By Robyn Mak

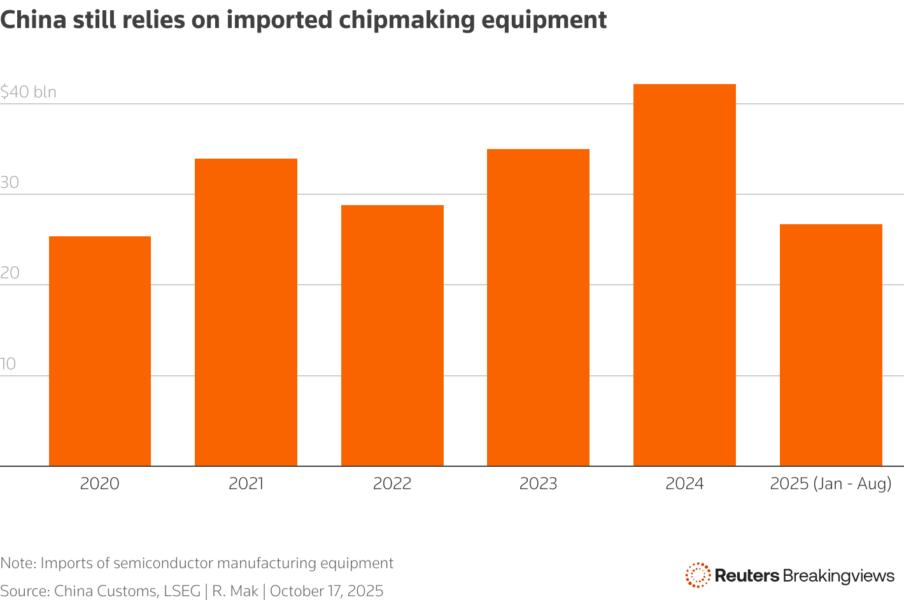

Washington is tightening its export controls using a sledgehammer. As part of the latest flare-up in Sino-American tensions, the U.S. Commerce Department last month issued new rules to extend sanctions to the subsidiaries of companies already on its blacklist, known as the Entity List. That will make it harder for Chinese firms to use affiliates to buy off-limits technology, and it may slow China’s chip advances.

Known as the Affiliates Rule, entities at least 50% owned, directly or indirectly, individually or in aggregate, by companies blacklisted by the U.S. government are now automatically subject to the same restrictions as their parent. The amendment includes provisions that will also subject a larger number of Chinese companies to Washington’s harshest sanction: the Foreign Direct Product Rule, which can prevent the sale of any product made using American technology, including in a foreign country.

On paper, Washington is plugging a loophole: its policymakers have complained that Huawei , Beijing’s designated chip champion, weaved a complex web of expanding subsidiaries and affiliates to bypass U.S. export controls. For the past few years, the tech giant and its peers were supposed to be cut off from American technology as well as anything made with American tools . Yet Huawei recently debuted its made-in-China AI processors , some of which featured restricted components from Taiwan’s TSMC 2330 and South Korea’s SK Hynix

000660 and Samsung Electronics

005930, semiconductor research outfit TechInsights found.

The fallout from the latest U.S. measures will be intense. For a start, the rules could ensnare “thousands” of China-linked entities across 100 jurisdictions that have never appeared on a government list before, accordingto risk analytics firm Kharon. Nexperia is just one such example: in 2019, the Netherlands-based auto chips specialist was acquired for $3.6 billion by a Chinese group that was subsequently blacklisted. The 50% rule ultimately resulted in the Dutch government seizing control of Nexperia this week. Now European and American carmakers are caught in the crossfire because China has banned the export of products made in the People’s Republic by Nexperia and its subcontractors.

Global companies may become more selective about who they sell to. In a significant shift, the U.S. rules put a heavy compliance burden on suppliers. If a company has “knowledge” that a buyer is affiliated with a sanctioned company, it has a duty to determine the percentage of ownership, and even if the ownership is below the 50% threshold, that might still trigger a “Red Flag“ and require additional due diligence. That will add costs and result in delays. Many of Huawei’s subsidiaries were already blacklisted, but not all, per Reuters.

Little wonder officials in Beijing responded this month by unveiling plans mirroring Washington’s: China will assert extraterritorial authority over products where it dominates supply chains, including in rare earths, as well as over products made using certain Chinese tools and technology. More than plugging a loophole, the U.S. sanctions overhaul has dramatically resulted in an escalation of tensions that may be difficult to dial down.

Follow Robyn Mak on X.

CONTEXT NEWS

The U.S. Commerce Department on September 29 issued a new rule expanding its restricted export list, known as the Entity List, to automatically include subsidiaries that are 50% or more owned in the aggregate, directly or indirectly, by one or more companies on that list, as well as on other sanctions-related lists.

The agency describes this rule, effective immediately, as closing “a significant loophole.”

The U.S. puts companies on the Entity List that it has determined pose risks to U.S. national security or foreign policy. Huawei, drone maker DJI, video surveillance company Hikvision and artificial intelligence firm SenseTime are all on the list.

China’s Commerce Ministry strongly criticised the rule. “This move by the U.S. is extremely egregious in nature,” the ministry said in a statement. “It seriously infringes upon the legitimate rights and interests of the affected enterprises, severely disrupts international economic and trade order and gravely undermines the security and stability of global industrial and supply chains.”

![[News] Microsoft Reportedly Moving Most Laptop and Server Production Outside China as Early as 2026](https://koala-by.com/wp-content/uploads/2025/10/Microsoft-20250909-624x458.jpg)