In markets, there are always monsters in the dark—some real, some stitched together by imagination and fear. Right now, many currency traders appear to have been spooked by the spectre of the Federal Reserve losing its independence, haunted by talk of political meddling and looming economic weakness due to White House polices. These ghosts of institutional decay and “threadbare” doom narratives have crept into probability matrices across trading desks, pulling even seasoned hands off their compass bearings. Yet, in the middle of this haunted house, the dollar still stands upright—scarred, yes, but hardly broken.

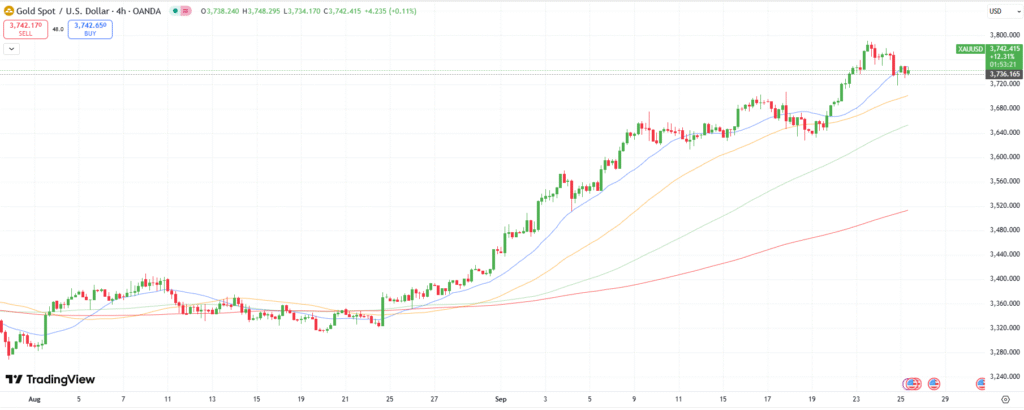

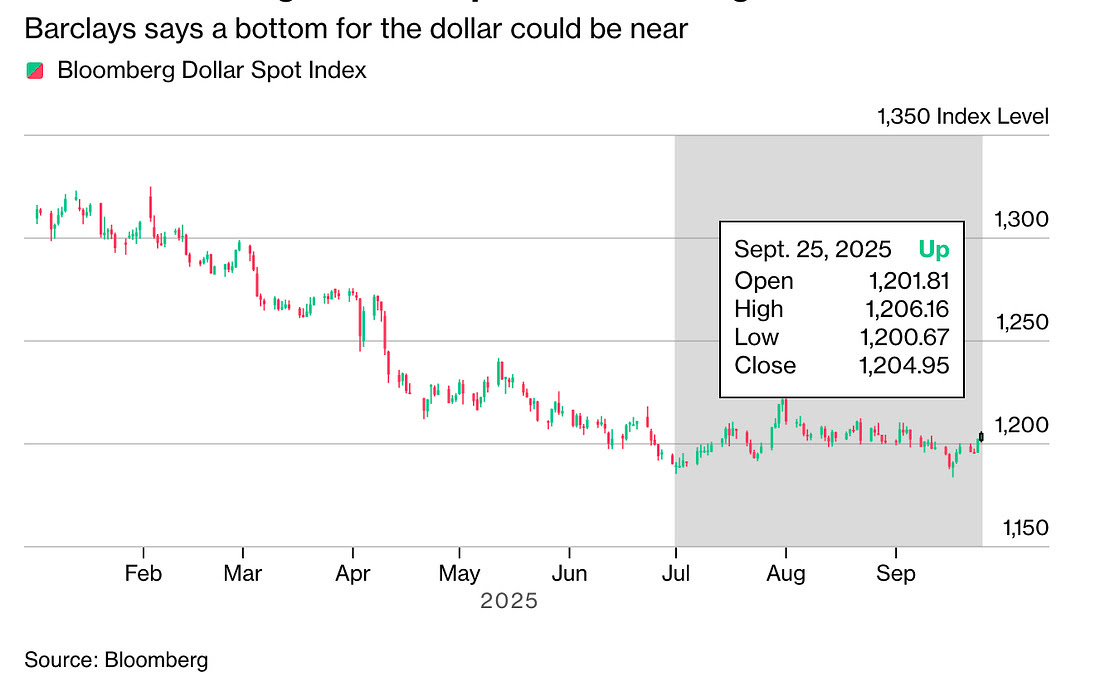

The greenback’s performance in recent months has been an uncomfortable reminder for dollar bears that the fundamentals underpinning reserve currency status do not surrender easily. Even after the worst six-month start in half a century—torched by Trump’s sweeping tariffs and equity selloffs—the dollar has clawed back its footing. A Bloomberg dollar gauge is up 1.5% in the second half of the year, and recent jobless claims underscored the resilience beneath the surface. Far from a jobs market unravelling, the currency has found strength precisely when its obituary was being drafted.

