Stay informed with free updates

Simply sign up to the US equities myFT Digest — delivered directly to your inbox.

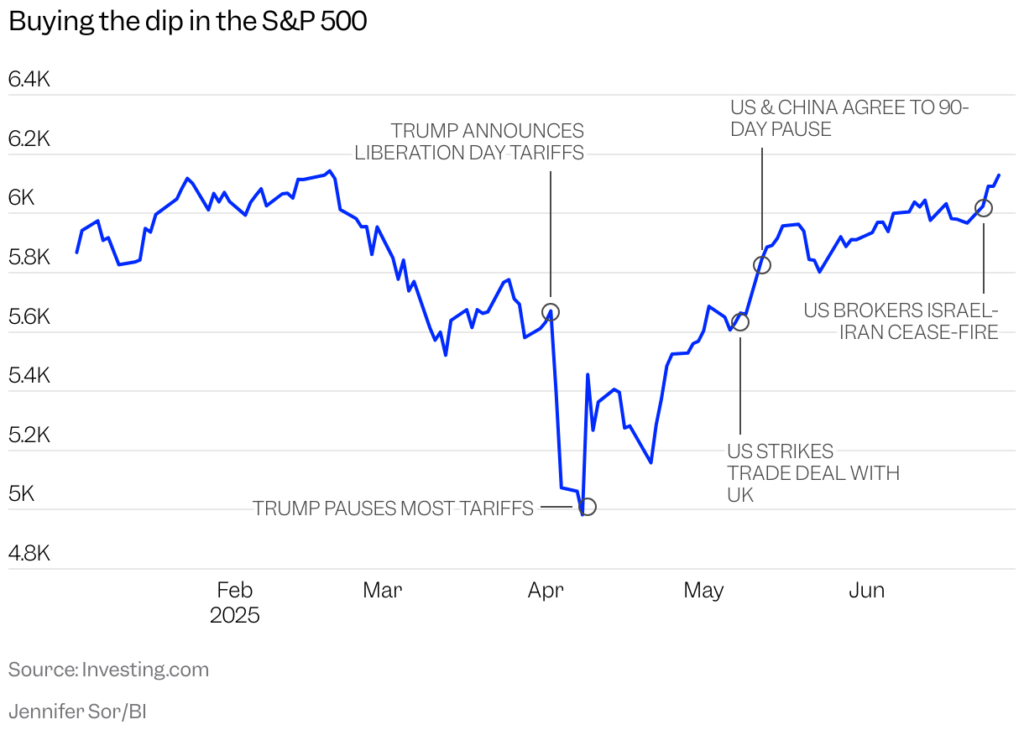

Wall Street’s comeback from tariff turmoil to hit a record high has dramatically narrowed the gap with European stocks, testing the mettle of investors who were betting on an end to an era of exceptionalism for US markets.

The blue-chip S&P 500 stock index has torn 10 per cent higher in the second quarter of the year, far outstripping Europe’s region-wide Stoxx 600, which has risen less 2 per cent, as well as other big global indices.

The outperformance of American stocks is confounding bets that US President Donald Trump’s chaotic tariff policies would spark a lasting rotation into other markets, particularly Europe, where hopes of a spending splurge on defence and infrastructure buoyed shares early in 2025. Instead, investors have flooded back to the tech stocks that had powered the market rally of recent years.

“In the second quarter, what we’ve seen is a reversion to the playbook,” said Shep Perkins, chief investment officer at equity fund manager Putnam Investments.

European stocks are still narrowly outperforming US peers in 2025, driven by optimism that broad movement towards fiscal stimulus and reforms to bring the bloc’s economies closer together will ignite growth. The region-wide Stoxx Europe 600 is 7 per cent higher in 2025, compared with 5 per cent for the S&P.

But Europe’s recent underperformance is feeding anxiety among investors that the region is failing to sustain the momentum created by Germany’s €1tn “whatever it takes” spending plan for defence and infrastructure.

“The European problem has always been earnings, earnings, earnings,” said Dec Mullarkey, managing director at fund manager SLC Management. “You can debate US valuations all you like, but these stocks are backed by solid balance sheets. The Europe trade is far more speculative, it depends on Germany, for example, following through on its infrastructure plan.”

