- The USD/JPY outlook indicates that focus has shifted from tariffs to upcoming central bank policy meetings.

- US business activity data was mixed.

- Traders expect Powell to maintain his cautious tone.

The USD/JPY outlook indicates a shift in sentiment as the market’s focus shifts from tariffs to upcoming central bank policy meetings. The dollar recovered, while the yen remained fragile, as traders speculated on the upcoming Fed and BoJ policy meetings.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The dollar recovered as the week came to a close, as the impact of the recent US-Japan trade deal faded. Traders focused on economic data on Thursday, which gave a mixed picture of the economy. The manufacturing sector unexpectedly contracted while the services sector expanded more than expected. Nevertheless, recent US economic data has led to a decline in Fed rate cut expectations. As a result, the timing for the next cut has moved to October. When the Fed meets next week, traders expect Powell to maintain his cautious tone.

At the same time, the Bank of Japan will meet next week and likely keep rates unchanged. The trade deal has lowered tariffs on Japan and improved the prospects of BoJ rate hikes. However, experts believe the next hike might not come for some time. The economy must first survive Trump’s tariffs before policymakers gain the confidence to hike rates.

USD/JPY key events today

The pair might end the week quietly as market participants do not expect any key economic releases from Japan or the US.

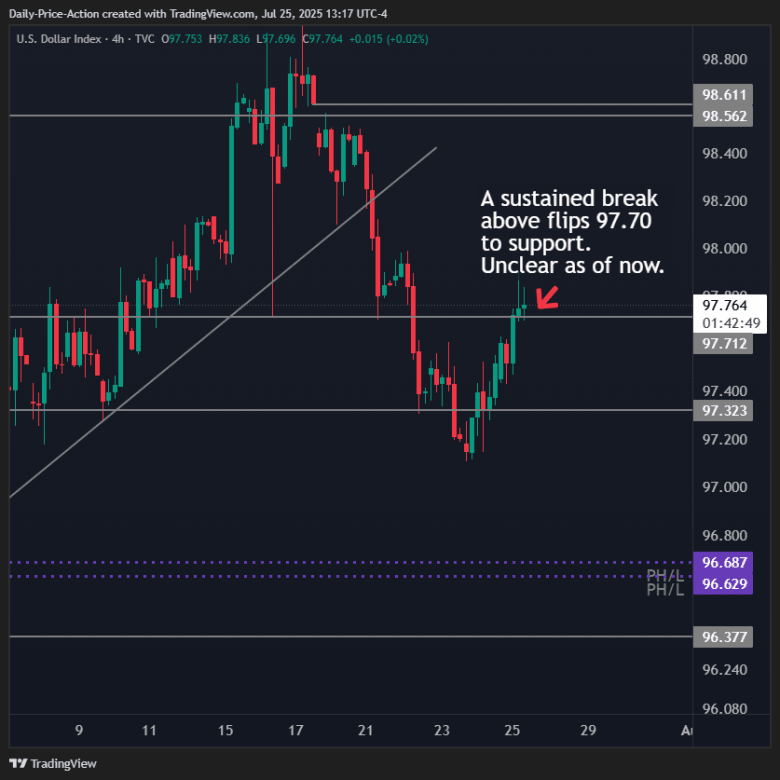

USD/JPY technical outlook: Bulls challenge the new downtrend at the 30-SMA

On the technical side, the USD/JPY price has rebounded to retest the 30-SMA as resistance. However, it still trades below the SMA, meaning bears remain in the lead. Meanwhile, the RSI has broken above 50, showing bullish momentum is strengthening.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Previously, the price declined sharply after it broke below the SMA. The SMA break was a sign that sentiment had shifted, and the new direction was down. However, bears paused when the price reached a solid support zone comprising the 146.01 key level and the 0.5 Fib retracement level.

At this zone, bulls emerged to challenge the new decline. As a result, the price climbed to the 30-SMA. Given the new bearish bias, USD/JPY might respect the SMA as resistance and bounce lower. Meanwhile, a break above the SMA would allow bulls to retest the 149.01 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.