- The USD/CAD weekly forecast is neutral as markets prepare for rate cuts in Canada and the US.

- The Bank of Canada is under pressure to lower borrowing costs due to the weak labor market.

- Data revealed slightly hotter-than-expected US consumer inflation.

The USD/CAD weekly forecast is neutral as markets prepare for rate cuts from the Bank of Canada and the Fed.

Ups and downs of USD/CAD

The USD/CAD pair had a slightly bullish week as traders balanced the policy outlooks for the Bank of Canada and the Fed. Meanwhile, US data added more pressure on the Fed to lower borrowing costs.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The Bank of Canada is under pressure to lower borrowing costs due to the weak labor market in Canada. Similarly, market participants expect the Fed to cut rates next week. Data during the week revealed slightly hotter-than-expected US consumer inflation. However, a weak unemployment claims report overshadowed it, keeping rate cut expectations elevated.

Next week’s key events for USD/CAD

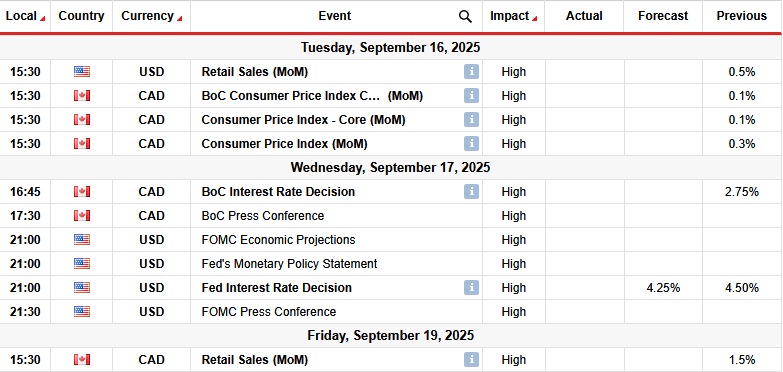

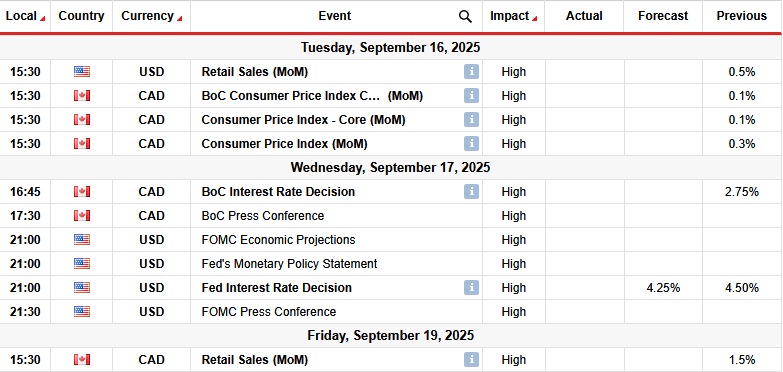

Next week, market participants will focus on inflation and retail sales figures from Canada, as well as the Bank of Canada’s policy meeting. At the same time, the US will release retail sales figures on Monday, and the Fed will hold its policy meeting on Wednesday.

Traders expect the BoC to deliver a rate cut when it meets. Recent data from Canada pointed to a weak labor market, piling pressure on the central bank. The situation is the same with the US labor market. As a result, the Fed will also likely lower borrowing costs.

USD/CAD weekly technical forecast: Bullish trend faces the 1.3850 hurdle

On the technical side, the USD/CAD price trades slightly above the 22-SMA with the RSI above 50, suggesting a bullish bias. However, bulls are struggling to break above the 1.3850 key resistance level. Meanwhile, bears are getting strong enough to puncture the 22-SMA support.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

The trend turned bullish when the previous decline met the 1.3600 key support and made a triple bottom. After that, bulls took charge by breaking above the 22-SMA and starting a pattern of higher highs and higher lows. However, his pattern has paused at the 1.3850 resistance level. If bulls regain momentum, the price is likely to break past this level and make a new higher high.

At the same time, such a move would clear the path for USD/CAD to revisit the 1.4201 resistance level. On the other hand, if bulls fail to continue higher, the price will likely drop to retest the 1.3600 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.