Wia dis foto come from, Getty Images

Di US dey plan to impose a 25% tax on products wey dey enta di kontri from South Korea and Japan on 1 August, President Donald Trump tok.

Im announce di tariffs for post on social media, e share letters wey im say im don send to leaders of di two kontris.

Di White House say dem go send similar messages to many oda kontris as di 90-day pause wey dem put in place on some of dia most aggressive tariffs go soon expire.

Di window for negotiations dey expected to close on 9 July but Trump say im dey he plan to start to charge di tariffs on 1 August, dis go extend dat deadline.

For now, di first two letters suggest say Trump dey committed to im initial push for tariffs, wit little change from di rates wey im bin announce for April.

At dat time, im bin say im bin dey look to hit goods from Japan wit duties of 24% and charge a 25% on products wey dem make for South Korea.

Those tariffs dey included for a bigger “Liberation Day” announcement, wey bin impose new taxes on goods from kontris around the world – wit goods from some kontris dey face levies of more dan 40%.

Afta outcry and turmoil on financial markets sake of di initial tariffs announcement, Trump bin suspend some of di highest import taxes to allow for talks, while im keep a 10% levy in place.

Di window for negotiations to avoid di higher duties dey set to close on 9 July. Trump say im plans to start to charge di tariffs on 1 August, extending dat deadline.

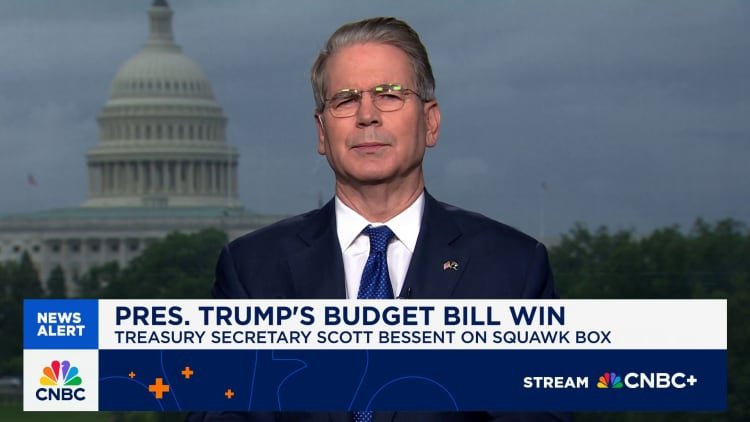

On Monday, Treasury Secretary Scott Bessent say im dey expect “a busy couple of days”.

“We don get a lot of pipo wey don change dia tune in terms of negotiations. So my mailbox bin full last night wit a lot of new offers, a lot of new proposals,” im tell US business broadcaster CNBC.

Trump initially bin describe im April tariffs as “reciprocal”, e claim say na to fight back against oda kontris trade rules wey im bin see as unfair to US exports.

Im don separately announce tariffs for key sectors, like steel and cars, citing national security concerns, and threaten to raise levies on oda items, like pharmaceuticals and lumber.

Di multi-layered policies get complicated trade talks, car tariffs na one key sticking point for di negotiations wit Japan and South Korea.

White House press secretary Karoline Leavitt say the White House dey plan to send letters to about 12 oda kontris today, dem say more letters go follow.

“These letters dem say dem go kotinu to post am for Truth Social,” she tok, dat na di social media platform wey Trump own.

So far, US don reach agreements wit di UK and Vietnam, as well as a partial deal wit China.

In all three of those cases, di agreements don raise tariffs compared wit levels bifor Trump bin return to di White House, while key issues still remain unresolved.

Di European Union (EU) also dey in talks in talks we go keep a provisional 10% tax in place for most goods wey dem go ship to US beyond di deadline according to reports.

But dem also dey look to reduce Trump 25% tariff on cars and parts, and a 50% tax on steel and aluminium.

On Monday, one tok-tok pesin say di European Commission president Ursula von der Leyen bin get a “good exchange” wit Trump. Just a few weeks ago, di US president bin threaten di EU wit a 50% tax unless dem reac agreement.

Last week, Trump say Japan fit face a “30% or 35%” tariff if di kontri fail to reach a deal wit di US by Wednesday.

Stocks for US bin slip afta Trump bin share di letters.