- The USD/JPY forecast shows a rebound as the dollar gains on trade optimism.

- The US economy lost 33,000 private jobs in June.

- Economists expect 120,000 new US jobs, a slowdown from the previous month.

The USD/JPY forecast shows a rebound as the dollar gains on trade optimism. However, downbeat employment figures in the previous session led to an increase in Fed rate cut expectations. Market participants are now looking forward to the nonfarm payrolls report.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The dollar strengthened on Thursday after news of a trade deal between the US and Vietnam. The news raised hopes of more deals before the July 9 deadline for reciprocal tariffs. The progress in trade talks has been slow, and there are concerns that tariffs will increase again soon. Therefore, any new deal boosts market sentiment.

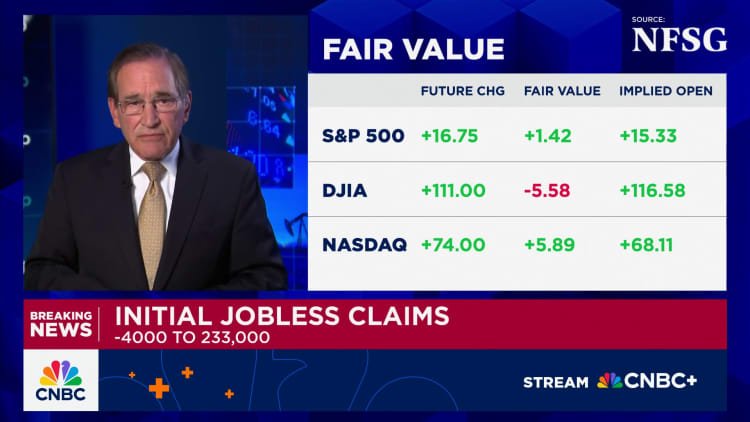

However, the dollar remains under pressure after data in the previous session revealed weak private employment. The economy lost 33,000 private jobs in June. Meanwhile, economists had expected 99,000 new jobs. The report raised concerns about the state of the labor market. At the same time, it increased the likelihood of a Fed rate cut in July.

All eyes are now on the nonfarm payrolls. Economists expect 120,000 new jobs, a slowdown from the previous month. Moreover, unemployment might increase from 4.2% to 4.3%. Softer-than-expected figures will weigh on the dollar by adding pressure on the Fed to lower borrowing costs.

USD/JPY key events today

- US average hourly earnings m/m

- US nonfarm employment change

- US unemployment rate

- US ISM services PMI

USD/JPY technical forecast: Price retests trendline after recent break

On the technical side, the USD/JPY price has broken below its bullish trendline to make a lower low. The move has strengthened the bearish bias. However, the price has pulled back to retest the recently broken trendline and the 30-SMA. However, the price remains below the SMA, with the RSI under 50, indicating that bears are still in the lead. However, this might change.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

The current resistance zone must hold firm to allow the price to bounce lower and confirm the breakout. If this happens, the USD/JPY pair will likely drop to retest the 142.55 support level.

On the other hand, if bulls are stronger, the price will likely break above the resistance zone. Still, to confirm a new bullish move, the price would need to break above the 145.00 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.