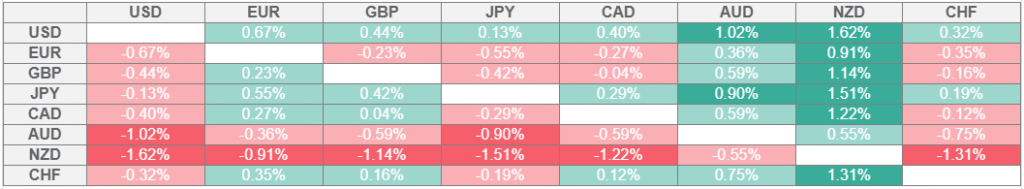

- The USD/CAD outlook shows the Canadian dollar weakening ahead of crucial inflation figures.

- Traders are anticipating policy clues at the Jackson Hole symposium.

- The US will guarantee the country’s safety in the event of a peace deal.

The USD/CAD outlook deteriorates as the Canadian dollar weakens ahead of crucial inflation figures from Canada. Meanwhile, the dollar remained strong as traders watched developments in peace talks to end the war in Ukraine.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Canada is set to release pivotal inflation figures that will shape the outlook for Bank of Canada rate cuts. Economists expect the monthly figure to accelerate from 0.1% to 0.3%. A bigger-than-expected number would allow the BoC to continue pausing. On the other hand, if inflation comes in soft, policymakers might feel more pressure to lower borrowing costs.

Meanwhile, traders are anticipating the Jackson Hole symposium, where Powell might drop clues about the next rate cut. Most traders expect a dovish tone from Powell and a signal for when the central bank will cut rates. However, this might not be exactly the case.

Analysts at DBS expect Powell to deliver a calibrated message, “keeping the door open for an insurance cut to avert a sharper deterioration in the labour market while also cautioning against excessive or rapid rate cuts,” they said in a note.

Meanwhile, Trump told Ukraine’s president that the US would guarantee the country’s safety in the event of a peace deal. However, there was little clarity about what might happen next.

USD/CAD key events today

- Canada CPI m/m

- Canada median CPI y/y

- Canada trimmed CPI y/y

USD/CAD technical outlook: Bulls target the 1.3875 resistance

On the technical side, the USD/CAD price trades above the 30-SMA with the RSI above 50, suggesting a bullish bias. Bulls recently took charge after the previous decline failed to continue below the 1.3750 key support level. The price broke back above the level and started making higher highs and lows.

–Are you interested to learn more about forex tools? Check our detailed guide-

At the same time, the price is trading in a bullish channel on a larger scale. Moreover, it recently touched the channel support and is now bouncing higher. Bulls are eyeing the 1.3875 key resistance level. A break above this level would strengthen the bullish bias.

However, if the level holds firm, the price might pull back to the channel support before climbing higher. Meanwhile, a break below the channel support would signal a likely reversal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.