Both Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer slammed China on Wednesday, Oct. 15, 2025, for what they call the “Chinese chokehold.” (Credit: Treasury Department)

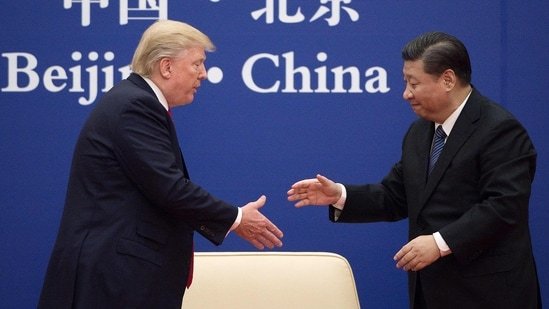

Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer spoke on Wednesday about what they refer to as a “global power grab” by China.

The Trump administration officials held a press conference during which they said they are “constantly focused on the Chinese chokehold on the world of rare earth and rare earth materials.”

Bessent insisted that Washington did not want to escalate a trade conflict with China, stressing that President Donald Trump is ready to meet Chinese President Xi Jinping in South Korea later this month.

When asked by FOX Business’ Edward Lawrence if there was room for a positive economic relationship with China, Greer said, “There certainly is.”

A worker holds a soil sample at a Meteoric Resources rare earth exploration project in Caldas Novas, Minas Gerais state, Brazil, on Tuesday, July 8, 2025. (Victor Moriyama/Bloomberg / Getty Images)

“To paraphrase the secretary in one of our recent meetings with the Chinese, this is the last time we want to be talking about rare earths with the Chinese,” Greer said. “Unfortunately, that is not the last time they want to be talking about it. The reality is, there are a lot of areas where we can trade with the Chinese. Our trade is wildly imbalanced. So it needs to be more balanced. And there is a lot of, as the secretary said, areas of risk.”

The U.S. and China appeared poised to return to an all-out trade war late last week, after China on Thursday announced a major expansion of its rare earths export controls.

TRUMP THREATENS ‘MASSIVE’ CHINA TARIFFS, SEES ‘NO REASON’ TO MEET WITH XI

Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer take questions from reporters as they deliver remarks on “Game Plan for U.S. Investment” in Washington, D.C., on Oct. 15, 2025. (Brendan SmialowskiAFP)

Trump responded on Friday by threatening to raise tariffs on Chinese goods to triple-digit levels, sending financial markets and U.S.-China relations into a tailspin. Bessent and other officials have sought to get ties back on track in a series of interviews this week.

On Wednesday, Bessent said China had clearly intended to take action “all along,” rejecting Beijing’s claim that the actions were a response to U.S. actions.

Gantry cranes stand near shipping containers at Yangshan Port outside of Shanghai, China, April 15, 2025. (REUTERS/Go Nakamura / Reuters)

Bessent said a lower-level Chinese trade official had threatened to “unleash chaos” if the U.S. went ahead with port fees on Chinese ships in August.

CLICK HERE TO READ MORE ON FOX BUSINESS

“There was a lower-level trade person who was slightly unhinged here in August… saying that China would unleash chaos on the global system if the U.S. went ahead with our docking fees for Chinese ships,” Bessent said.

Reuters contributed to this report.