- The USD/JPY outlook indicates that the yen is starting the week strong.

- A former top currency diplomat in Japan noted that the yen could strengthen to the 135-140 range.

- The US released data showing 139,000 new jobs in May.

The USD/JPY outlook indicates that the yen is starting the week strong as market focus shifts back to policy outlooks. On Friday, Japan’s currency collapsed against a strong dollar after the US released a better-than-expected employment report.

–Are you interested to learn more about crypto signals? Check our detailed guide-

An ex-top currency diplomat in Japan noted on Friday that the yen could strengthen to the 135-140 range against the dollar, mainly due to policy divergence. The Federal Reserve’s next move will likely be a rate cut. Despite a resilient economy, several sectors have experienced a slowdown. At the same time, inflation is easing, giving policymakers confidence to lower borrowing costs.

On the other hand, the Bank of Japan has stated that it will continue to hike rates as long as the economy re-accelerates after the global tariff slowdown. Rate cuts in the US and rate hikes in Japan will result in a narrowing interest rate gap. This, in turn, will boost the yen.

On Friday, the US released data showing 139,000 new jobs in May. This was bigger than the forecast of 130,000. As a result, rate cut expectations eased. Meanwhile, the dollar rallied. Market participants are now looking forward to crucial inflation figures from the US for more clues on rate cuts.

USD/JPY key events today

Market participants are not expecting any high-impact reports from the US or Japan.

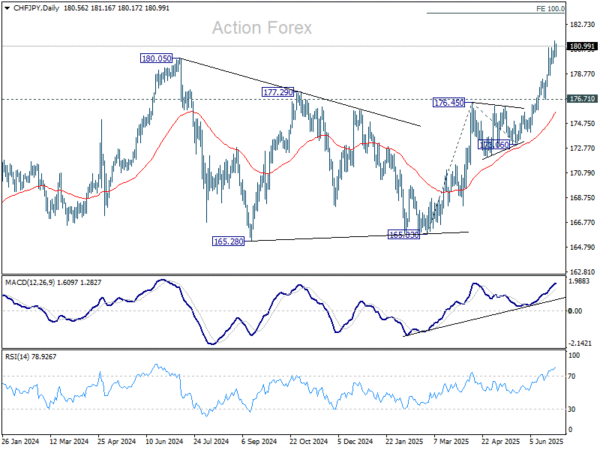

USD/JPY technical outlook: Bears return after trendline retest

On the technical side, the USD/JPY price is pulling back after meeting its resistance trendline and the 145.00 key level. However, the bias is bullish because the price trades above the 30-SMA, with the RSI above 50. The bias will only change if bears breach the SMA line.

–Are you interested to learn more about forex robots? Check our detailed guide-

USD/JPY has gradually descended, making lower highs. However, bears have been unable to break below the 142.55 support level. As a result, the price has been forming a descending triangle.

There is a high chance it will breach the 30-SMA to retest the 142.55 support. If bears have gained enough momentum, the price will break below this level, starting to make lower lows. However, if they are still weak, it will bounce again, remaining in the descending triangle.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.