Tariffs, paradoxically, act like ballast under the dollar’s keel. By artificially improving the terms of trade for the U.S., levies compress the true cost of American goods abroad, distorting valuations. Adjust for this distortion, and the euro-dollar pair is trading closer to 1.30 rather than the 1.1660 handle that glows on our screens. (according to Barclays currency strategists, including Themistoklis Fiotakis and Lefteris Farmakis.)

|

What are the implications if the Barclays model is correct? The dollar is already cheaper than it looks—a vessel trading below book value even as passengers scream about overpricing. Traders have anchored their narratives to the visible spot price while ignoring the hidden hull beneath the waterline.

If the dollar is supposedly toxic waste, then where exactly are traders meant to stash their cash? The euro drifts in waters poisoned by structural stagnation, political fissures, and the uncomfortable reality of being tethered to a live war zone. The yen, once the ark that carried investors through storms, now lists badly under the weight of Tokyo’s political theatre and a Bank of Japan whose credibility feels hostage to the whims of the next prime minister. The yuan, meanwhile, sails under a half-mast flag—neither free-floating nor firmly anchored—its course dictated each morning by where Beijing wants it to be. These so-called alternatives aren’t safe harbors at all; they’re patched-up vessels leaking in open seas. Reserve managers, corporates, and hedgers know the score, which is why capital tiptoes into them rather than rushing headlong.

The real danger isn’t the dollar itself but the way traders are fighting shadows. After the shock waves of February through May, when tariffs and equity routs forced seismic shifts, many expected a second-half collapse. Instead, the dollar has settled into a tight range, failing to deliver the apocalyptic weakness everyone positioned for. Traders have been chasing phantoms—handwringing over Fed independence, apocalyptic chatter about economic collapse—while the price action quietly betrays their fear. Markets punish those who trade on ghosts rather than substance, and I’m starting to think that I might have fallen prey to economic ghost hunting.

Make no mistake, the one genuine tail risk still circling is the challenge to the Fed’s autonomy. If Trump succeeds in ousting a sitting governor, the symbolism would be seismic. Central banks live or die on credibility, and credibility once fractured is almost impossible to mend. A Supreme Court ruling that blesses executive intrusion into FOMC composition would invite global investors to question the sanctity of U.S. monetary stewardship. In that event, the dollar’s scaffolding—built on trust in impartiality—would indeed creak. But until that line is crossed, the remains the anchor to which dollar resilience is lashed.

What the dollar’s persistence tells us is simple: fundamentals still trump phantoms. continue to show surprising strength, revised surprised the hell out of everyone, tariffs have created hidden value, and global investors face a dearth of credible alternatives. Traders obsessed with nightmares of Fed capture or systemic unravelling are trading ghosts, not grids. The greenback, while bruised, is not broken; its bedrock status remains intact for at least today.

For those of us who live by probability matrices, the lesson is humbling. When your models start chasing shadows, recalibrate. The dollar is not the haunted house many imagine—it is still the foundation stone of the global financial architecture. And until something truly rips that stone loose, betting aggressively against it remains less a strategy and more a séance.

Friday is never the best day to hit any buttons, but it feels like this weekend will be less about chasing screens and more about soul-searching. A whole lot of digging into the dollar narrative awaits, as traders try to untangle whether the greenback’s resilience is rooted in fundamentals or if we’ve all been shadow-boxing with ghosts. The danger isn’t the price action itself—it’s the way fear of phantoms has warped positioning and probability maps. By Monday, desks will be asking the uncomfortable question: have we fallen prey to specters of Fed handwringing and threadbare doom, or is the dollar’s footing stronger than the haunted stories that stalk it?