- The USD/JPY weekly forecast points to cautious tones from Powell and Ueda.

- The yen gained after Prime Minister Ishiba said he would stay on.

- A surprise trade deal between Japan and the US boosted the yen.

The USD/JPY weekly forecast points to cautious tones during next week’s Fed and Bank of Japan policy meetings.

Ups and downs of USD/JPY

The USD/JPY price ended the week red but far above its lows. The price fluctuated throughout the week as traders focused on elections, tariffs, and economic data. The ruling party in Japan lost its majority in the upper house. However, the yen gained after Prime Minister Ishiba said he would stay on.

-Are you looking for the best CFD broker? Check our detailed guide-

Meanwhile, a surprise trade deal between Japan and the US further boosted the yen. It lowered Japan’s reciprocal tariff from 25% to 15%. However, the pair reversed its decline after unemployment claims data revealed resilience in the US labor market, pushing the dollar higher.

Next week’s key events for USD/JPY

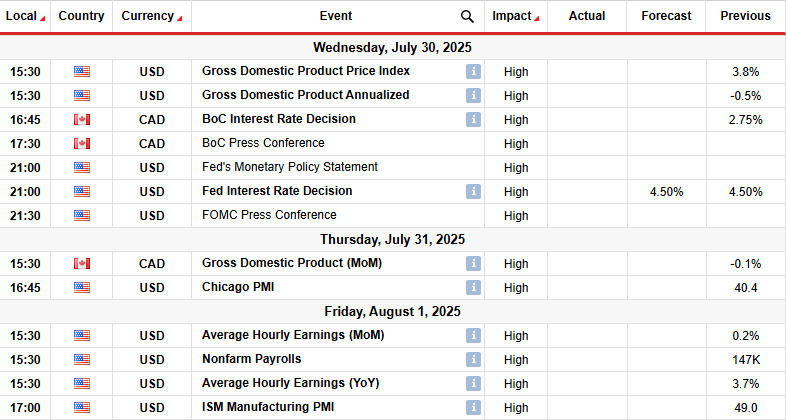

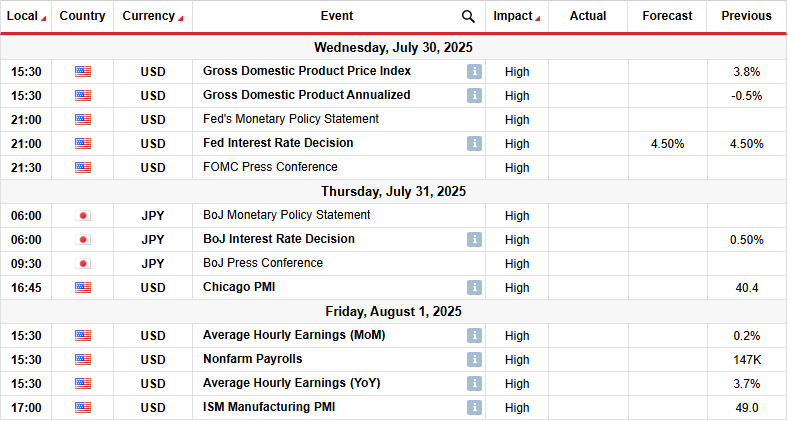

Next week, the US will release its GDP report, business activity data, and the nonfarm payrolls. At the same time, traders will focus on the FOMC policy meeting for clues on the next rate cut. Meanwhile, the Bank of Japan is also set to meet on Thursday.

Both the Fed and the BoJ are likely to keep delaying their next moves due to the impact of Trump’s tariffs. Therefore, Powell might remain cautious about rate cuts while Ueda will remain cautious about rate hikes.

USD/JPY weekly technical forecast: Bulls retarget the 149.01 resistance level

On the technical side, the USD/JPY price is bouncing towards the 149.01 resistance after retesting the 22-SMA support line. The price has been in a corrective move between a key support trendline and the 149.01 key resistance level. Within this area, the price has chopped through the SMA, a sign that bears and bulls are almost equally matched.

-If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

The corrective move came after a downtrend that paused at the 140.01 support level. Therefore, it might only be a pause as bears regain momentum. If this is the case, the price will likely soon break below the support trendline. To retest the 140.01 support. Such a move would also allow the previous downtrend to continue.

On the other hand, if bulls are ready to take charge, the price will break above the 149.01 key resistance level. This would allow USD/JPY to retest the 154.02 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

![AI Day Trading - All You Need to Know–Updated [Year, Month]](https://koala-by.com/wp-content/uploads/2025/07/ai1.webp)