- The USD/CAD weekly forecast shows optimism about US-Canada trade talks.

- Demand for the dollar fell after the US Senate passed Trump’s controversial bill.

- The pair recovered slightly at the end of the week after upbeat US employment numbers.

The USD/CAD weekly forecast shows optimism regarding progress in trade negotiations between Canada and the US.

Ups and downs of USD/CAD

USD/CAD had a bearish week as the Canadian dollar gained on hopes of a trade deal between Canada and the US. At the start of the week, data indicated weakness in the US labor market. Private employment unexpectedly dropped, weighing on the dollar.

–Are you interested in learning more about Forex indicators? Check our detailed guide-

At the same time, demand for the dollar fell after the US Senate passed Trump’s controversial bill. Meanwhile, progress in talks between Canada and the US boosted the Canadian dollar. Still, the pair recovered slightly at the end of the week after upbeat US employment numbers.

Next week’s key events for USD/CAD

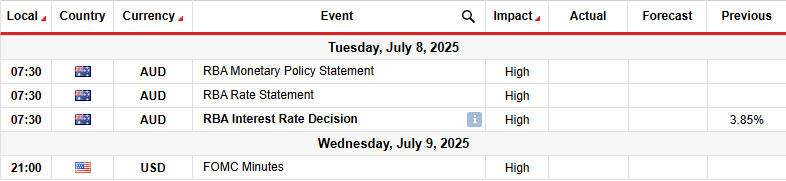

Next week, the US will release the FOMC minutes. Meanwhile, Canada will release its crucial monthly employment figures.

The FOMC minutes will show the tone of policymakers during the last meeting. Therefore, it might contain clues on future policy moves. So far, traders are pricing the first rate cut in September.

Meanwhile, Canada’s employment report will continue to shape the outlook for Bank of Canada rate cuts. Currently, market participants are pricing a 37.25% chance of a cut in July.

USD/CAD weekly technical forecast: Second attempt at 1.3550 is weak

On the technical side, the USD/CAD price is attempting a second break below the 1.3550 support level. The price trades below the 22-SMA with the RSI below 50, supporting a bearish bias. USD/CAD has maintained a downtrend, with the price making lower highs and lows. Although the price pierced the 22-SMA several times, it respected a resistance trendline.

–Are you interested in learning more about Best Bitcoin Exchanges? Check our detailed guide-

However, as bears challenge the 1.3550 support a second time, it is clear that momentum has weakened. The RSI has made a higher low, suggesting fading momentum. Therefore, if bears are weaker this time, they might fail to break below the support.

In such a case, the price would break above the SMA and the trendline resistance. This would allow bulls to retest the 1.4003 key resistance level. However, if bears regain momentum before this happens, the price will break below 1.3550, continuing the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.