Optimism over Europe’s prospects is yet to show up meaningfully in economic data. The European Commission last month revised down its growth forecasts after Trump’s tariff broadside. Consumer and business sentiment for both the EU and euro area declined in June, according to a commission survey published last week.

Meanwhile, the US has had more robust jobs numbers than expected, and unemployment is holding steady, despite predictions of a trade war hit.

US stocks have also been underpinned by both retail investors, who have piled into equities to “buy the dip”, and by companies, which have bet on themselves by buying back their own shares in record quantities.

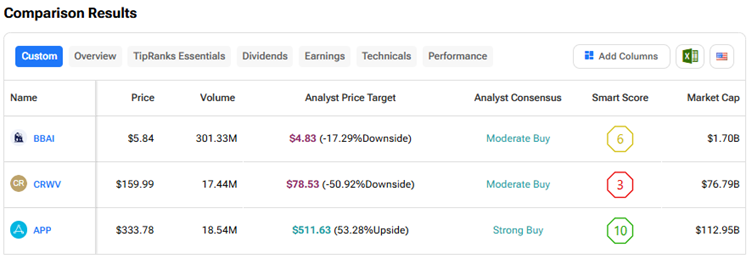

Nvidia, the main engine of Wall Street’s AI rally, hit a record high last week. Big gainers have included the Peter Thiel-chaired data intelligence company Palantir, up more than 50 per cent in the second quarter, and cryptocurrency exchange Coinbase, which has doubled as investors pile into crypto stocks.

As Big Tech stocks take the lead, a much predicted broadening in equity returns has stalled. An alternative version of the S&P that equally weights constituents is trailing its traditional, market cap-weighted equivalent this year.

Some investors are sticking to their expectations of a broader rotation away from US markets, as global investors question the big overweight they have built up in dollar assets.

Although equities have narrowed the performance gap in the second quarter, the dollar remains 13 per cent lower against the euro — meaning there is still a wide gulf if returns are measured in the same currency — and US Treasuries have come under pressure amid concerns over the rising American debt load.

Goldman Sachs analysts said in a note last week that US stock valuations had become stretched, even adjusting for the greater return on equity that US companies provide. “The era of diversification has begun,” the analysts wrote. “We think it has further to run.”

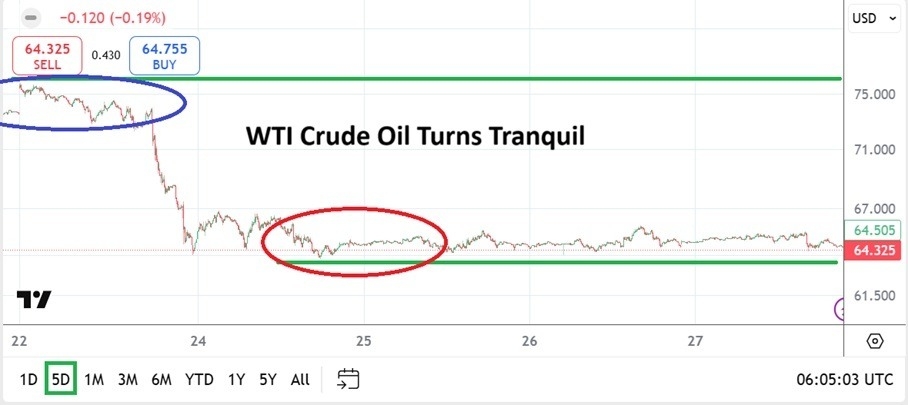

Some investors think turbulence on Wall Street could return as Trump continues to wage his trade war. The president’s 90-day pause on so-called reciprocal tariffs expires early next week and the US remains in negotiations with countries around the world to avert the imposition of hefty trade levies.

Over the longer term, fading economic growth in the US as well as Europe’s fiscal push should help to narrow the persistent transatlantic gap in stock market performance, according to Luca Paolini, chief strategist at Pictet Asset Management.

But momentum probably swung too quickly in Europe’s favour earlier in the year, he added.

“The truth is probably somewhere in between, where the US is not a paradise and Europe is not the worst place on the planet.”