces new risks, it also highlights the resilience of U.S. semiconductor firms in navigating a fragmented global market. For investors, the challenge lies in assessing whether the benefits of market access and innovation outweigh the costs of regulatory uncertainty—a question that will shape the future of the semiconductor industry for years to come.