- The USD/CAD weekly forecast indicates a more dovish stance among Fed officials.

- Fed’s Christopher Waller said he expects a cut in September.

- Canada’s economy contracted by 0.1%.

The USD/CAD weekly forecast suggests a more dovish stance among Fed officials, which is weighing on the dollar.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week as the dollar fell amid increased expectations for a Fed rate cut. Fed officials sounded more dovish this week, increasing the chances that they will vote for a rate cut at the next meeting. John Williams said a rate cut is possible. Meanwhile, Christopher Waller said he expects a cut in September and more similar moves in the months ahead. However, he also noted that the outlook would depend on incoming data.

–Are you interested in learning more about forex indicators? Check our detailed guide-

Meanwhile, data on Friday revealed that Canada’s economy contracted by 0.1%, leading to a drop in the loonie.

Next week’s key events for USD/CAD

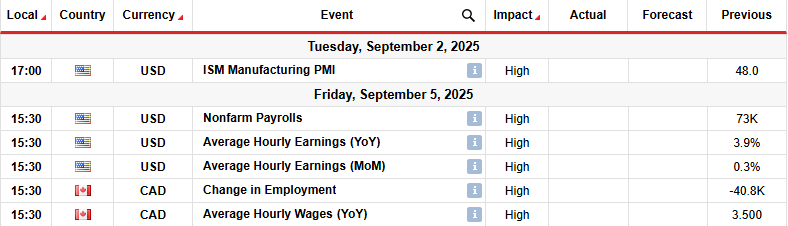

Next week, market participants will focus on business activity and employment data from the US. Canada will also release its crucial monthly employment figures.

The US nonfarm payrolls report will play a key role in shaping the outlook for Fed rate cuts. Further weakness in the labor market will solidify bets for a cut in September, weighing on the dollar.

USD/CAD weekly technical forecast: Bears face the 1.3750 level after SMA break

USD/CAD daily chart

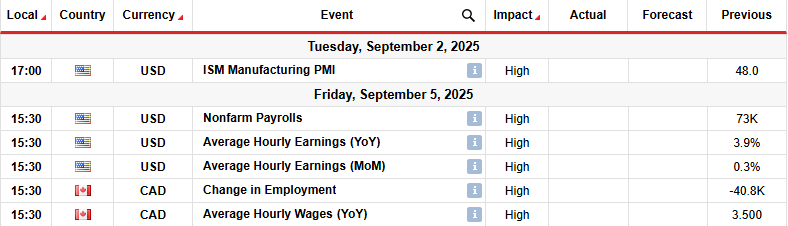

On the technical side, the USD/CAD price has broken below the 22-SMA, a sign that bears have taken the lead. At the same time, the RSI has broken below 50, indicating stronger bearish momentum. However, bears are facing the 1.3750 key level that might be difficult to break.

–Are you interested in learning more about next cryptocurrency to explode? Check our detailed guide-

Previously, the trend turned bullish after forming a triple bottom at the 1.3600 key level. The bulls broke above the 1.3750 level and respected the 22-SMA. Moreover, they made a higher high, confirming the start of a new trend. However, this changed when the price broke below the SMA. If this were just a deep pullback, bulls will likely return at the 1.3750 key level. This would allow the price to continue its new trend with a new high. It would also enable bulls to retest the 1.4000 key resistance level.

On the other hand, if bears have taken over, the price will likely retest the 1.3600 support level. A break below would continue the previous downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.