Is USDJPY about to rally 400 pips?

Watch today’s video for the details, including key levels, a Time Price Opportunity (TPO) analysis, and targets.

I also share the latest on the DXY and Japanese yen basket, so you have a complete USDJPY trade plan.

USDJPY is breaking out this week after two months of sideways action. That could set the stage for an aggressive rally.

Since early August, USDJPY has been capped by resistance near 148.70. Support held at the lower wicks. That range kept the price locked for nearly two months.

Wednesday’s breakout changes everything.

Breakouts after long consolidations often run aggressively. That suggests the potential for shallow pullbacks rather than full retracements.

The first target is the 150.23 single print from early August. Above that is the 151.20 region, which has been significant since March.

Support now comes in at 148.70. Daily closes above keep the breakout intact. A sustained move back below would point to a failed breakout and put 147.00 back in play.

On the short-term chart, TPO levels show single prints around 150.23. These often act as magnets. If we see shallow pullbacks into the 149.00–149.50 range, those areas could turn into support on the way toward 151.20.

In the longer term, an ascending channel from the April lows lines up near 153.00–154.00. That is approximately 400 pips higher from here.

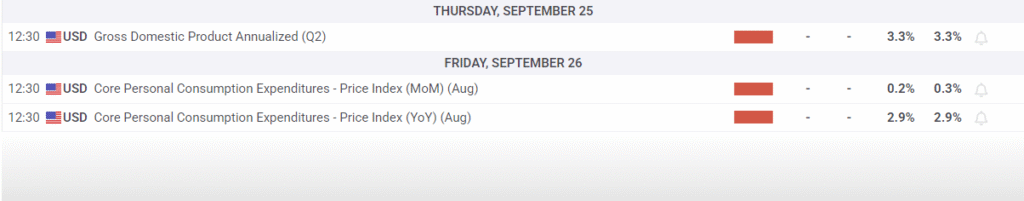

The DXY supports the USDJPY long setup.

The dollar bounced hard off of its 2011 channel support last week and is breaking above 97.70 this week.

That helps the USDJPY’s case, but resistance at 98.60–99.00 could slow the dollar.

Additionally, the yen index looks bearish. Lower highs have formed since it failed at a key trend line. That weakness could give USDJPY more fuel to move higher.

Bottom line: above 148.70 keeps the upside open toward 150.20 and 151.20. A close below 148.70 would be bearish and open the door to the 147.00 region.

Join us in the VIP Discord group for real-time market updates, VIP-only videos, my trades in real time, and the complete trading course.