The Defiance Oil Enhanced Options Income ETF (USOY 0.32%) is an alluring income-focused investment opportunity. The exchange-traded fund’s (ETF) implied annualized distribution rate is an eye-popping 111%. It distributes income to fund investors on a weekly basis.

That combination of yield and payment frequency makes it appear to be an income juggernaut. However, and you probably know this is coming, there is a big catch: The fund has a very high-risk profile.

Here’s a closer look at this ETF, which aims to provide investors with an enhanced oil-fueled income stream.

Image source: Getty Images.

Drilling down into the Defiance Oil Enhanced Options Income ETF

USOY is an actively managed ETF that aims to provide investors with an oil-backed income stream through options. The fund’s strategy is to sell put options on the popular oil ETF, the United States Oil Fund (USO -0.53%).

The United States Oil Fund is an exchange-traded security designed to track the daily price movements of crude oil delivered to Cushing, Oklahoma (the country’s main oil trading hub). USO does that by investing in oil futures contracts and over-the-counter swaps (customized contracts between two parties, such as financial institutions and corporations).

The United States Oil Fund doesn’t own physical oil, nor does it take delivery of physical barrels at Cushing. It invests in futures contracts and swaps that it sells before expiration. It rolls the proceeds into new contracts that typically expire in less than two months. USO’s primary holding is currently 15,081 U.S. crude oil futures contracts that expire in August.

The Defiance Oil Enhanced Options Income ETF writes (shorts) put options on USO that are either at the money (right at the current price of the underlying security) or in the money (below the current market price). This strategy aims to generate income and provide exposure to the price of USO.

The ETF sells put options on USO at least once a week. Selling put options generates income if USO’s share price increases above the current price, stays flat, or decreases slightly (as long as the decline is less than the value of the options premium received). The fund distributes the income it earns to investors each week.

Drilling down into the fund’s returns

Writing put options can be a very lucrative income strategy. Options writers receive the premium (the value of the option) up front. They retain all or part of the premium, depending on the price of the underlying security at expiration.

The Defiance Oil Enhance Options Income ETF’s distribution payment for the last week of June was $0.1999 per share. If we annualized that rate, the fund would distribute $10.39 per share of income to investors over the course of a year. That’s a 111% yield on the ETF’s recent price in the low-$9.00-per-share range.

As big as that payout seems, it’s down from prior payment levels. The fund, which had only recently started making weekly income distributions, had previously paid investors monthly. Those payments had been as high as $1.2365 per share ($14.84 annualized).

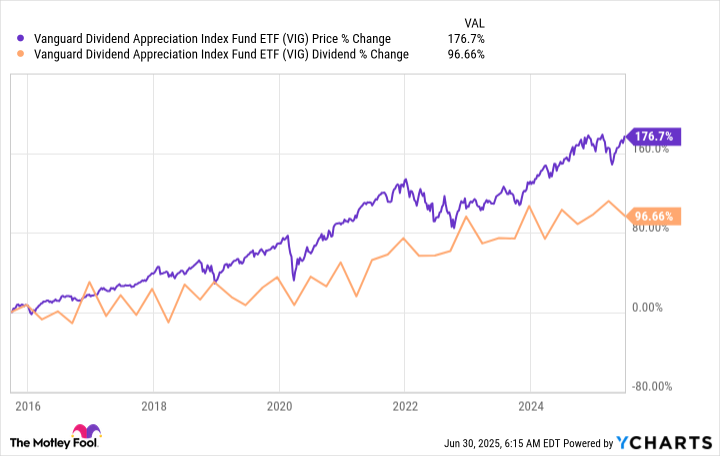

As the chart shows, the fund’s income payments (and the value of the fund’s share price) have been steadily declining since its launch last year:

The decline in the fund’s value is worth noting. When we add the income paid to the share price, the total return has actually been negative 0.93% since the fund’s inception in May 2024.

That’s due to two issues. First, the fund has a high expense ratio of 1.22%. The costs of actively writing put options on USO are eating into the returns generated by the fund.

The other issue is that USO’s strategy aims to track the daily price movements of oil. While it does a solid job of tracking oil over the short term, it’s abysmal at following crude prices over the longer term. That’s due to the costs of rolling futures contracts. Since the fund’s inception a decade ago, the value of WTI crude has risen by nearly 20%, while the fund’s value has declined by more than 50%.

The cost of writing put options on a security that steadily loses value hasn’t been a winning strategy for the Defiance Oil Enhanced Options Income ETF.

A high-risk income ETF

The Defiance Oil Enhanced Options Income ETF seeks to deliver a high-yielding income stream generated by writing put options on a crude oil ETF. While the fund’s weekly distributions are high relative to its share price, that price has been steadily declining. That value erosion (due in part to its high expense ratio) has more than offset all the income generated by the fund since its inception.

While the fund may perform better in the future, especially if oil prices are volatile to the upside, it’s a very high-risk fund that’s not suitable for investors seeking a bankable passive income stream.

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.