Key Highlights

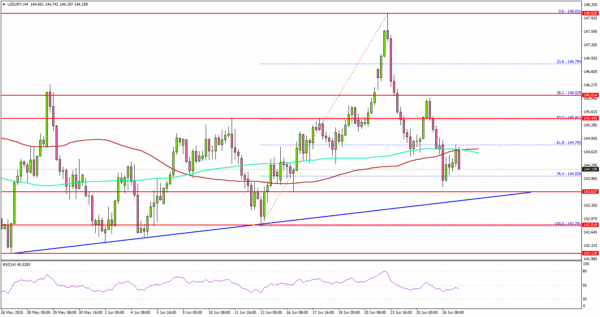

- USD/JPY extended losses and traded below the 145.00 support zone.

- A major bullish trend line is forming with support at 143.50 on the 4-hour chart.

- EUR/USD extended gains and broke the 1.1700 resistance.

- GBP/USD rallied above the 1.3620 and 1.3650 levels.

USD/JPY Technical Analysis

The US Dollar failed to stay above 146.20 and extended losses against the Japanese Yen. USD/JPY traded below the 145.50 and 145.00 support levels.

Looking at the 4-hour chart, the pair dipped below the 61.8% Fib retracement level of the upward move from the 142.79 swing low to the 148.03 high. Besides, there was a drop below the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour).

On the downside, immediate support is near the 143.65 level. The next key support sits near 143.50. There is also a major bullish trend line forming with support at 143.50 on the same chart.

Any more losses could send the pair toward the 142.80 support zone. If the bulls remain active above the stated support levels, there could be a fresh increase. On the upside, the pair could face resistance near the 145.00 level.

The next key resistance sits near the 145.50 level. The first major resistance sits at 146.20. A close above the 146.20 level could set the pace for another increase. In the stated case, the pair could even clear the 147.00 resistance. The next major stop for the bulls could be near the 148.00 resistance.

Looking at EUR/USD, the pair gained pace for an upside break above the 1.1620 and 1.1650 resistance levels. The next key hurdle sits at 1.1800.

Upcoming Economic Events:

- US Personal Income for May 2025 (MoM) – Forecast +0.3%, versus +0.8% previous.

- US Core Personal Consumption Expenditure for May 2025 (MoM) – Forecast +0.1%, versus +0.1% previous.

- Michigan Consumer Sentiment Index for June 2025 – Forecast 60.5, versus 60.5 previous.